Smart contract platforms are a new type of financial infrastructure.

Despite their staggering scale, total fees are bound to rise—one of the biggest structural headwinds to price is beginning to recede as inflation approaches zero or even deflation.

Meanwhile, adoption and tokenization are driving a powerful flywheel effect in decentralized finance (DeFi). Stablecoin payments are fueling increasingly non-cyclical settlement activity, making these networks look more like large tech companies—with growing and more stable cash flows. Metcalfe's Law tells us what this means for market capitalization expansion.

As more and more L1 tokens are used for staking and DeFi collateralization, they form deep pools of collateral absorption, transforming them into efficient, yield-generating stores of value—measured in the same way we assess Bitcoin's monetary strength. They are increasingly attracting funds from traditional financial yield assets to DeFi, offering growth similar to large tech companies and sovereign bond-level yields.

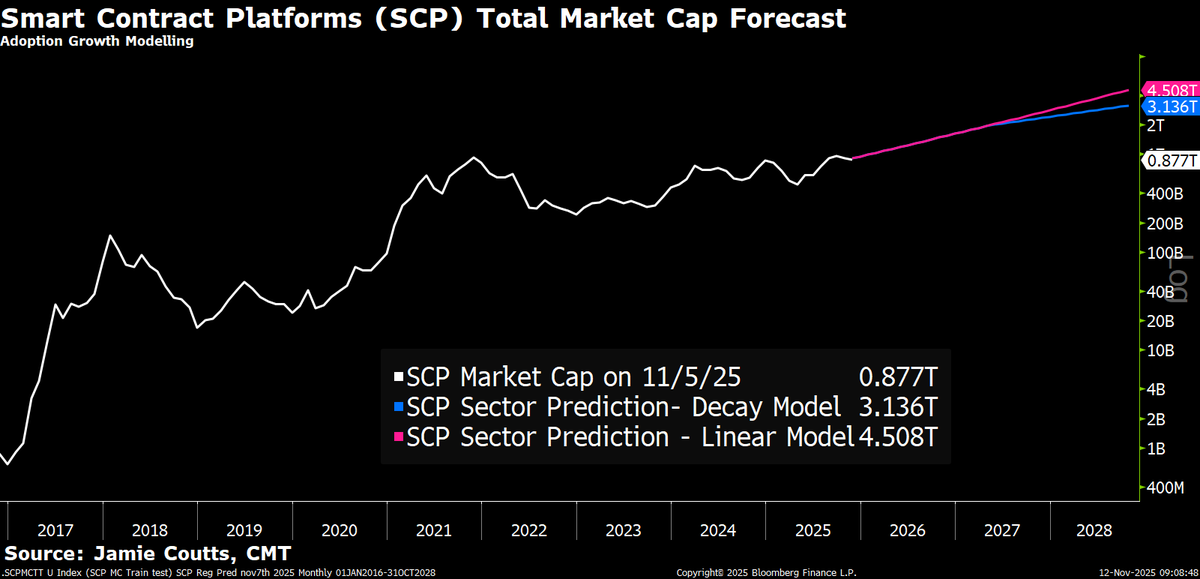

With the changing settlement volumes and the accumulation of value on-chain, the industry's next 3-5x growth depends on adoption, not hype.