I've been in Thailand 🇹🇭 lately, full of hope and embarking on a new chapter!

A new day begins. Be a traveler on the journey of time, a brave warrior overcoming obstacles in life. Life is long, and things will eventually turn out as desired. Effort is never outdated; only by moving forward can you see the scenery, and only by keeping moving forward can you welcome the next sweet treat in life.

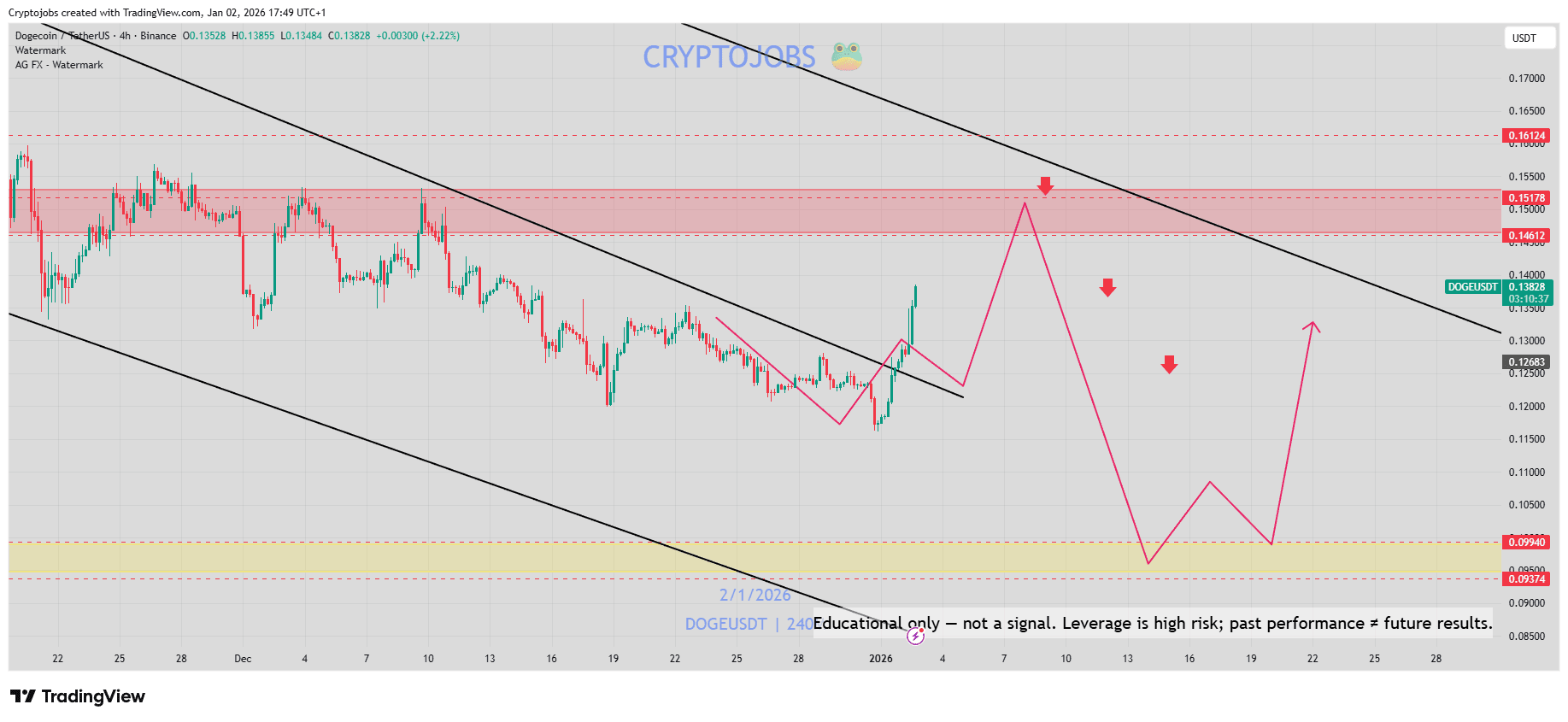

Gold has broken through 5000, while Bitcoin is slowly declining every day, and Ethereum is also declining, hovering around 2950 💲. Liquidity is poor, so we can only wait patiently.

Only by focusing on ourselves, constantly being busy, and constantly improving ourselves can we achieve breakthroughs at each stage of growth.

#FedInterest Rate Decision #ETH Price Analysis

$BTC $ETH $SOL

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data