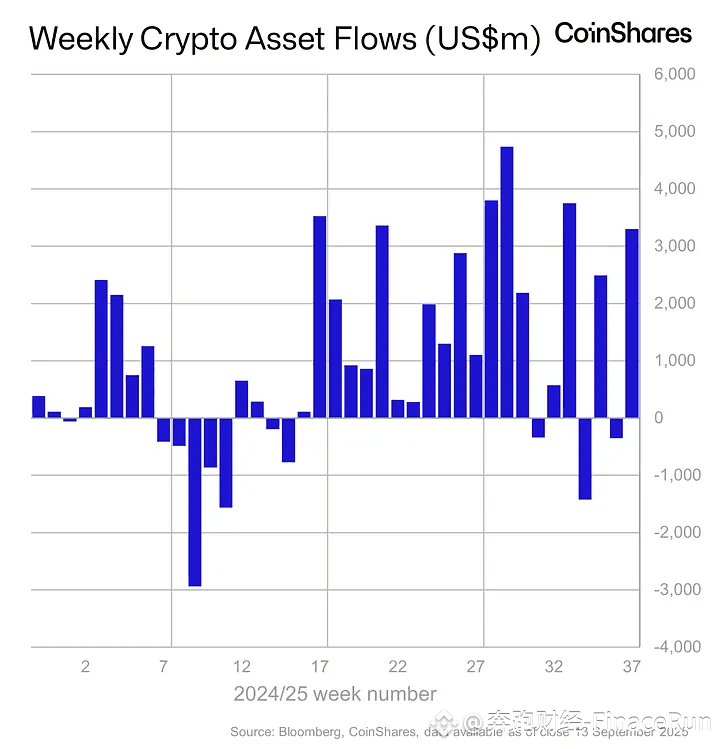

Global digital asset inflows exceeded $3.3 billion last week. Is BTC and ETH market sentiment recovering?

Last week, BTC and ETH market sentiment rebounded significantly, with inflows exceeding $3.3 billion into global digital asset investment products, pushing their total global assets under management to $239 billion, approaching their all-time high in August.

According to Coinshares' weekly analysis, this positive development was primarily due to weaker-than-expected US macroeconomic data and the widespread rise in digital asset prices over the weekend.

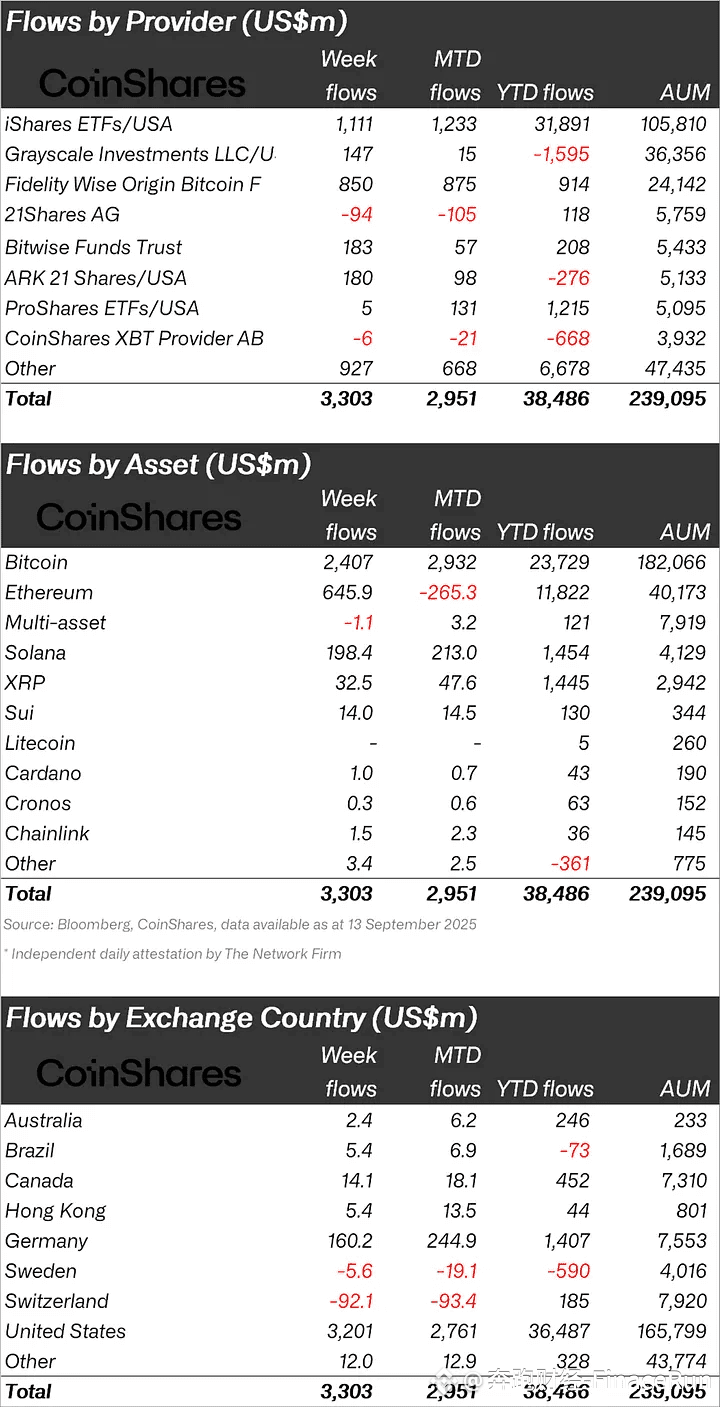

Among asset classes, BTC saw the strongest rebound in market sentiment, attracting over $2.4 billion in inflows in a single week, the largest weekly inflow since July and maintaining its position as "digital gold."

Meanwhile, sentiment around Ethereum also reversed. After eight consecutive days of outflows, it saw four consecutive days of inflows last week, reaching $646 million in weekly inflows, signaling a return of investor confidence.

Solana even set a record single-day inflow of $145 million on Friday, bringing its weekly total to $198 million, demonstrating strong market interest in the asset class.

By country/region, the US market led with $3.2 billion in inflows, followed by Germany, which saw $160 million in inflows and achieved its second-highest single-day inflow on record on Friday. However, Switzerland saw an outflow of $92.1 million, partially offsetting the net inflows.

In summary, last week's massive $3.3 billion in capital outflows, particularly Bitcoin, which saw its largest weekly inflow in months, indicates a return of institutional capital to the crypto market.

The reversal in Ethereum's capital flows and Solana's record-breaking performance further confirm that market sentiment has shifted from caution to optimism.

Despite minor outflows from some assets, the overall trend suggests investors are repositioning at key price points, building momentum for the next potential rally.

#DigitalAssets #InvestmentTrends