Operate efficiently. Every moment you waste is your enemy's gain.

Collect and defeat your enemies.

🚨Best ETH Yields, September Edition🚨

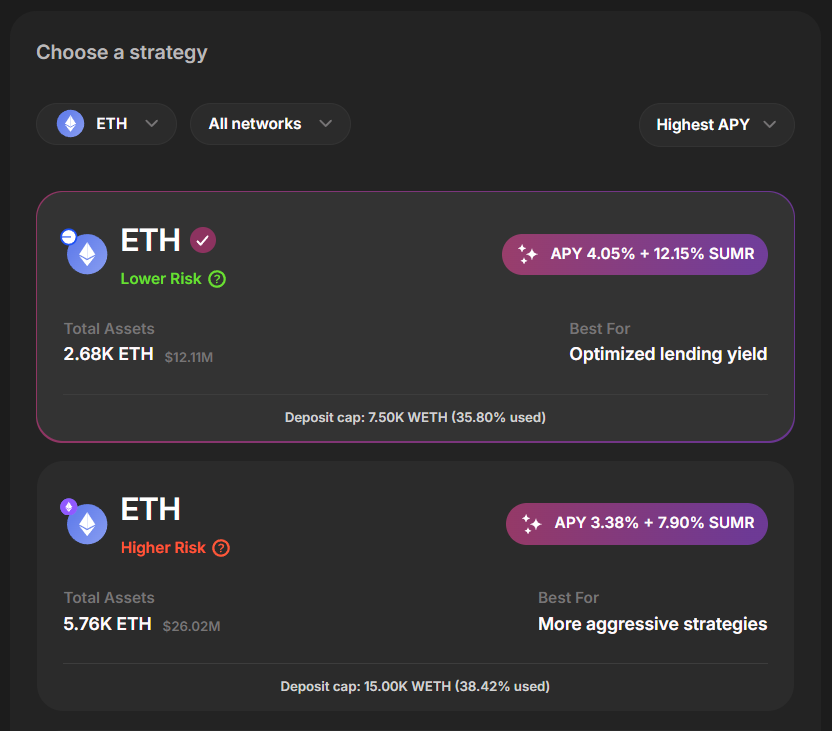

1) @summerfinance_

One of my favorite low-risk ETH vaults for Lend Agg.

Not only do you get a fantastic 4% yield, but you also earn $SUMR tokens, which should be available in the next 1-2 months.

The best part is you can withdraw at any time without worrying about redemption.

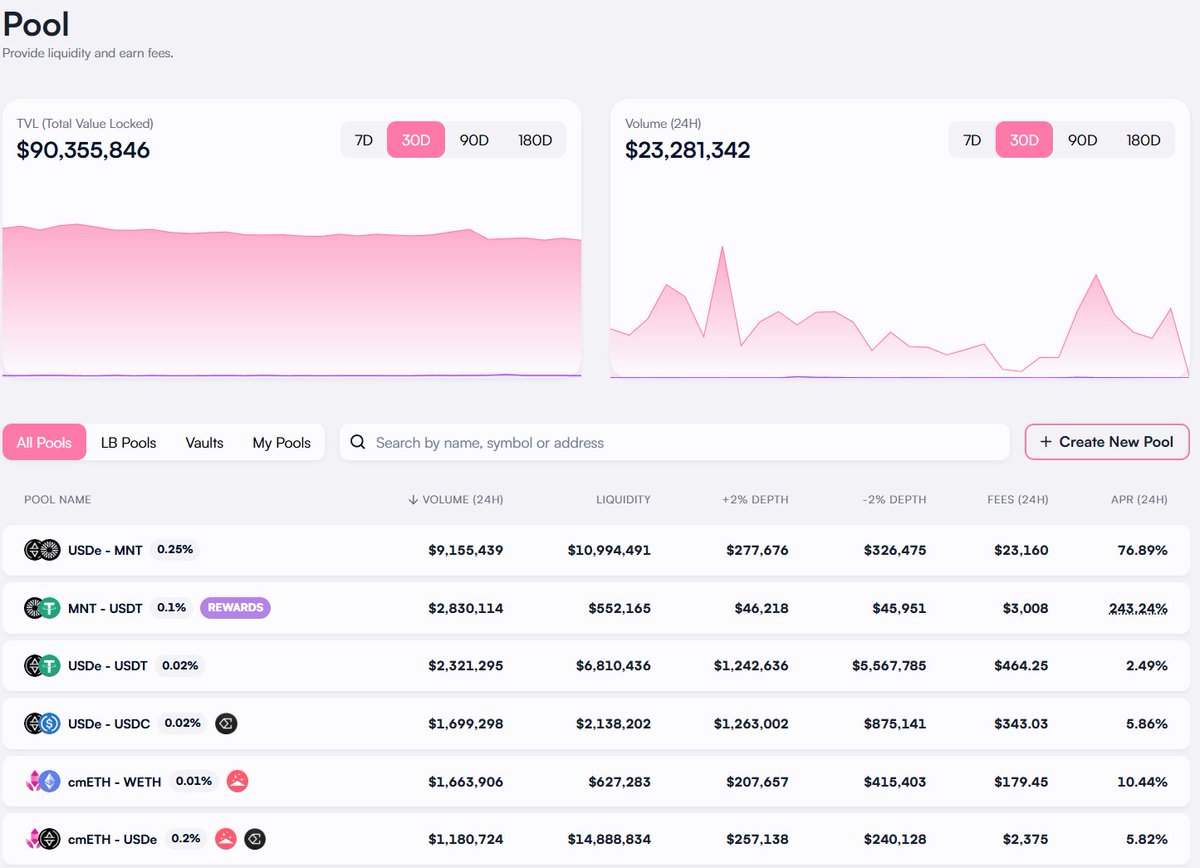

2) @MerchantMoe_xyz from @Mantle_Official

I've talked about this before, and I still love it.

The entire LFJ stack does a great job of displaying average APYs (rather than single quote APYs).

cmETH - WETH still currently enjoys an average APY of 10%, plus cmETH offers additional yield.

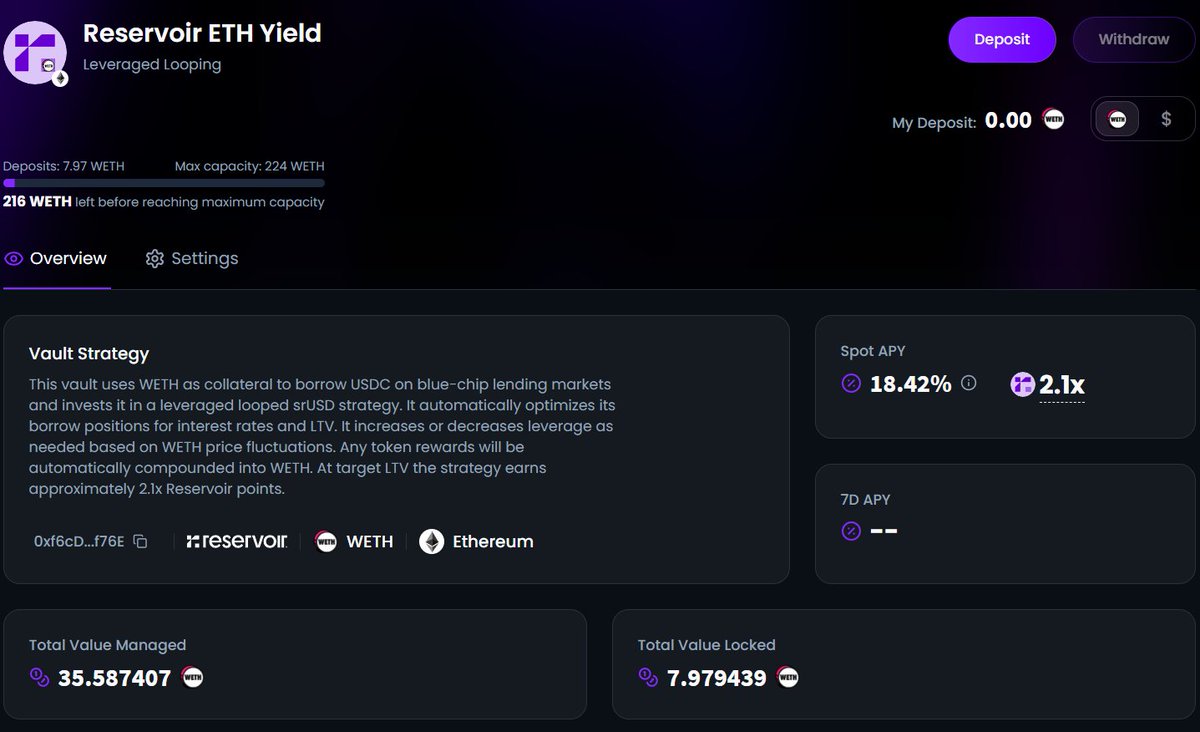

3) @reservoir_xyz 🤝 @ipor_io

This vault borrows USDC against WETH and leverages srUSD on behalf of users.

This vault typically averages around 6% yield (which is already quite good), but since wsrUSD hit 15% APY, the yield on the underlying WETH has been close to 20%.

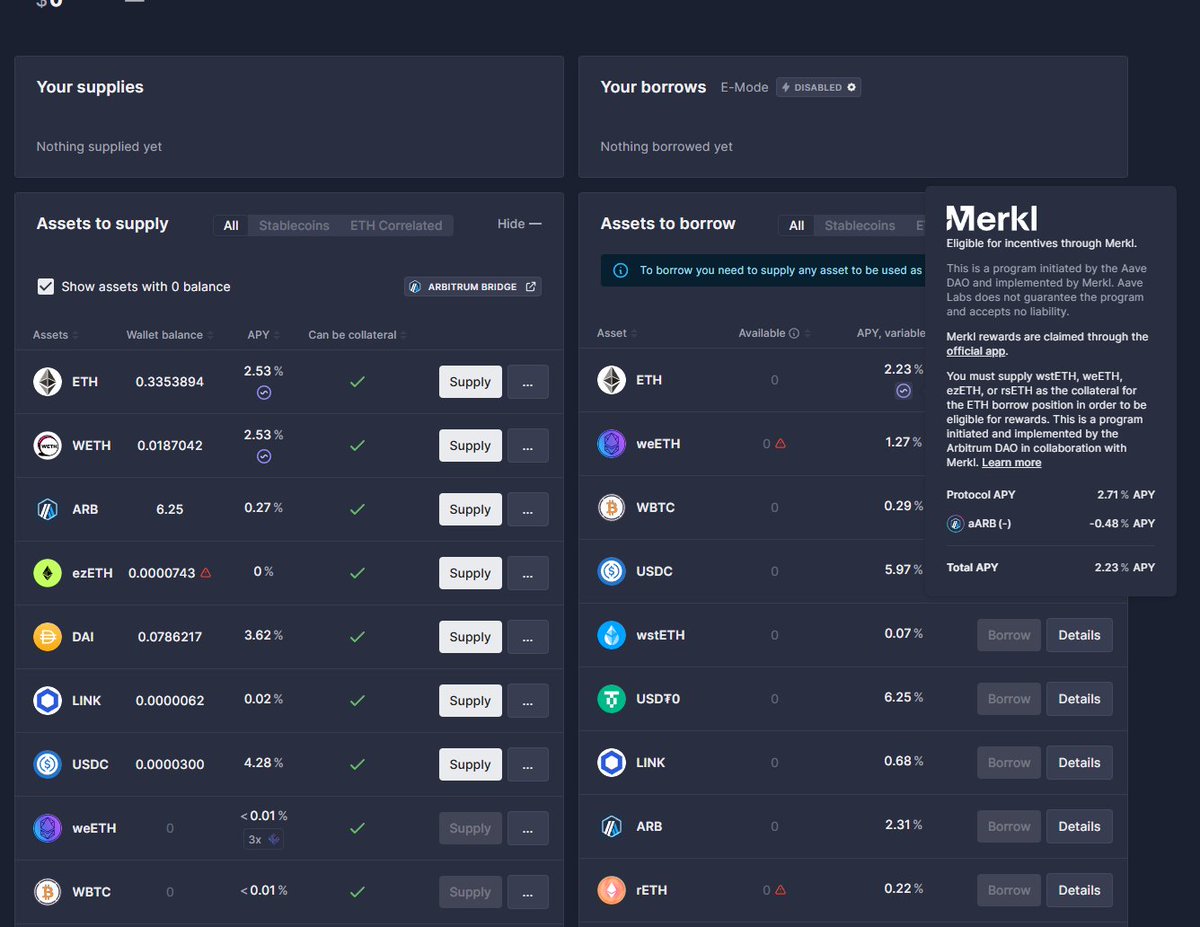

4) @arbitrum DRIP Promotion Recommended @aave

@ether_fi wins.

weETH Staking Yield: 3.1% APY

ETH Borrowing: 2.23% APY

Maximum Leverage: 14x

Maximum Yield = 14.41%

I'd like to see more liquidity on @MorphoLabs, but I haven't seen it coming in yet.

5) @Dolomite_io Glove ETH

Note: I've never used GLV derivatives, but every time I see them, I find the APR ridiculously high.

Dolomite and @GMX_IO list GLV ETH as effectively neutral exposure to ETH (with yield).

You can trade with 2x leverage on Dolomite, earning a whopping 43.47% yield.

6) There's a secret strategy only tech geeks know about.

It involves @protocol_fx and @DriftProtocol.

In short, go long f(x) and short Drift.

No capital/interest required to go long.

Shorting yields good returns, and margin returns are also high.

Example:

$10,000 margin f(x), 2x (a $20,000 long position)

$5,000 USDC margin, 2x (a $10,000 short position)

You are now long 10,000 ETH at 1x with $15,000 principal.

The long position yields 0%, but the margin yields 9%, and the notional short position yields 15%.

Net APY: 13%

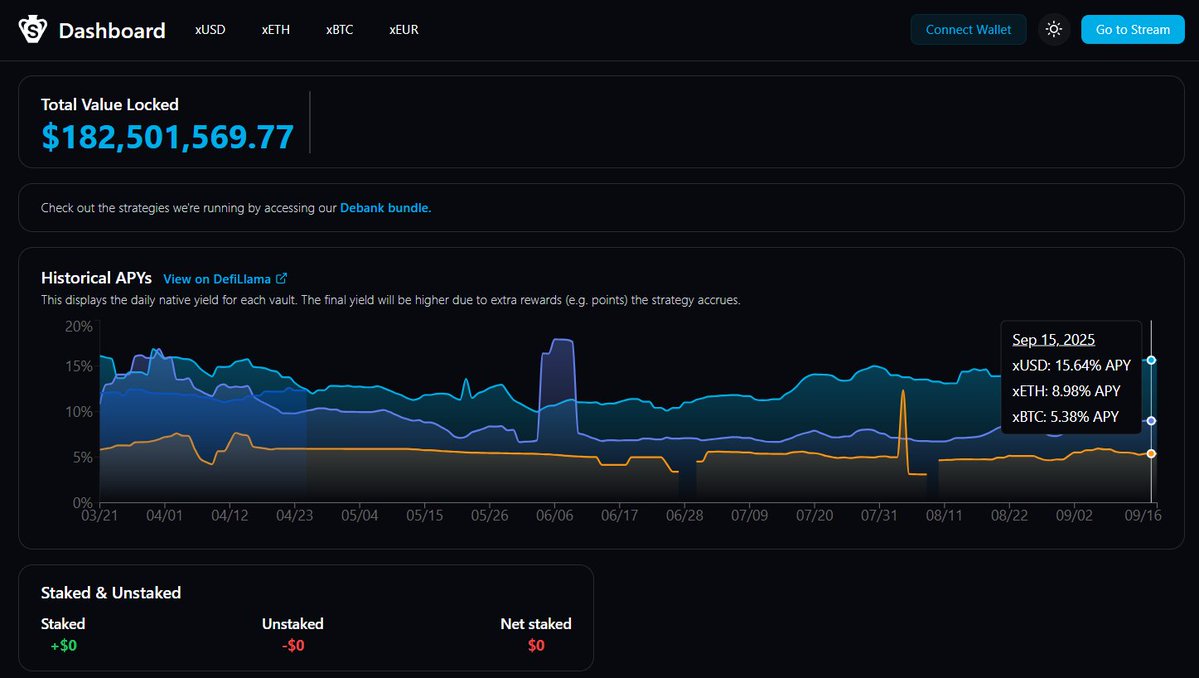

7) @StreamDefi

Actual APY of >8% has been consistently achieved for several weeks.

If you like the risk profile of xETH's underlying strategy, then xETH is a good option, which you can find here:

Thanks for reading. Go earn some money!

Join us:

@phtevenstrong Stephen, what kind of AI have you been using to create your "clones"?

@phtevenstrong The counterparty is still poor. My ETH yields.

@phtevenstrong @threadreaderapp Expand

@phtevenstrong Good leveraged ETH mining, based on Euler Lines and Aave, with improved yields and low borrowing costs. Most LRTs have decent liquidity, reaching eight figures, but bridging these LRTs through non-native methods will reduce yields.

@phtevenstrong How do these ETH yields protect against impermanent loss risk?