The Ethereum ecosystem has enormous potential, but its value remains underestimated by Wall Street.

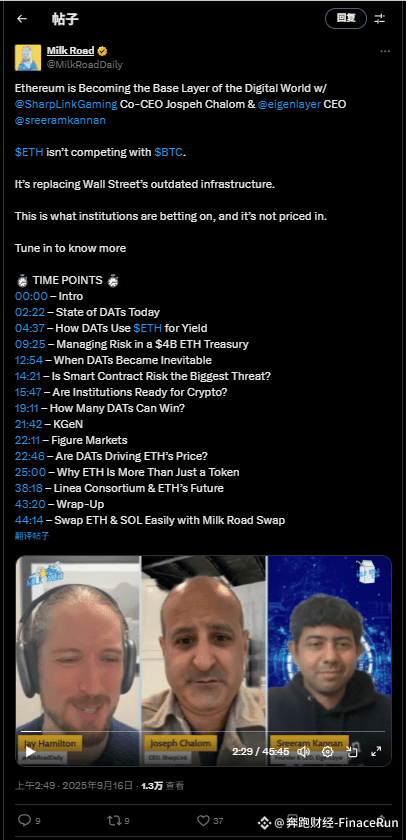

In a recent interview on the Milk Road podcast, SharpLink CEO Joseph Chalom and EigenLayer founder Sreeram Kannan highlighted the structural limitations of the current traditional financial system and the significant potential of Ethereum to replace Wall Street's outdated settlement system.

The traditional financial system relies on a 24-hour settlement cycle, which not only lengthens transaction times but also increases the risk of counterparty default. Furthermore, market participants are required to post collateral for overnight financing, burdening investors. This inefficiency also serves as a source of significant profits for intermediaries.

In stark contrast, Ethereum's atomic settlement function allows transactions to be completed in seconds, completely eliminating counterparty default risk.

Chalom, who previously led BlackRock's digital asset initiative, positioned Ethereum as an "emerging new public infrastructure," similar to the internet of the Web 1 era, capable of serving as a universal settlement layer for the financial and economic systems.

Furthermore, Ethereum's programmable nature enables portfolio rebalancing through smart contracts, dividend distribution in minutes rather than days, and composable trading, allowing any asset to be traded with any other asset at any time.

Kannan further elaborated on his vision of Ethereum as a "platform of verifiable trust," addressing counterparty default risk through cryptographic verification rather than institutional guarantees.

He also mentioned that EigenLayer technology enables the Ethereum ecosystem to support networks beyond the base protocol, opening up broad application prospects in areas such as AI agent verification, prediction markets, and autonomous systems.

In summary, Ethereum demonstrates tremendous potential to replace traditional financial infrastructure. Its atomic settlement, programmable nature, and ability to eliminate counterparty risk revolutionize financial transaction efficiency.

Although institutions are accelerating their investment through channels such as ETFs, the market still underestimates its long-term value as a "platform of verifiable trust" and an emerging public infrastructure.

As more institutions recognize the advantages of staking and DeFi yields, ETH is expected to become a new focus of institutional investment, surpassing BTC, and assume a core role in the next-generation global settlement layer.

#ETH #DeFi