Bitcoin spot ETFs saw net inflows for four consecutive days, while Ethereum ETFs saw net inflows for the 18th consecutive day.

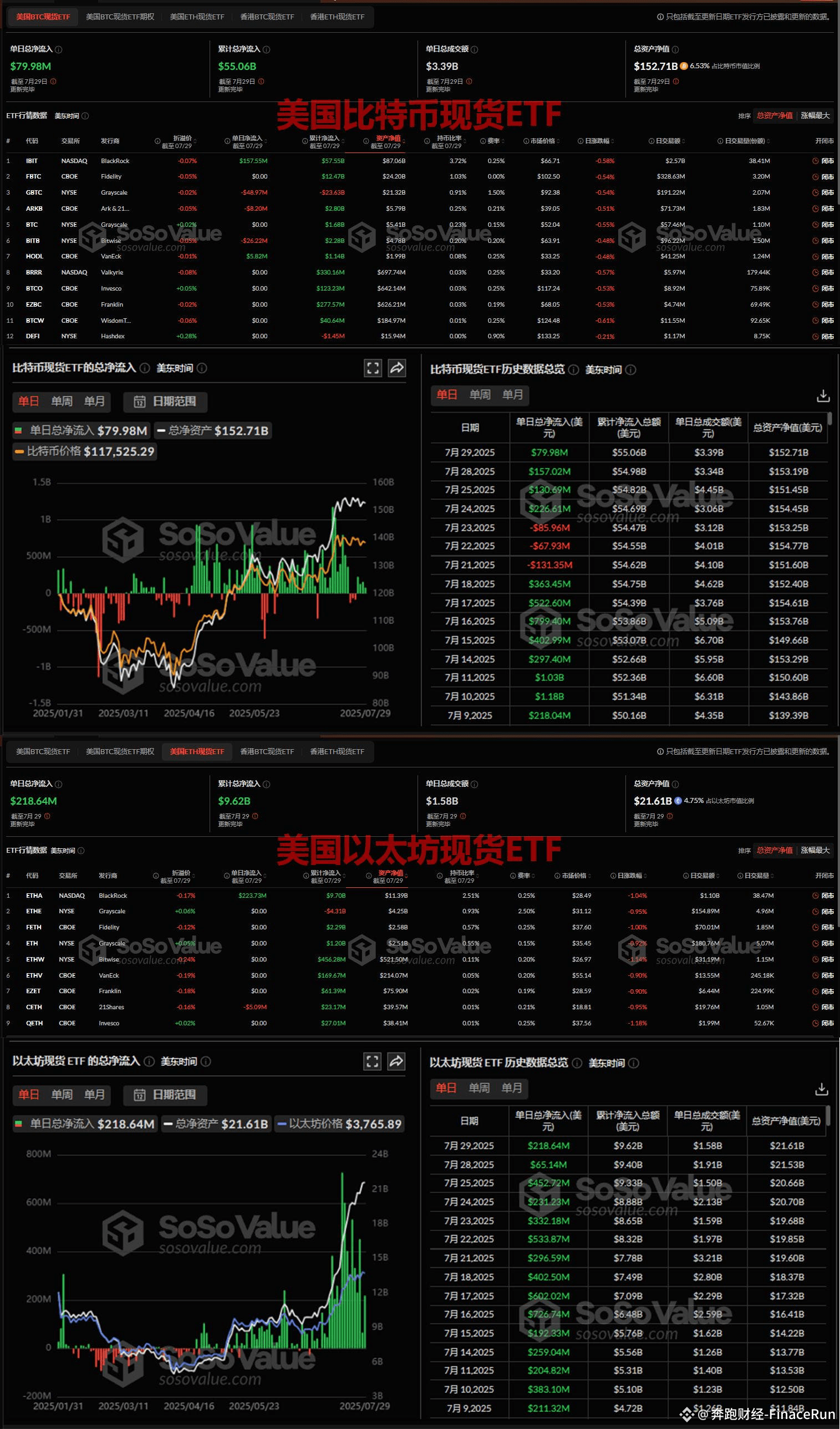

According to SoSoValue data, US Bitcoin spot ETFs saw net inflows of $79.98 million yesterday, marking their fourth consecutive day of net inflows.

Among them, BlackRock's Bitcoin spot ETF IBIT led the list with a single-day net inflow of nearly $158 million yesterday, bringing IBIT's cumulative net inflow to $57.55 billion. Meanwhile, VanEck's Bitcoin ETF HODL saw a net inflow of $5.82 million yesterday.

Notably, Grayscale's GBTC, Bitwise's BITB, and Ark & 21shares' ARKB saw net outflows of $48.97 million, $26.22 million, and $8.2 million, respectively, yesterday.

As of now, the total net asset value of Bitcoin spot ETFs is $152.71 billion, accounting for 6.53% of Bitcoin's total market capitalization, with a cumulative net inflow of $55.06 billion.

On the same day, Ethereum spot ETFs saw a single-day net inflow of nearly $219 million, marking their 18th consecutive day of net inflows.

Of these, BlackRock's Ethereum spot ETF, ETHA, saw a single-day net inflow of nearly $224 million, bringing ETHA's cumulative net inflow to $9.7 billion.

However, 21shares' CETH saw a net outflow of $5.09 million yesterday. These two Ethereum ETFs were the only ETFs to experience net inflows or outflows yesterday.

As of now, the total net asset value of Ethereum spot ETFs is $21.61 billion, accounting for 4.75% of Ethereum's total market capitalization, with a cumulative net inflow of $9.62 billion.

#BitcoinETF #EthereumETF #ETFFlows