Why is the market crashing after the government shutdown ended?

This morning, the market was indeed in a slump, with Bitcoin (BTC) falling below $100,000 again, and many altcoins suffering heavy losses!

This second dip was necessary!

Last night's plunge wasn't due to a "collapse in fundamentals," but rather a combination of macroeconomic uncertainty, emotional resonance, and leveraged panic selling.

The end of the shutdown is undoubtedly a positive, but the delayed release of key economic data due to the shutdown—

employment, CPI, non-farm payrolls, and many other data points—is either missing or delayed. The market can't price these in, meaning investment expectations are gone, and the pricing basis has been removed.

Add to that the fact that a December rate cut is still far off, hawkish elements have emerged within the Fed, and the data cannot confirm whether the economy is truly cooling down, leading to a general decline in tech stocks and cryptocurrencies, which is understandable.

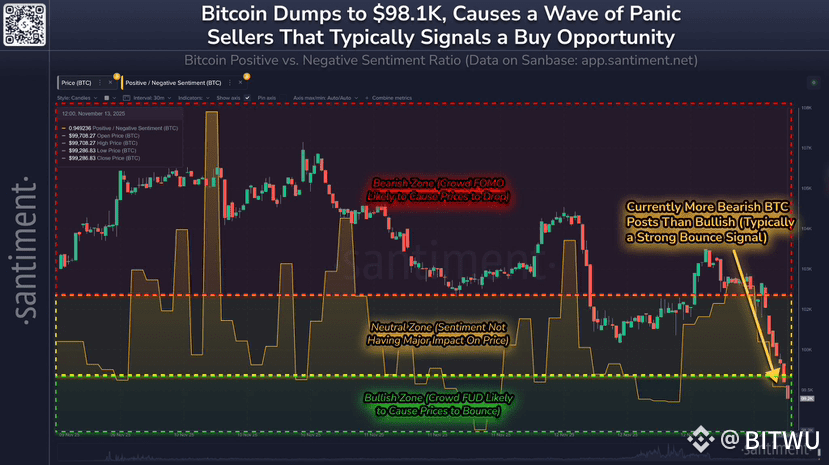

This is clearly a panic sell-off driven by sentiment, and then, due to liquidity issues, there aren't many people willing to buy, which is also crucial.

If the market continues its downward trend with no clear direction, I see a pullback to the 95K-92K "value zone" as a good entry point.

Therefore, my analysis of the sentiment index remains unchanged from yesterday. This is not a trend reversal in the short term, but rather an emotional sell-off.

After the leverage is cleared, the medium-term trend remains healthy.

Currently, sentiment is at a state of "extreme panic," and historically, this has led to a rebound in 80% of cases.

The expectation of a December rate cut still exists; it's just that the market is currently directionless in the short term. Bitcoin's strength comes from a "spot-driven cycle," not a leverage cycle. After the emotional and leveraged sentiment is cleared, the trend remains the same.

Remember, all declines are for a better rise!

Be patient, be respectful!

Image from @SantimentFeed