Does Bitcoin behave like a store of value? Or like a tech asset?

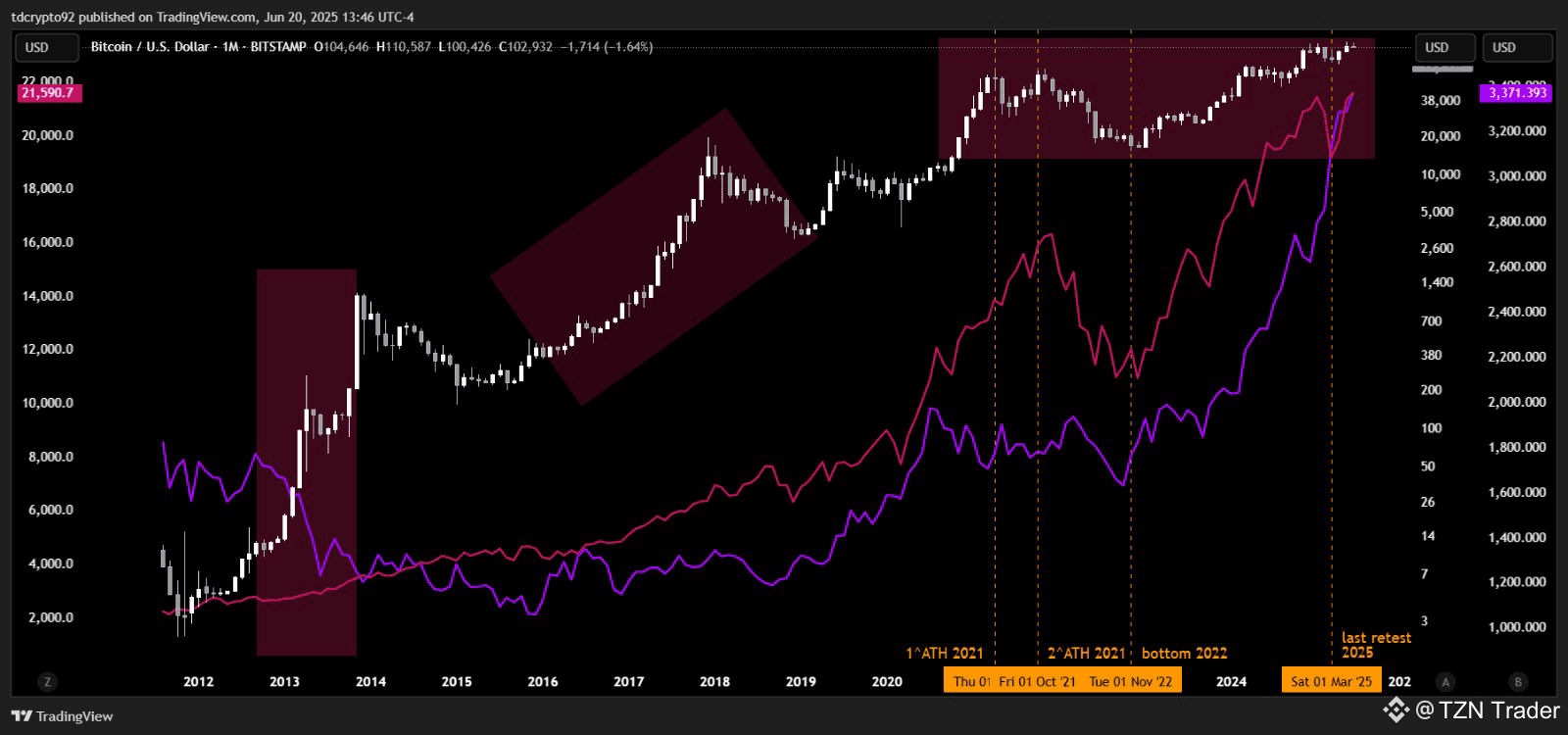

$BTC - $NASDAQ - $GOLD

NASDAQ -> Pink Line

Gold -> Purple Line

As you can see, even over the long term (here I start from 2012), BTC is more correlated to NASDAQ.

The price action is also more similar, when $BTC made its first two all-time highs in 2021, NASDAQ followed suit, though not on the same day, but in the same period when gold was moving one-sided.

The 2022 bottom was more in line with the NASDAQ, and gold had already started to rise before that (this time frame is monthly). Today, geopolitical tensions are driving gold higher, while Bitcoin and NASDAQ have retested this structure.

There is no positive or negative correlation between the three assets, but I can say with certainty that over the years, BTC has behaved more like a tech asset than a store of value.

If the Nasdaq starts to collapse due to a war, I expect BTC to fall with it and gold to rise.

Why is Bitcoin considered a store of value when its correlation is more similar to the Nasdaq?

The reason is simple, because Bitcoin has been rising in price since its inception and despite bear markets and price corrections, it continues to rise in value in the long run.

It is currently unresponsive to the dynamics of gold, if a new war breaks out, the Nasdaq will pull back, Bitcoin will pull back, gold will rise, but despite falling in the long run, it will still tend to rise due to limited supply, due to institutional interest, due to Bitcoin's strong community and large companies investing in the space, and due to the culture that has been and is being built around Bitcoin.