Topic Background

欧鹏同学

Crypto Newbie

01-30 15:17

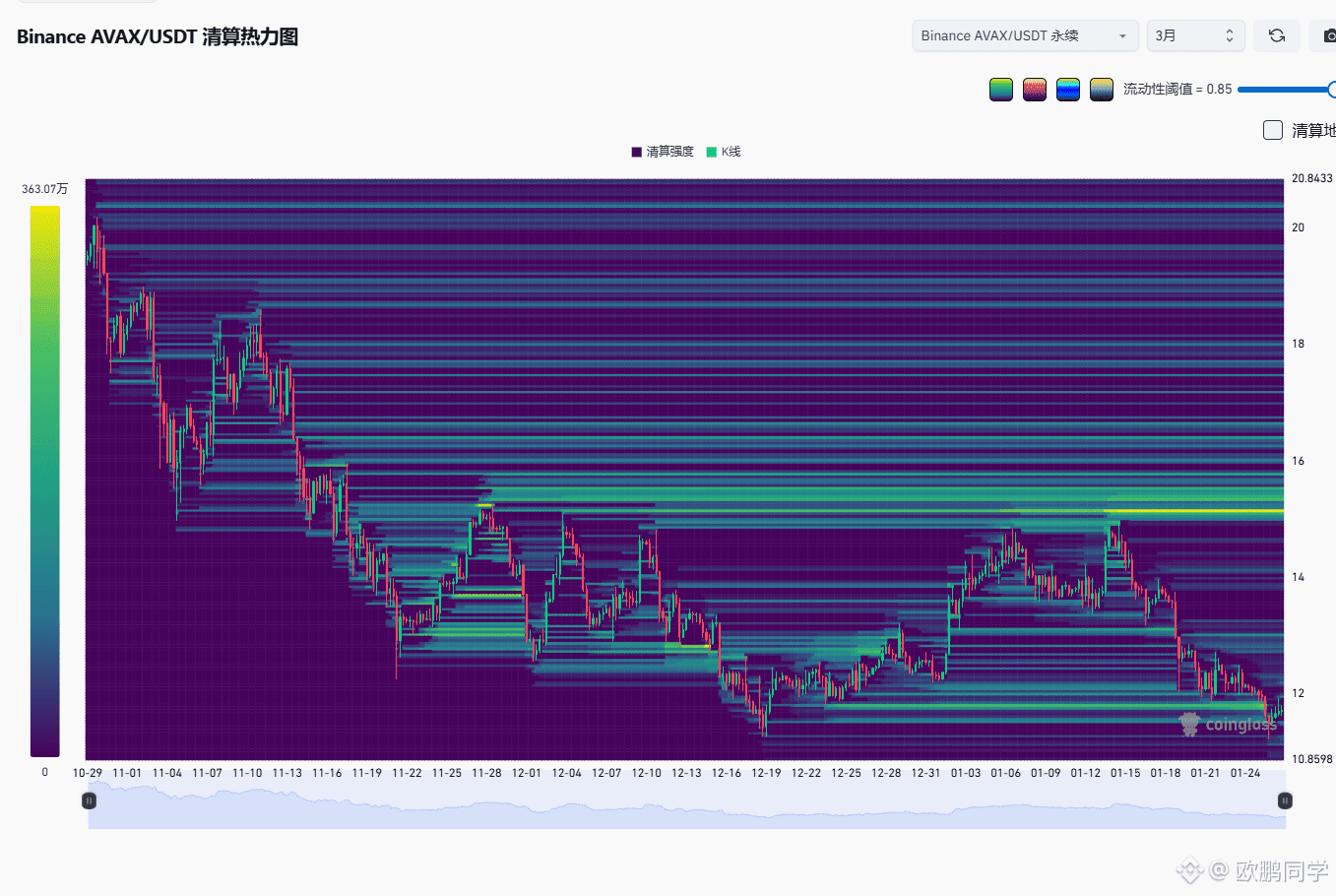

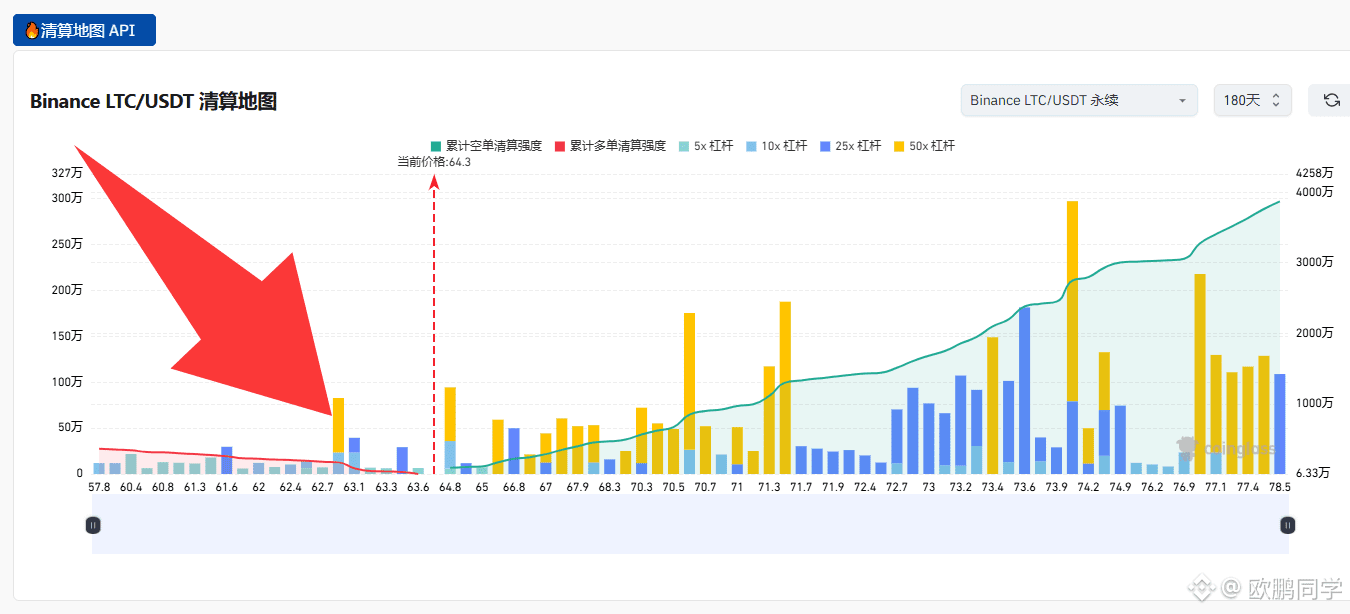

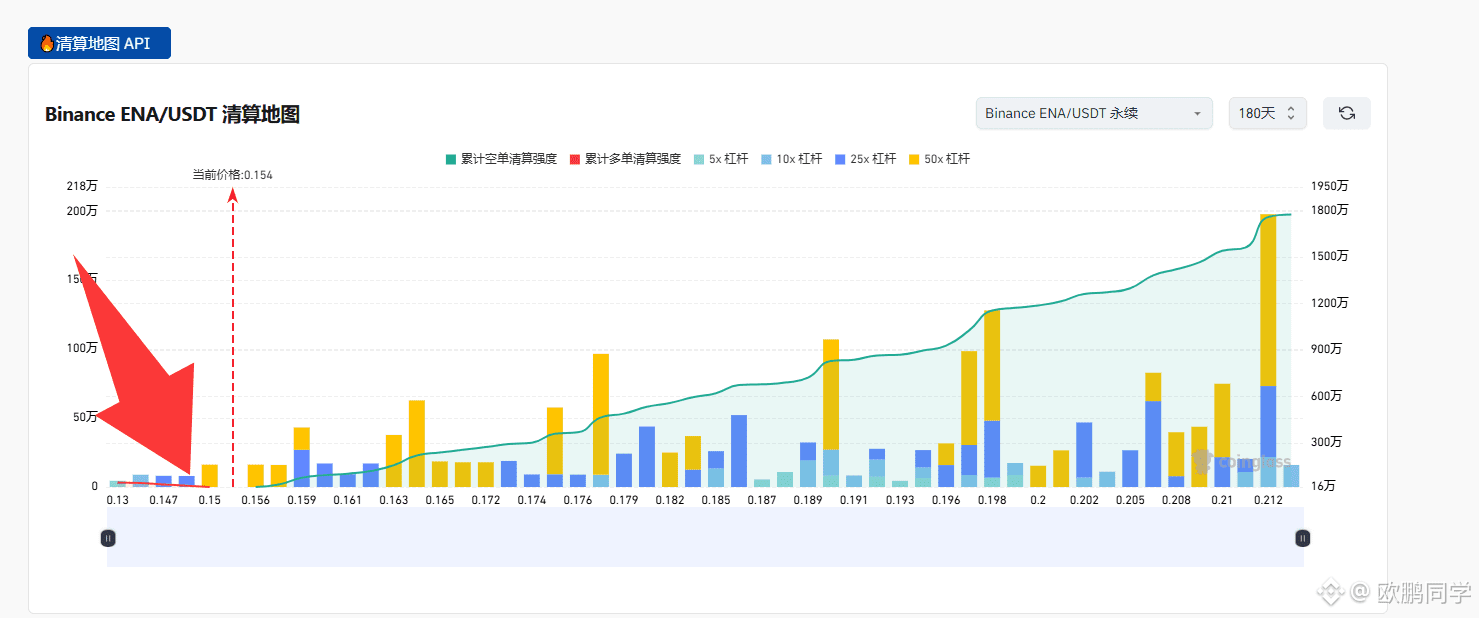

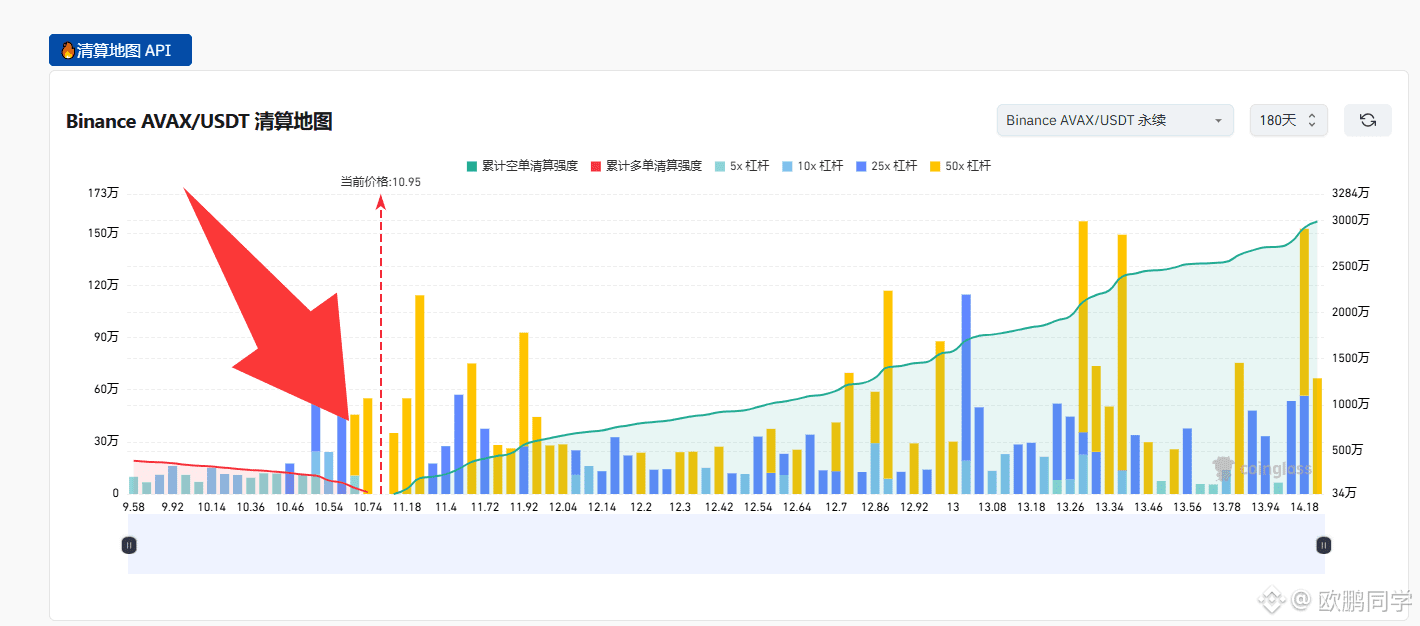

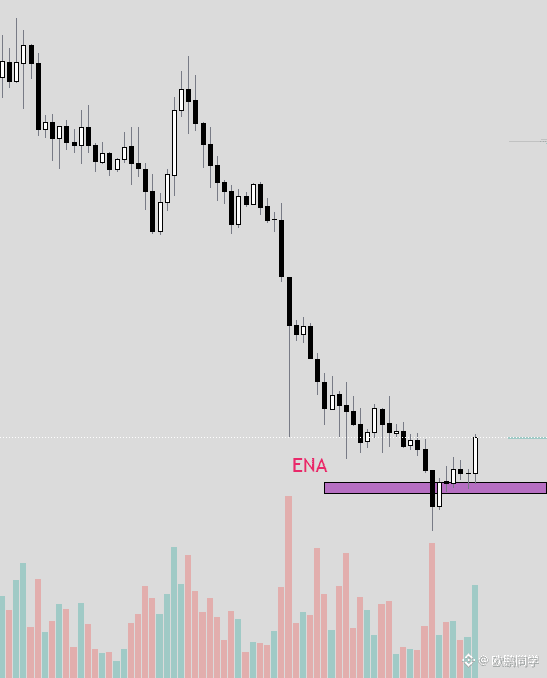

My holdings of LTC, AVAX, and ENA have just completed their first round of position additions. Looking at the 180-day liquidation chart, the long positions are almost fully liquidated. Unless Bitcoin spikes to 74,000, I won't add to the remaining positions before the Spring Festival. I'll patiently wait for the market to bottom out and reverse.

$LTC

{future}(LTCUSDT)

$AVAX

{future}(AVAXUSDT)

$ENA

{future}(ENAUSDT)

Tanghua spotted bamboo

Crypto Newbie

01-29 19:47

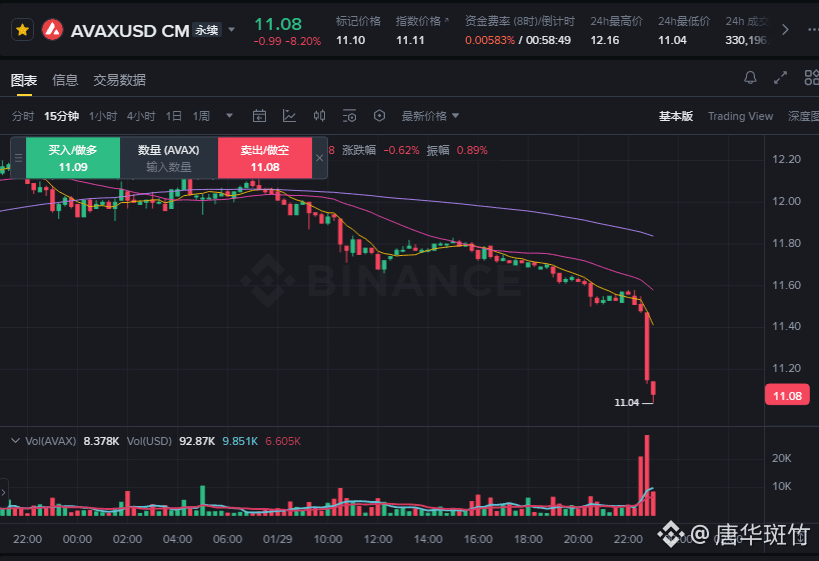

I was too embarrassed to talk about investments during the Spring Festival gatherings with relatives and friends. My neighbor, an older woman, spent over 20,000 yuan last week on a 20-gram gold bracelet. It cost 1200 yuan then, and now it's 1700 yuan and sold out everywhere. She made 10,000 yuan in a week, with an initial investment of just over 20,000 yuan. Meanwhile, I have a bunch of counterfeit stocks that are still plummeting. I bought AVAX at 19 USDT a few days ago, and now it's at 11, almost halved. The worst part is, I even opened a futures contract. I'm such an idiot. There's no explanation needed; I'm just an idiot. $AVAX

{future}(AVAXUSDT)

Chain Broker

Crypto Newbie

01-28 18:00

👀 Avalanche Total Value Locked Overview

Major Protocols:

@Aave $561 million

@BenqiFinance $198 million

@BlackholeDex $72.4 million

Protocols with the Largest Gains:

@beefyfinance +32.1%

@NEARProtocol +29.3%

@spectra_finance +22.6%

@mesonfi +14.8%

@radioshack +6.65%

$AVAX #Avalanche

$BIFI $NEAR $SPECTRA $RADIO

欧鹏同学

Crypto Newbie

01-28 08:31

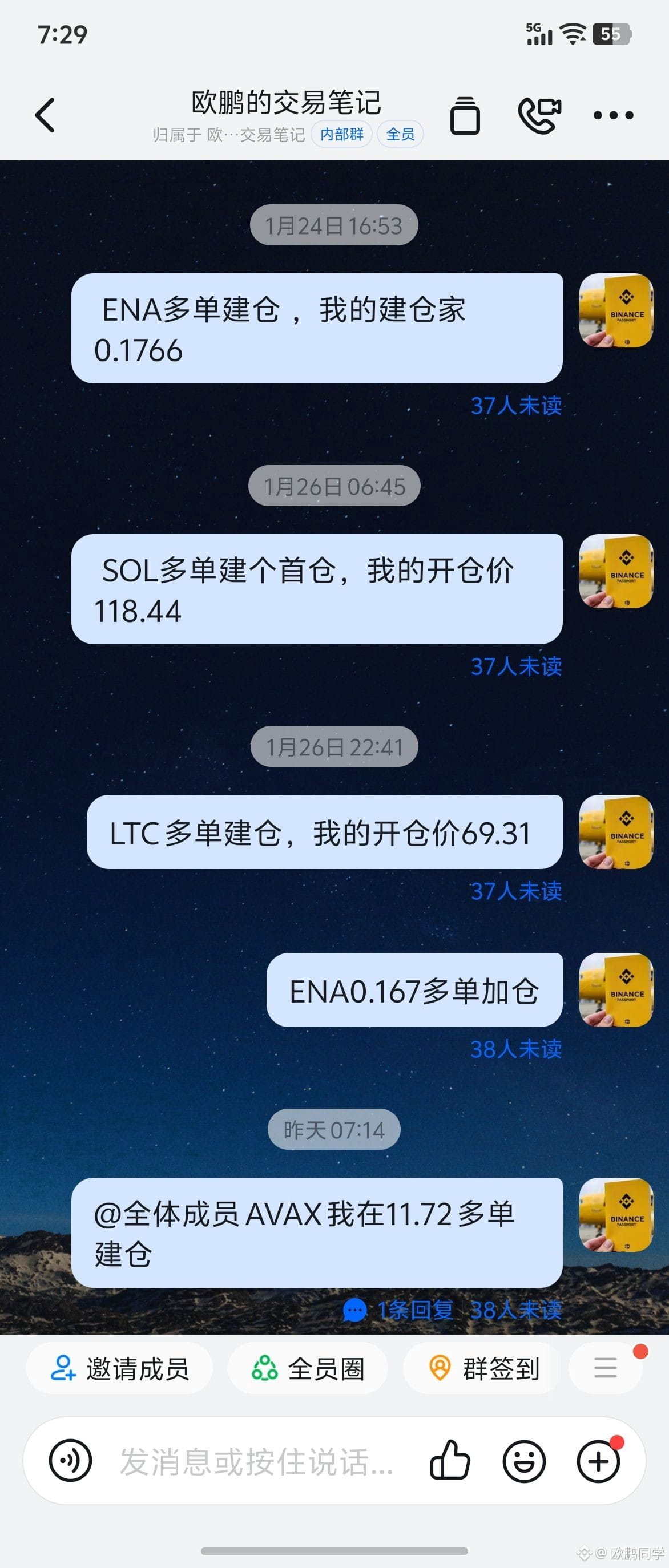

GM☀️ Today is January 28th. We currently hold long positions in ENA (established on the 24th), LTC (established on the 26th), SOL (established on the 26th, already sold short), and AVAX (established on the 27th).

The market has started to rebound, and all positions are currently showing profits. How was our prediction? Still accurate!

Whether it's the trend judgment, entry points, adding to positions, or the waiting these past few days, this profit should belong to our community. What do you think?

Live broadcast time: Monday to Friday, 6-7 AM; 10 PM-11:30 PM

欧鹏同学

Crypto Newbie

01-27 10:39

GM☀️ initiated a long position on AVAX this morning during a live stream. My entry price was 11.72. Looking at the three-month liquidation chart, the liquidity below has been completely cleared. Gold and silver also started to fall this morning, so I'm initiating a long position.

Current long positions: SOL, LTC, AVAX, ENA.

{future}(AVAXUSDT)

{future}(LTCUSDT)

{future}(ENAUSDT)