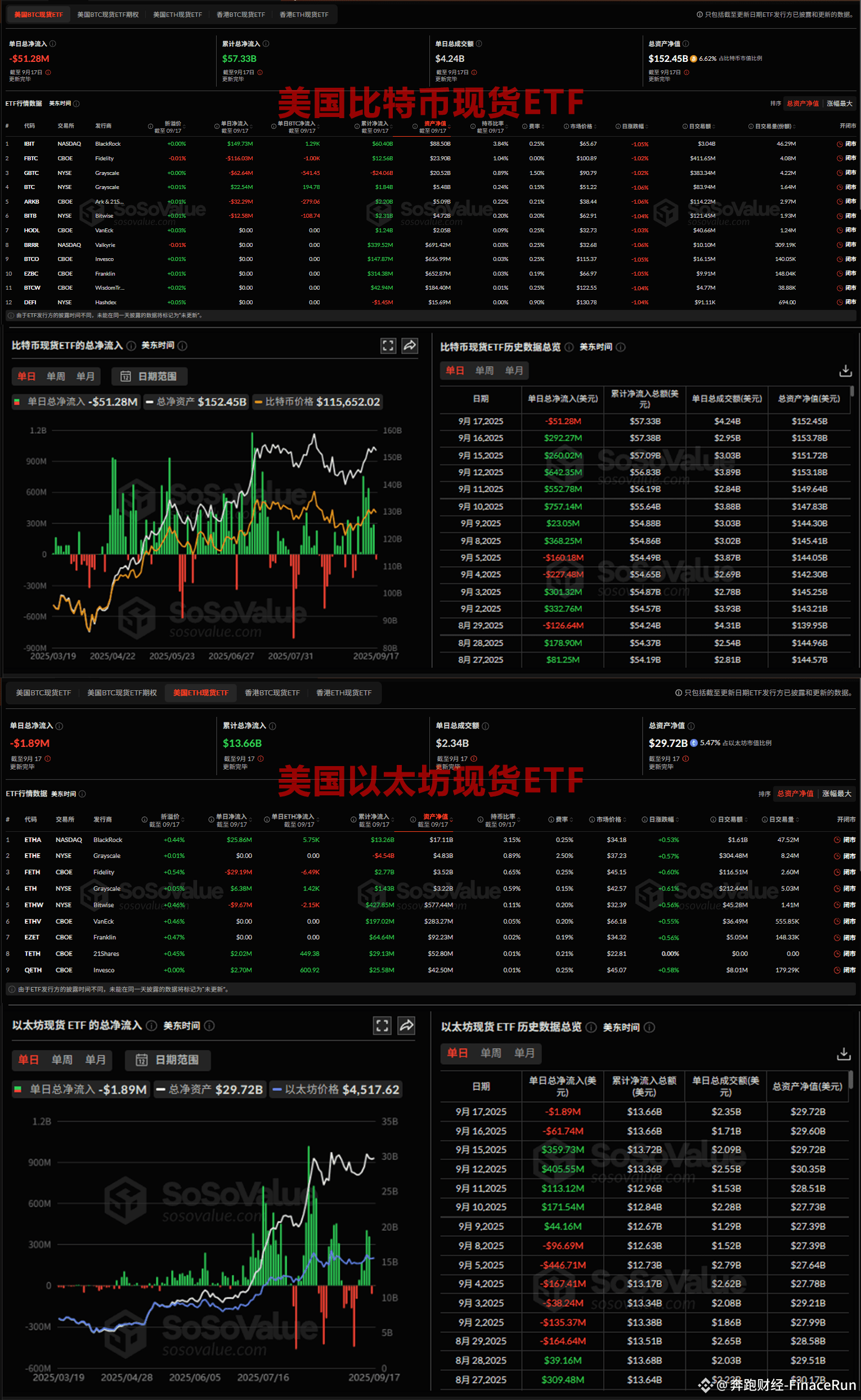

BTC and ETH spot ETFs both saw net outflows, with Fidelity's ETFs leading the list of net outflows yesterday.

According to SoSoValue data, US Bitcoin spot ETFs saw a net outflow of $51.28 million yesterday, marking their first day of net outflows after seven consecutive days of net inflows.

Fidelity's FBTC saw the largest net outflow yesterday, with $116 million (approximately 1,000 BTC) in daily outflows. FBTC has now seen a cumulative net inflow of $12.56 billion.

GrayScale's GBTC saw a net outflow of $62.64 million (541.45 BTC) in daily outflows, bringing the total to $24.06 billion.

Ark & 21Shares ARKB and VanEck HODL saw net outflows of $32.29 million (279.06 BTC) and $12.58 million (108.74 BTC), respectively, yesterday.

On the other hand, BlackRock's IBIT and GrayScale's BTC saw net inflows of nearly $150 million (1,290 BTC) and $22.54 million (194.78 BTC), respectively, yesterday.

As of now, Bitcoin spot ETFs... The total net asset value was $152.45 billion, accounting for 6.62% of Bitcoin's total market capitalization, with a cumulative net inflow of $57.33 billion.

On the same day, the Ethereum spot ETF saw a net outflow of $1.89 million, marking its second consecutive day of net outflows.

Fidelity's FETH saw the largest net outflow of any Ethereum ETF yesterday, with $29.19 million (6,490 ETH), bringing its cumulative net inflow to nearly $2.77 billion.

Bitwise ETHW saw a net outflow of $9.67 million (2,150 ETH) in a single day, bringing its cumulative net outflow to nearly $428 million.

BlackRock's ETHA, however, saw a net inflow of $25.86 million (5,750 ETH), making it the largest Ethereum ETF yesterday.

Grayscale ETH, Invesco QETH, and 21Shares TETH saw net inflows of $6.38 million (1,420 ETH), $2.7 million (600.92 ETH), and $2.02 million (449.38 ETH), respectively.

As of now, the total net asset value of Ethereum spot ETFs is $29.72 billion, accounting for 5.47% of Ethereum's total market capitalization, with a cumulative net inflow of $13.66 billion.

In summary, although several ETFs, led by Fidelity, experienced varying degrees of net outflows due to yesterday's Federal Reserve rate cut, BlackRock's derivatives products saw excellent net inflows, effectively offsetting some of the outflow pressure.

#BitcoinETF #EthereumETF