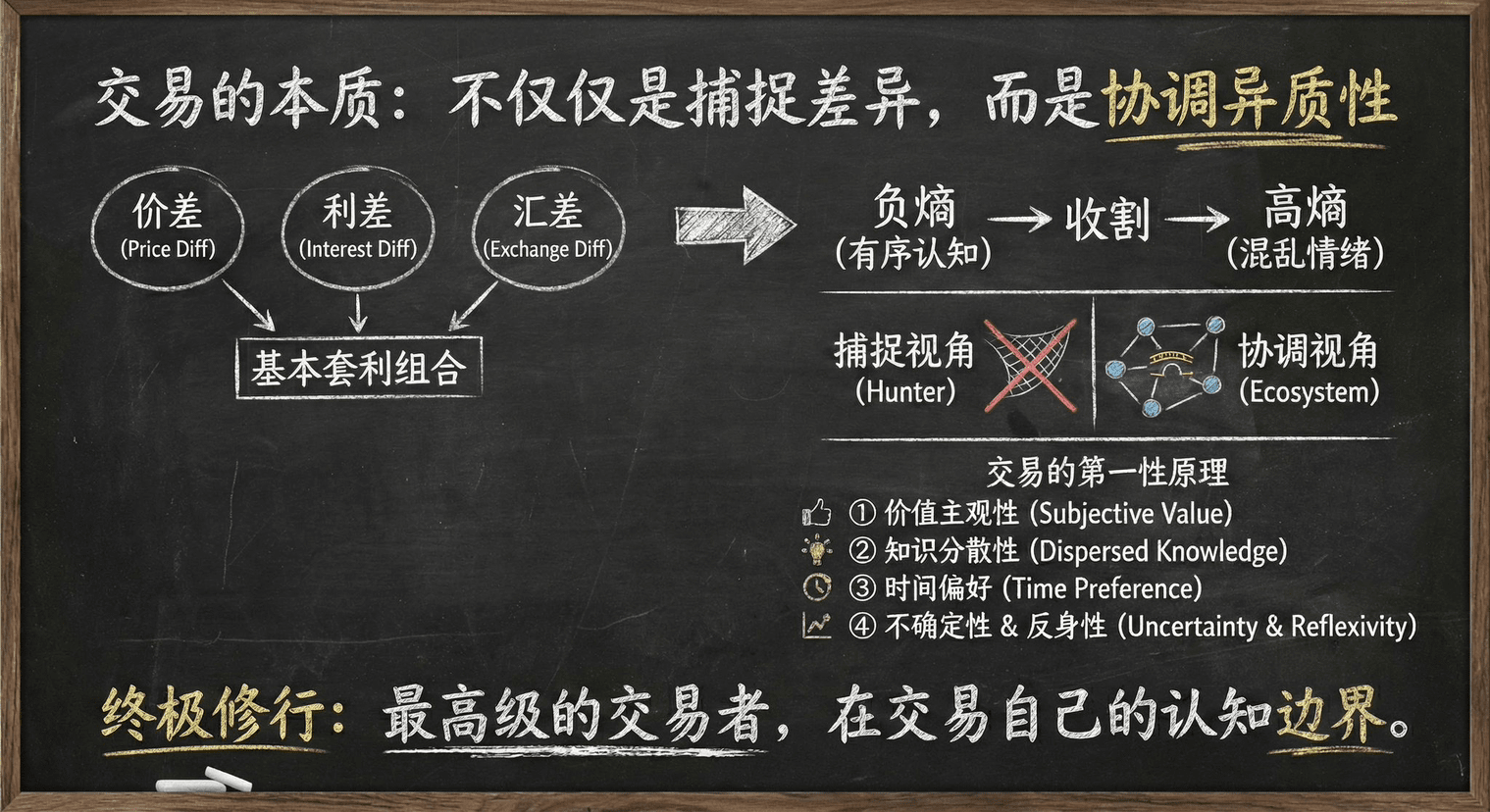

Rather than whether the price will rise or fall in the short term,

I'm actually more concerned about the underlying industry logic.

From Bitcoin's emergence in 2008 to now, 17 years later,

it has essentially completed a full path: from a scam, a haphazard approach, a geek toy, to imagination and faith, to the gradual entry of institutional, compliant, and allocation-oriented funds.

The price of this step is that it's no longer exciting, but more real.

Many people in the market are currently feeling uncomfortable and confused, essentially still using the logic of the previous round: waiting for a comprehensive surge, meticulously comparing gains to market movements, and fantasizing about getting rich quick.

But this time, the market is very clear: it doesn't want to reward everyone.

Assets are increasing, stories are increasing, but money and attention are always finite.

Therefore, you'll feel that the current market,

is like a casino on one hand, and on the other hand, it makes many entrepreneurs and investors start to doubt everything they've participated in, wondering if they've wasted their time.

But I actually think that the future of crypto will be more like finance than a casino.

Bitcoin will increasingly resemble an allocation product, and the widespread adoption of stablecoins may be the real game-changer. For an app to be profitable and survive, simply telling a story is no longer enough.

The industry has progressed from scams, shady practices, and geek toys to being recognized by the compliant world.

It's just that prices aren't cooperating right now. This isn't failure; it's the growing pains of maturation.

My current understanding is actually quite simple:

No matter how the market changes, the worst thing is never the lack of opportunities,

but using an old map to navigate a new world.

There's no such thing as a one-size-fits-all solution in this world; everything is constantly changing.

Often, it's not about rushing to find opportunities to "bet early."

Even if a good opportunity does exist, most of it is 90% or more of wasted time. Patience is needed to wait for the market to move.

Therefore, rather than constantly thinking about how to make money, avoiding fatal mistakes is more important.

Surviving in the investment market is a skill in itself.

Earn → Hold → Survive → Compound Interest.

Cycle 🔄

#Fed Rate Cut #Whale Movements #ETH Price Analysis

$BTC

{future}(BTCUSDT)

$ETH

{future}(ETHUSDT)

$SOL

{future}(SOLUSDT)