US spot ETFs attracted $620 million yesterday: $360 million went to ETH ETFs and $260 million went to BTC ETFs.

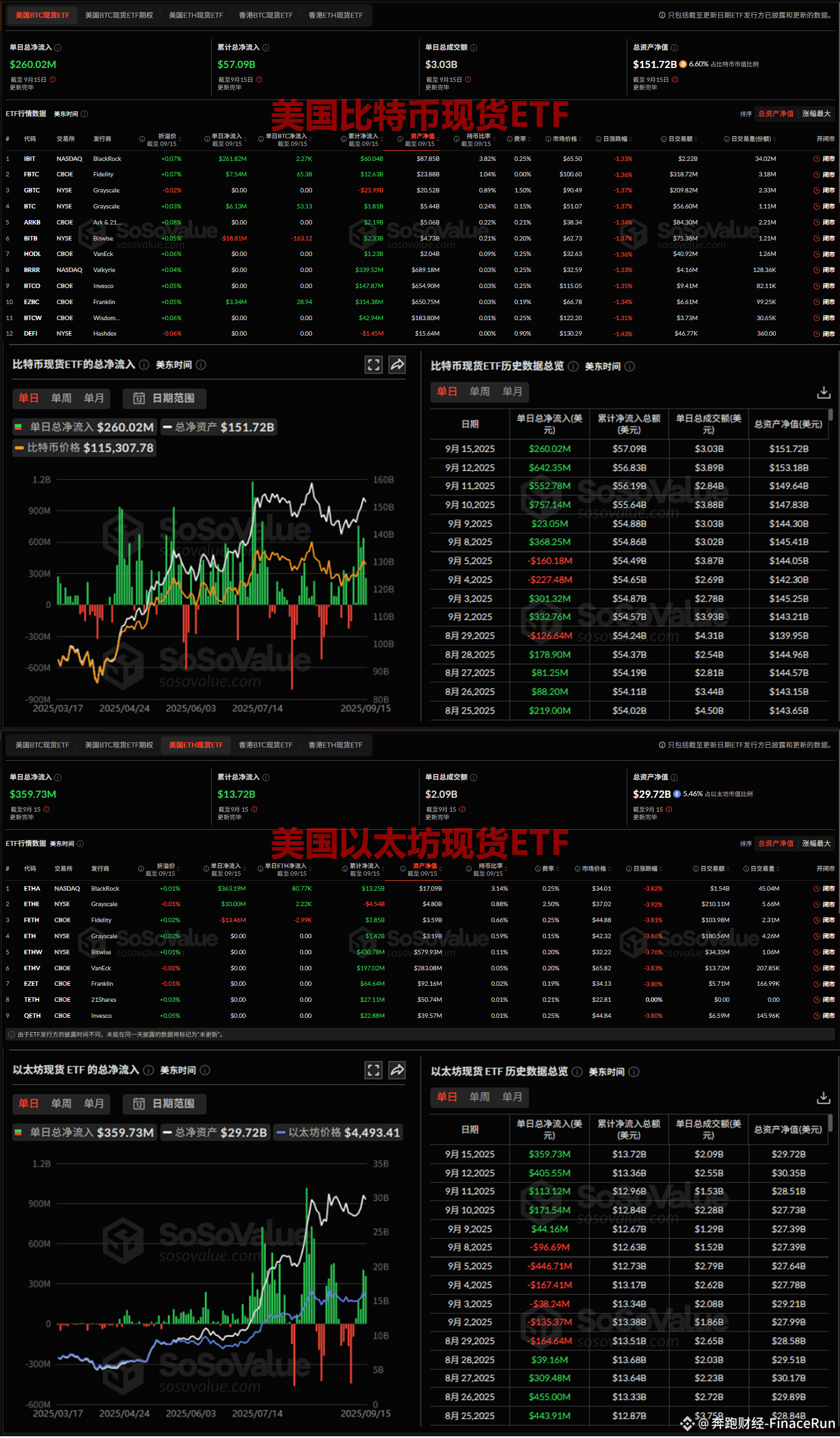

According to SoSoValue data, US Bitcoin spot ETFs saw a net inflow of $260 million yesterday, marking their sixth consecutive day of net inflows.

Among them, BlackRock's IBIT saw a net inflow of nearly $262 million (approximately 2,270 BTC) in a single day, topping yesterday's net inflow list. IBIT has now seen a cumulative net inflow of $60.04 billion.

Fidelity's FBTC, GrayScale's BTC, and Franklin's EZBC saw net inflows of $7.54 million (65.38 BTC), $6.13 million (53.13 BTC), and $3.34 million (28.94 BTC), respectively.

Bitwise's BITB, however, saw a net outflow of $18.81 million (163.12 BTC) yesterday, becoming the only Bitcoin ETF to experience a net outflow. BITB has now seen a cumulative net inflow of $2.33 billion.

As of now, the total net asset value of Bitcoin spot ETFs is $151.72 billion, representing 6.6% of Bitcoin's total market capitalization, with a cumulative net inflow of $570.9 billion. $100 million.

On the same day, the Ethereum spot ETF also saw a net inflow of nearly $360 million, marking its fifth consecutive day of net inflows.

BlackRock's ETHA also topped yesterday's net inflow list with a single-day net inflow of $363 million (approximately 80,770 ETH). ETHA currently has a cumulative net inflow of nearly $13.25 billion.

Next was Grayscale's ETHE, which saw a single-day net inflow of $10 million (2,220 ETH). ETHE currently has a cumulative net outflow of $4.54 million.

Fidelity's FETH, however, saw a net outflow of $13.46 million (2,990 ETH), making it the only Ethereum ETF to experience a net outflow yesterday. FETH currently has a cumulative net inflow of $2.85 billion.

As of now, the total net asset value of Ethereum spot ETFs is $29.72 billion, accounting for 5.46% of Ethereum's total market capitalization, with a cumulative net inflow of $13.72 billion.

In summary, despite the lackluster performance of most ETFs yesterday, BlackRock's products stood out, once again demonstrating the advantages of leading institutions' brand endorsement and stable strategies amidst volatility.

Amidst the uncertain market environment, funds appear to be flowing to these leading institutions at an accelerated pace, a trend that may foreshadow further market differentiation.

#BitcoinETF #EthereumETF