Topic Background

bjw586870

Binance

02-01 23:46

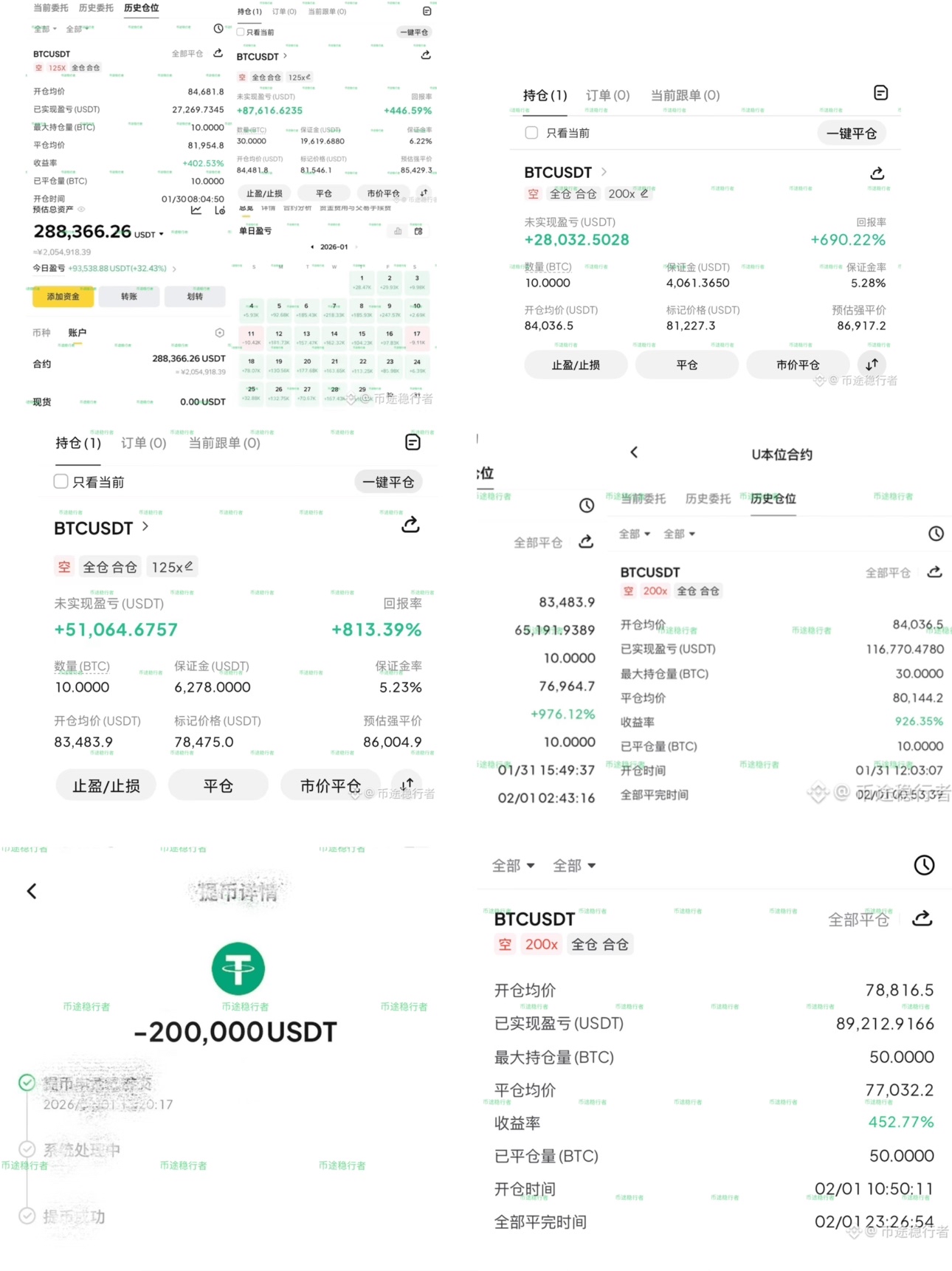

丝路策略持续兑现

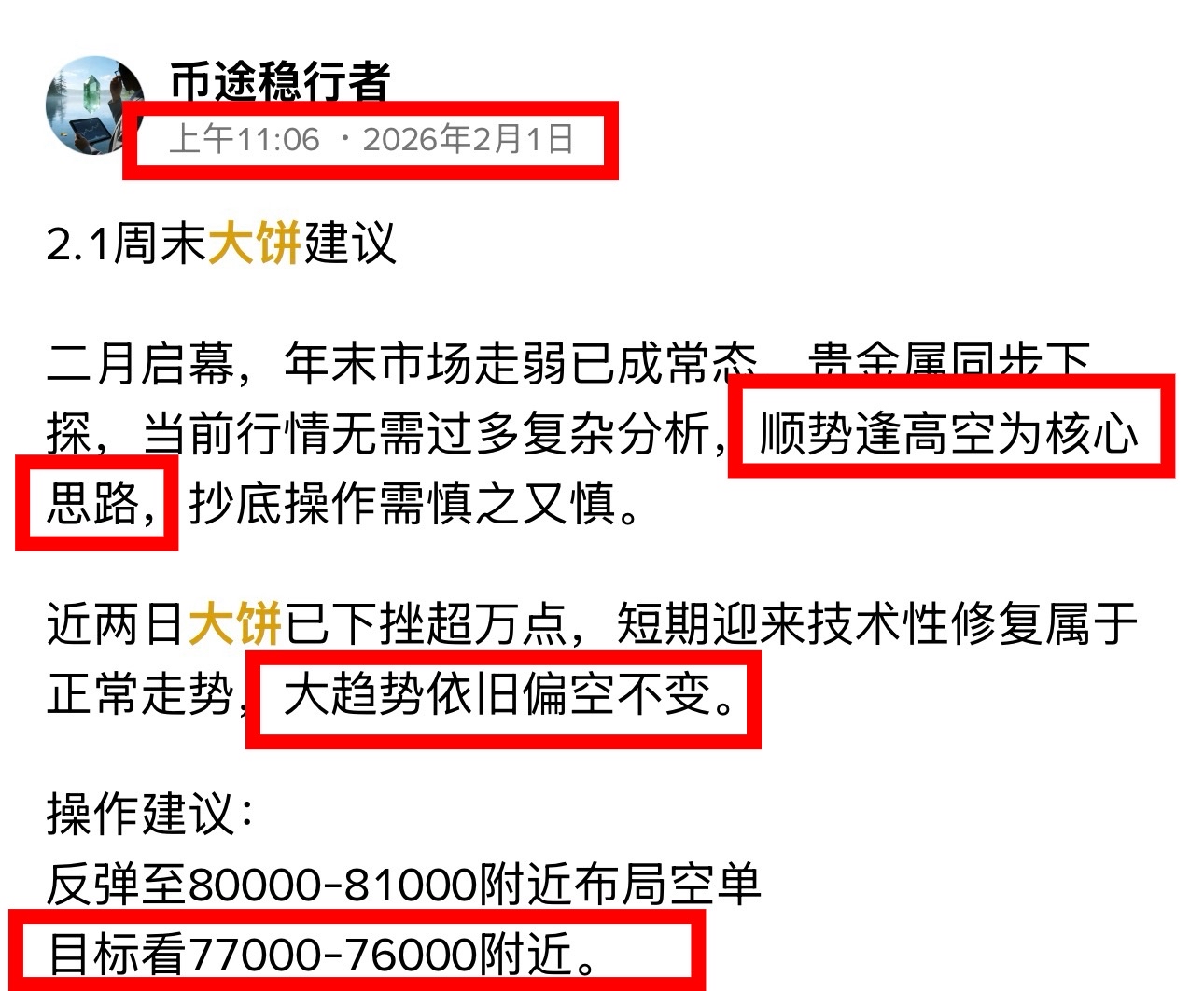

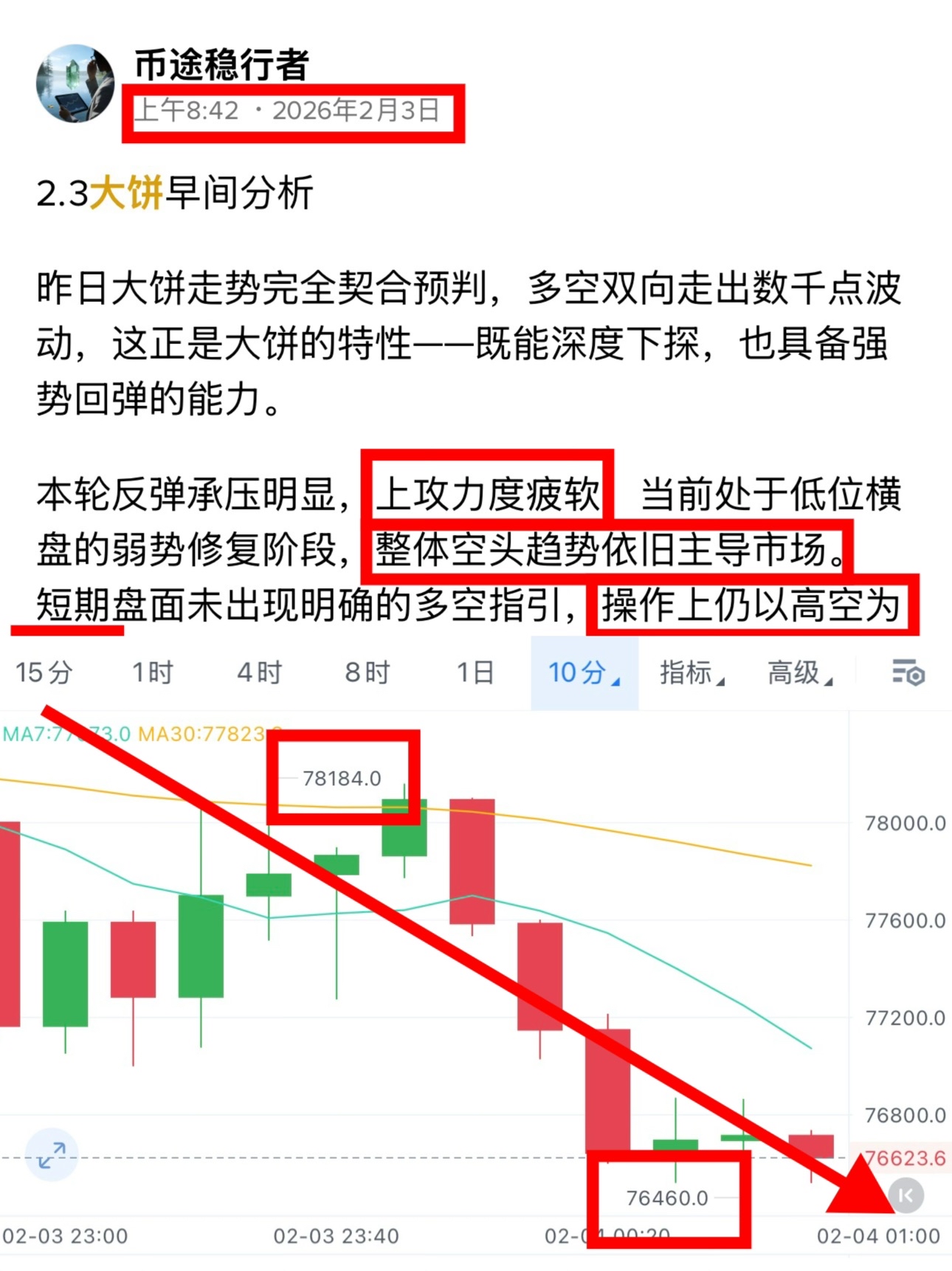

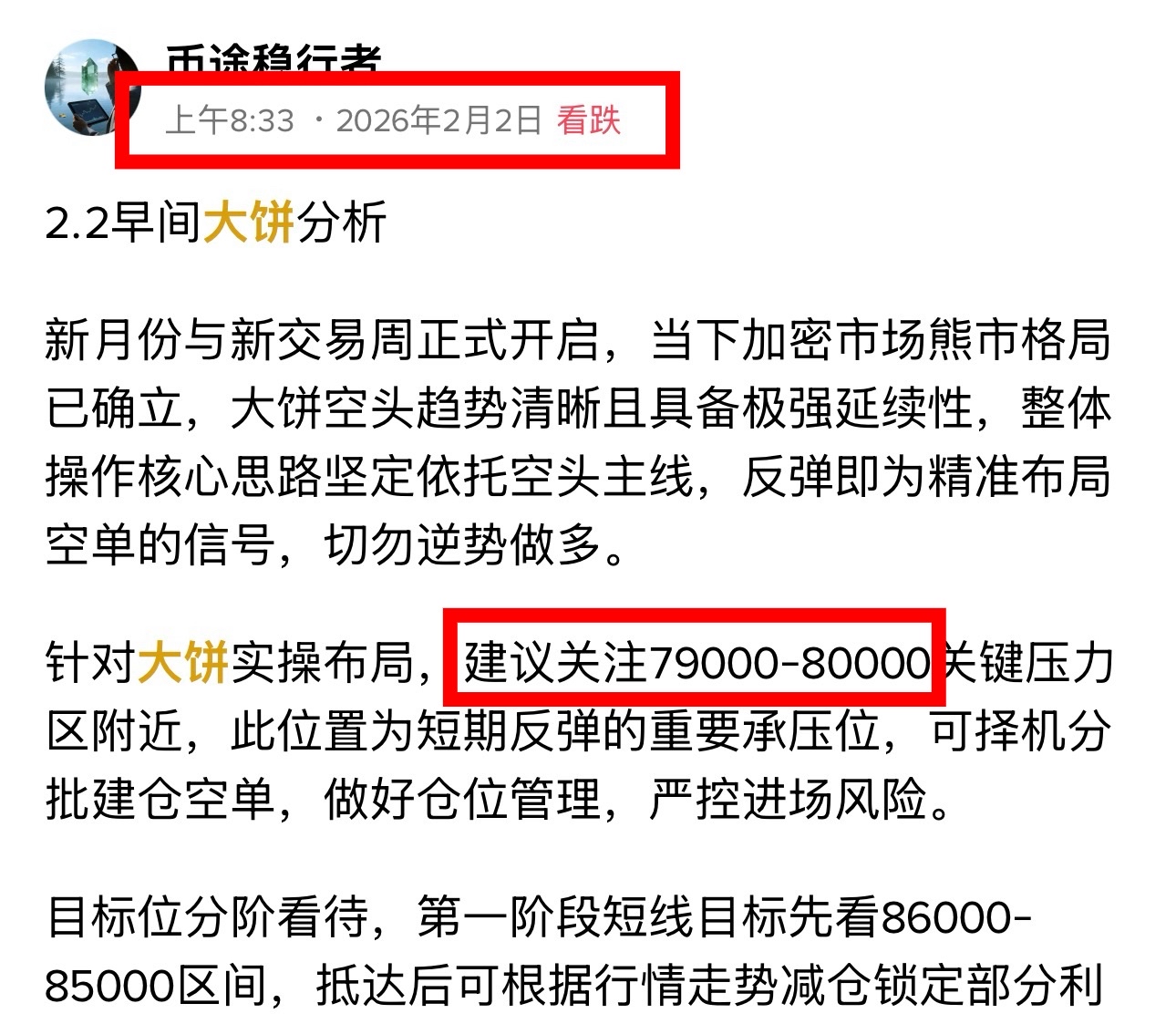

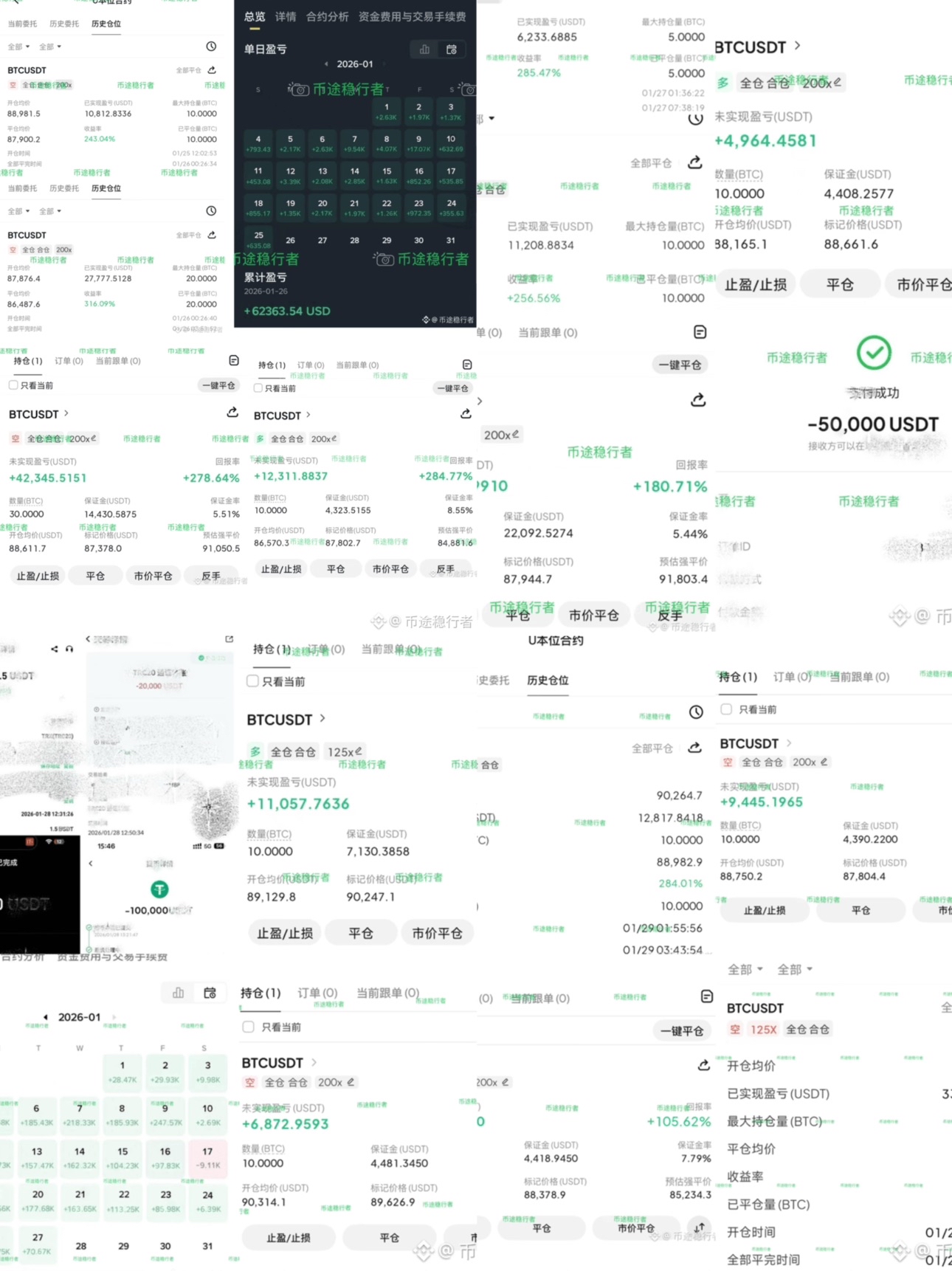

丝路策略延续稳健兑现节奏,本轮坚定布局空单思路,提前明确下看核心目标区间77000-76000一线,全程锚定趋势方向不变,精准把控行情下行节奏。

今日盘面按预判展开深度下探,行情最低下探至86839,完美落于既定目标区间内,走势轨迹与丝路预判的方向、空间高度契合,策略有效性再次得到实盘验证,全程无偏差贴合预判思路。

方向的精准把控是交易的核心前提,当前丝路空单布局已顺利达成目标,趋势判断与点位测算均完美落地;交易行至此刻,方向既定且成果已现,下一步核心重心将转向落袋为安,稳步兑现利润,将策略预判转化为实际收益,把控好交易闭环的最后关键一步。