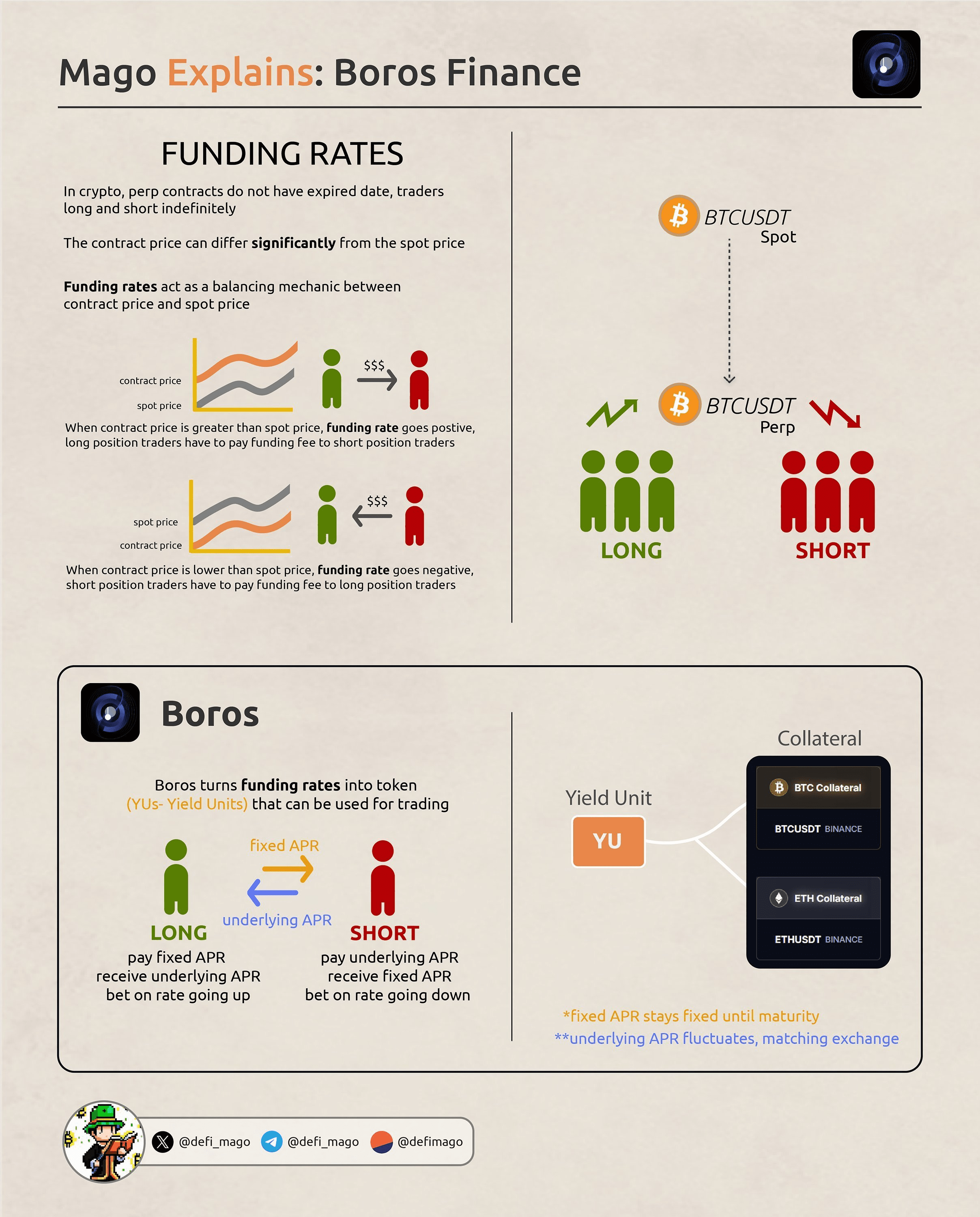

⚡️A great financial management method for BTC/ETH holders

After I wrote about Pendle Boros last time, many people wondered if it was only for institutional investors like Ethena.

Actually, it's not. Retail investors with BTC/ETH spot can also use Boros for simple arbitrage!

👇👇Here's the easiest way to get started:

Hold BTC spot (the basis for price hedging) + short BTC perpetual swaps (collect funding fees) + short BTC-YU (lock in a high funding rate).

Suppose: You already hold 1 $BTC, the current price is 10WU, and for a 90-day period, you short YU on Boros to lock in an Implied APR of 8%.

Scenario 1⃣: Funding rate remains at 8% throughout (same as the lock-in rate)

Perpetual short funding profit: $100,000 × 8% × (90/365) ≈ $1,972

Short YU profit: Actual rate = lock-in rate, no profit or loss → $0

Total profit: $1,972 + $0 = $1,972 (8% annualized)

Scenario 2⃣: Funding rate drops to 5% (lower than the lock-in rate)

Perpetual short funding profit: $100,000 × 5% × (90/365) ≈ $1,232

Short YU: Profit = profit corresponding to (lock-in rate - actual rate)

$100,000 × (8% - 5%) × (90/365) = $740

Total profit: $1,232 + $740 = $1,972

Scenario 3⃣: Funding rate rises to 11% (higher than the lock-in rate)

Perpetual short funding fee income: $100,000 × 11% × (90/365) ≈ $2,712

Shorting YU: Loss = (Actual Interest Rate - Lock-in Rate) corresponding to the cost, $100,000 × (11% - 8%) × (90/365) = $740

Total profit: $2,712 - $740 = $1,972

So, no matter how the fee rate changes, the "gains/losses" of the perpetual and the "gains/losses" of the YU will always offset each other, and the final profit you receive is the implied APR you locked in Boros.

And it doesn't affect your spot position, making it perfect for holders like me who don't plan to liquidate their positions in the short term!

By the way, Boros is really awesome! Just nine days after its launch, the technicals are already showing signs of growth.

- TVL increased from $1.78M to $2.75M (+53%)

- Trading volume reached $111.4M

- Position opening limits increased multiple times to $28.55M

- Pendle token price increased by 41.9%

It seems market demand remains quite strong!

So, I strongly recommend starting with a small position. Anyone who has experience with Hyperliquid and understands funding rates should find it easy to understand the Boros product!