Topic Background

Vellear.eth

Crypto Newbie

15h ago

Binance Chain (ffff) is worth watching recently.

I've discovered a new AI + GameFi coin – NodeHorse.

AI Agent × GameFi Next Generation

A major IP game for the Year of the Horse: Raise a warhorse, battle across the entire internet, and earn money while playing!

CA

0xf3921b1ff247c38be2cde4b8e80cb105fdb1ffff

Buy a small position for fun.

StoneKarinn

Crypto Newbie

02-02 06:43

👀 This game is simple yet exciting.

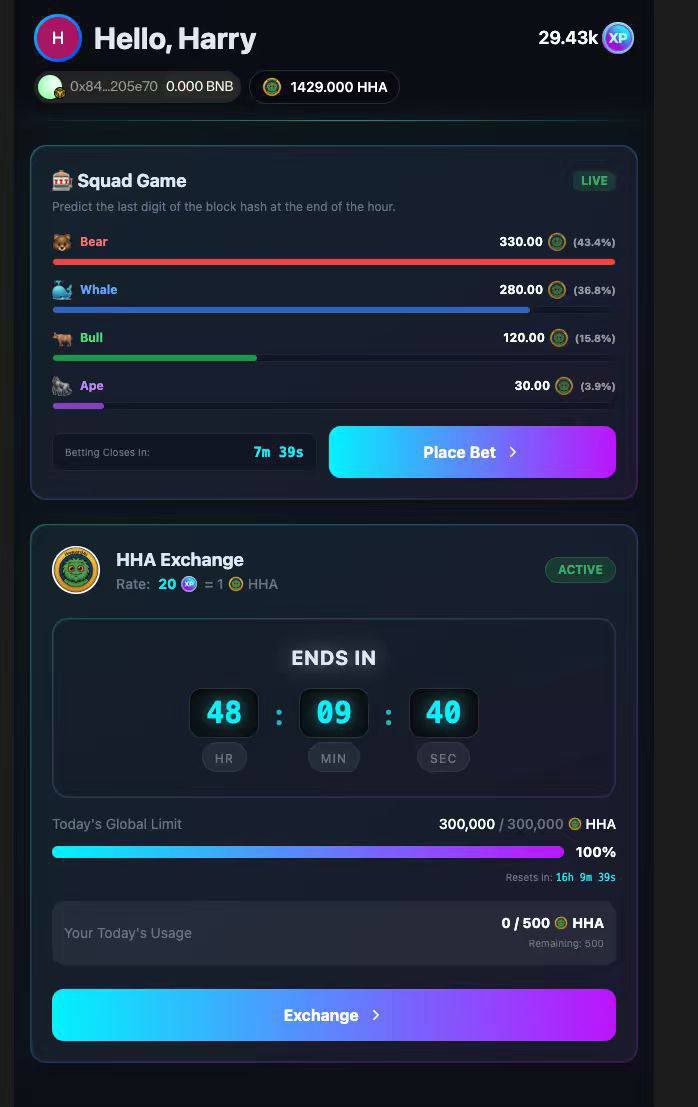

@HarryHowardAI's Squad Game runs hourly on BSC.

No odds, no charts.

Just choose a hexadecimal number from the block hash.

Choose your team 👇

🐂 0 / 4 / 8 / C

🐻 1 / 5 / 9 / D

🐳 2 / 6 / A / E

🦍 3 / 7 / B / F

⏰ Betting closes at 58 minutes.

💰 The winning team will split all the prize pools, even the smallest ones.

Fully chained.

#GameFi #BNBChain #Web3

The mining lamb

Crypto Newbie

01-30 20:31

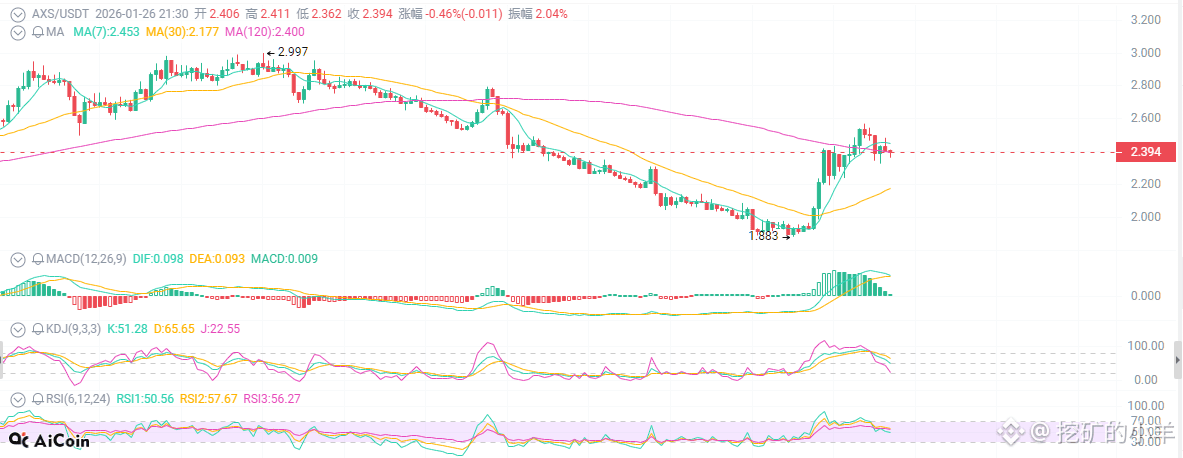

Looking at the $AXS chart tonight, I suddenly recalled the GameFi saga of overnight riches in 2021. Most of the protagonists of those stories have now vanished.

Over the past 30 days, large investors have spent a total of $15 million on AXS. Meanwhile, the token economic reforms launched by the Axie team in January completely halted the unlimited issuance of SLP.

This means inflation has been put on hold.

Unlimited issuance is like keeping a tap running in a swimming pool; no amount of buying can fill this bottomless pit. Now that the tap is off, the water in the pool has become precious.

The technical indicators are also supporting this. The MACD has formed a golden cross, the RSI has climbed out of the oversold zone, and short-term moving averages are starting to rise. These signals may not seem significant individually, but together they indicate a trend reversal.

AXS is currently at $2.15, more than 70 times away from its all-time high of $165. The long-term trend remains bearish, with the 99-day moving average still acting as resistance. Going long at this level requires courage, but even more so, discipline.

Support is at 2.10; exit if it breaks. Resistance is at 2.42; a break above this level targets 2.8.

Those who missed out on AXS in 2021 now have another chance. However, this time, the rules of the game have changed, and the players have changed.

Retail investors are panicking, while whales are accumulating. Which side are you on?

{future}(AXSUSDT)

Chain Broker

Crypto Newbie

01-27 22:00

👀 GameFi Ecosystem Overview

Top Protocols:

@AxieInfinity $446 million

@RealFlokiInu $401 million

@TheSandboxGame $351 million

Top Gainers:

@Capybobo_io +77.7%

@crosstheages +42.0%

@AxieInfinity +30.5%

@WemixNetwork +19.5%

@GUNbyGUNZ +15.3%

#Games #GameFi

$PYBOBO $CTA $AXS $WEMIX $GUN

The mining lamb

Crypto Newbie

01-26 21:44

Is this $AXS rebound a genuine recovery or just a final, fleeting moment of glory?

Today, $AXS rebounded by 10%, prompting many to proclaim "GameFi's triumphant return."

Let's start with the good news. $AXS is indeed making waves. The bAXS token economic reform sounds impressive. The MACD golden cross and price breakout above the EMA all look good.

But reality is harsh.

From January 23rd to now, $AXS has actually fallen 16.82%, from $2.85 to $2.37. This so-called 10% rebound is merely a struggle within an even larger decline.

Even more concerning is that the RSI is already at 69.83, nearing overbought territory. The $3 resistance level is firmly in place. Trading volume is shrinking, and the 10-day moving average has dropped 31.63%.

Back then, $AXS plummeted from $160 to just over $2, a 98% drop. Countless people lost everything in this game. Now, suddenly, they're saying it's recovering? Who believes it?

The GameFi sector, frankly, is a game of musical chairs. When the music stops, the last person holding the "flower" (the last piece of the pie) is the one left holding the bag.

The technicals are also contradicting this. The Three Black Crows pattern, the KDJ death cross, and the OBV sell signal all indicate that the sellers are back.

I'm not trying to be pessimistic about AXS. If you truly believe in the future of GameFi, you could try a small position around $2.

But the cruelest thing about the market is that it gives you hope, then crushes you.

AXS is like a seriously ill person; occasional moments of energy make the family think they're recovering. But the doctor knows best what's on the medical record.

If you're still fully invested in AXS, I urge you to wake up. The era of GameFi is over; now it's AI and memes. Holding onto an outdated game token is as ridiculous as Nokia waiting for Apple to collapse.

The market never lacks stories, it lacks buyers. AXS's story is over; all that's left is the despair of those trapped.

The mining lamb

Crypto Newbie

01-26 02:01

Yesterday everyone was touting $AXS as leading the GameFi recovery, and today it's down 17%. 😂😂

On one hand, whales are frantically buying 160,000 tokens, while on the other hand, retail investors are panicking and selling at a loss.

AXS has risen 120% this week from its bottom, and the GameFi sector is indeed recovering. But the question is, why are whales buying the dip while retail investors are panicking?

Whales are looking at the token economic model reform, the bAXS staking mechanism, and the valuation repair of the entire GameFi sector. They know this correction is just a technical pullback.

Retail investors are looking at the MACD death cross, the RSI oversold condition, and that scary "bearish Harami" pattern. Seeing all the technical indicators giving sell signals, they panic immediately.

But here's a key point: the trading volume is 38% higher than the 10-day average, indicating that someone is buying heavily. Who is buying? Not retail investors, but institutions.

The current price is at 2.30, with support at 2.17 and resistance at 2.79. Technically, it does appear bearish, but the fundamentals are changing. Axie Infinity's ecosystem reforms won't show results overnight.

My assessment: Short-term consolidation is expected, with a possible test of the 2.17 support level. However, if the GameFi sector truly takes off, AXS, as the leader, will have significant upside potential.

The key is to decide whether you're trading short-term or long-term. For short-term traders, wait for prices to reach around 2.17; for long-term holders, the current price isn't actually expensive.

Bitcoin CEO

Crypto Newbie

01-23 09:24

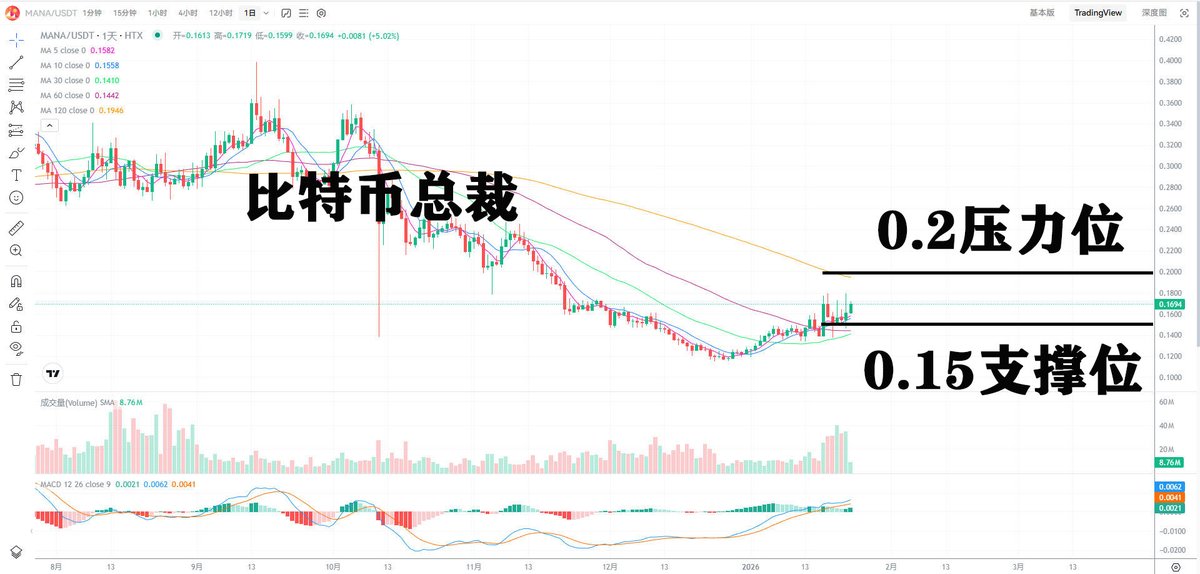

The GameFi sector has been very strong recently, with AXS and SAND both breaking above their daily MA120, while MANA hasn't even touched it yet. Looking at the daily chart, it has seen two consecutive days of gains, with the overall trend trending upwards in a volatile manner. The MACD has also returned to the zero line and is diverging upwards, indicating that the market is gradually moving out of its bottom range, suggesting further upside potential and a potential test of the 0.2 resistance level. #MANA

Blave

Crypto Newbie

01-21 08:13

The strongest performing token over the past few days has been $AXS, giving the impression that the GameFi craze is back! 🤣🤣

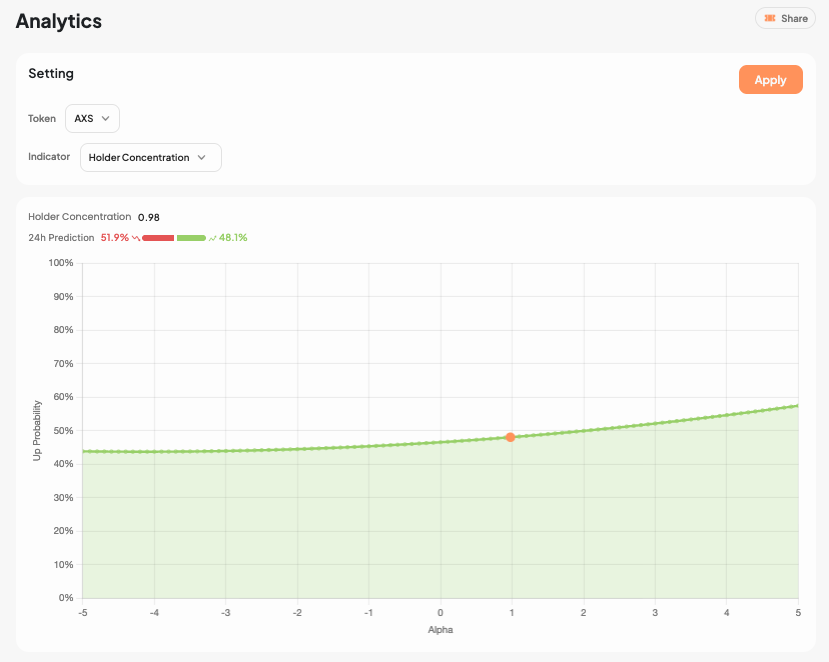

Besides protocol-driven catalysts, data shows that short-term momentum remains strong, but holder concentration has begun to weaken, meaning now is not the ideal time to aggressively chase the rally.

Instead, waiting for a pullback might be a better option.

The liquidation map shows a large accumulation of short liquidations around 2.376.

By checking current holder and momentum levels with Blave Analytics, #AXS remains in a high-probability upside zone, so rumors of a short squeeze are worth noting.

Use Blave Analytics to understand the best trading expectations:

CoinMarketCap

媒体

01-19 03:00

GameFi Weekly Update: Axie Price Adjustment, Pixiland's Exit from Web3 Platform, and More

The GameFi market cooled down after a strong start to January. Axie Infinity experienced significant price volatility, smaller-cap tokens saw price declines, and the game Ronin completely exited the Web3 platform.

Here's a brief recap. 🧵

1/7

The $AXS token experienced significant volatility this week.

On January 14th, $AXS's market capitalization surged to approximately $230 million, a roughly 50% increase in two days.

By January 15th, the token had fallen by over 14%, and its current market capitalization is approximately $208 million.

Source: @CoinMarketCap

2/7

Meanwhile, smaller-cap GameFi tokens struggled to maintain their gains.

The price of the World of Dypians token, $WOD, more than doubled last week, surging from approximately $9 million to over $20 million, but has since fallen nearly 40%.

Source: @CoinMarketCap

4/7

On the other hand, Pixiland: Age of Heroes announced the suspension of all Web3 functionality, switching entirely to a Web2 model.

The Ronin-based game stated that this move was due to market conditions, regulatory challenges, and limited resources.

Its Web3 control panel will be shut down on March 1st.

6/7

Data Overview:

• GameFi Total Market Cap: Approximately $9.35 billion

• Price Change: -2%

• 30-Day Change: +101%

For more details and full information, please see the news brief below 👇

7/7