Topic Background

ChinaCrypto

Crypto Newbie

19h ago

It feels like a little something was taken from my pocket 💸

Look into my eyes, look directly at your coin price

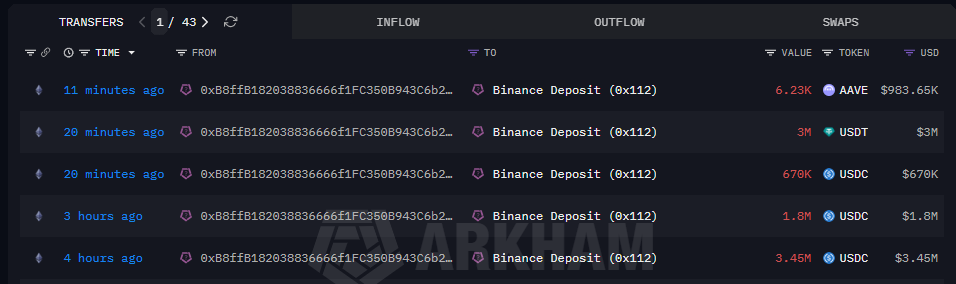

$AAVE has fallen from a high of $357 last year to $126 📉

Aave @aave founder buys five-story London mansion for approximately $30 million last year

Decentralized finance platform Aave founder Stani Kulechov @StaniKulechov has purchased a £22 million (approximately $30 million) mansion in London's Notting Hill neighborhood.

This transaction is reportedly one of the most expensive in the UK's sluggish luxury property market 🏠 over the past year.

According to documents 📰, the property was purchased last November, approximately £2 million below the previously listed guide price. This transaction occurred a week before the UK budget was released.

0xMoon

Crypto Newbie

02-01 14:53

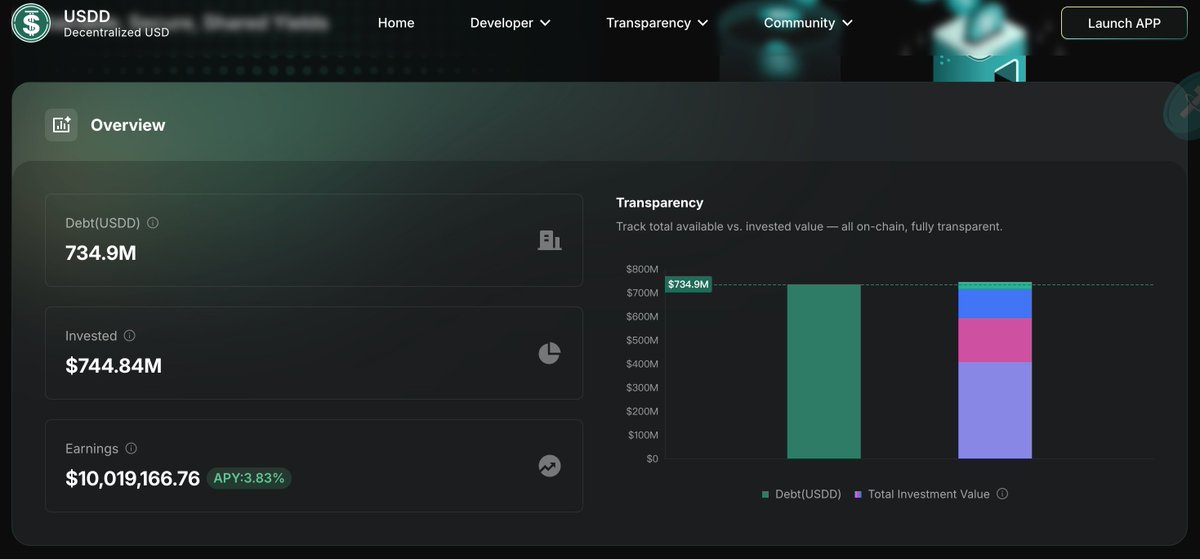

USDD Earns Over Ten Million Dollars

The Smart Allocator is a smart allocator for USDD that distributes idle reserves to USDT demand deposits on leading DeFi protocols such as AAVE, JustLend, Spark, Morpho, and Venus, offering the highest liquidity and security.

All the earnings from this are returned to USDD holders, meaning that USDD has already earned tens of millions of dollars for its holders.

@justinsuntron #TronEcoStar

Chain Broker

Crypto Newbie

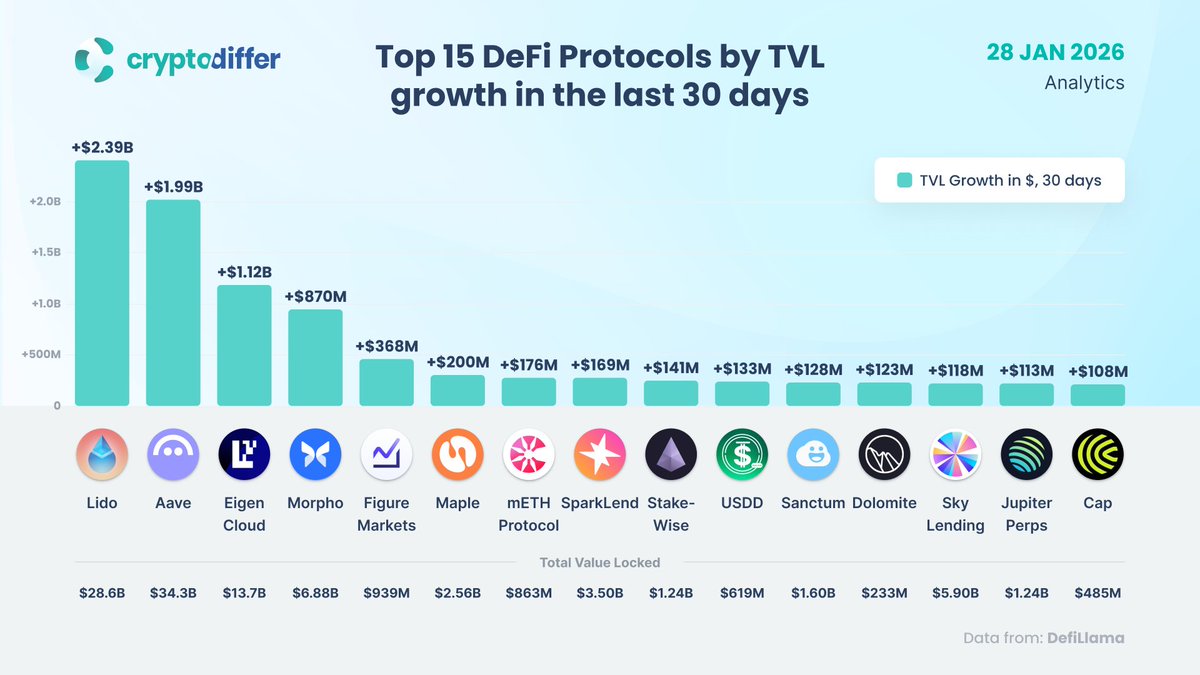

01-28 23:21

✨ Top-Ranking DApps by Weekly Fee Revenue and Total Revenue

@HyperliquidX $16.2 million

@LidoFinance $14 million

@Aave $15.2 million

@Pumpfun $7.2 million

@SkyEcosystem $7.96 million

@edgeX_exchange $6.69 million

@JupiterExchange $9.66 million

@Aster_DEX $6.15 million

@sanctumso $2.39 million

@jito_sol $2.33 million

#dApps

$HYPE $LDO $AAVE $JUP $CLOUD $JTO

大齐XBT

Crypto Newbie

01-27 22:35

🟢$AAVE Bullish📈

$AAVE's EMA5, EMA10, and EMA20 are in a bullish alignment. The price is closely following the upper Bollinger Band (156.08), with the middle band (154.69) providing solid support and the upper band acting as short-term resistance.

MACD: The DIF and DEA lines continue to diverge upwards above the zero line, and the MACD histogram remains positive, indicating strong bullish momentum with no signs of exhaustion.

Current trading volume (5,000.3) is slightly lower than the 5-day average (6,360.8), but the volume-price relationship during the upward movement is acceptable, suggesting continued trend continuation.

{future}(AAVEUSDT)

Chain Broker

Crypto Newbie

01-24 10:38

🎯 Top-performing projects in terms of developer activity growth:

@ethereum +181%

@LitProtocol +167%

@iota +160%

@HathorNetwork +154%

@Aave +148%

@arbitrum +116%

@XPRNetwork +110%

@Polkadot +105%

@NEARProtocol +91.7%

@StellarOrg +82.6%

$ETH $LITKEY $IOTA $HTR $AAVE $ARB $XPR $DOT $NEAR $XLM

CryptoDiffer - StandWithUkraine

Crypto Newbie

01-22 19:05

Lending protocols ranked by loan asset size

#Lending is the cornerstone of #DeFi, and #Aave is undoubtedly a leader in this field. These protocols underpin the credit market, providing ample liquidity, leverage options, and sustainable yield opportunities.

$AAVE $MPL $SPK $KMNO $COMP $EUL $XVS $JUP

Chain Broker

Crypto Newbie

01-21 20:00

✨ Top-Ranking DApps by Weekly Fee Revenue and Total Revenue

@Aave $14.4 million

@HyperliquidX $14.6 million

@LidoFinance $15.4 million

@JupiterExchange $9.48 million

@SkyEcosystem $7.89 million

@Pumpfun $7.04 million

@edgeX_exchange $5.54 million

@Aster_DEX $6.32 million

@phantom $2.85 million

@MeteoraAG $3.34 million

#dApps #Fees

$AAVE $HYPE $LDO $JUP