Bitcoin's four-year cycle wasn't a natural evolution; it was stifled.

Cause of Death: ETF Arbitrage.

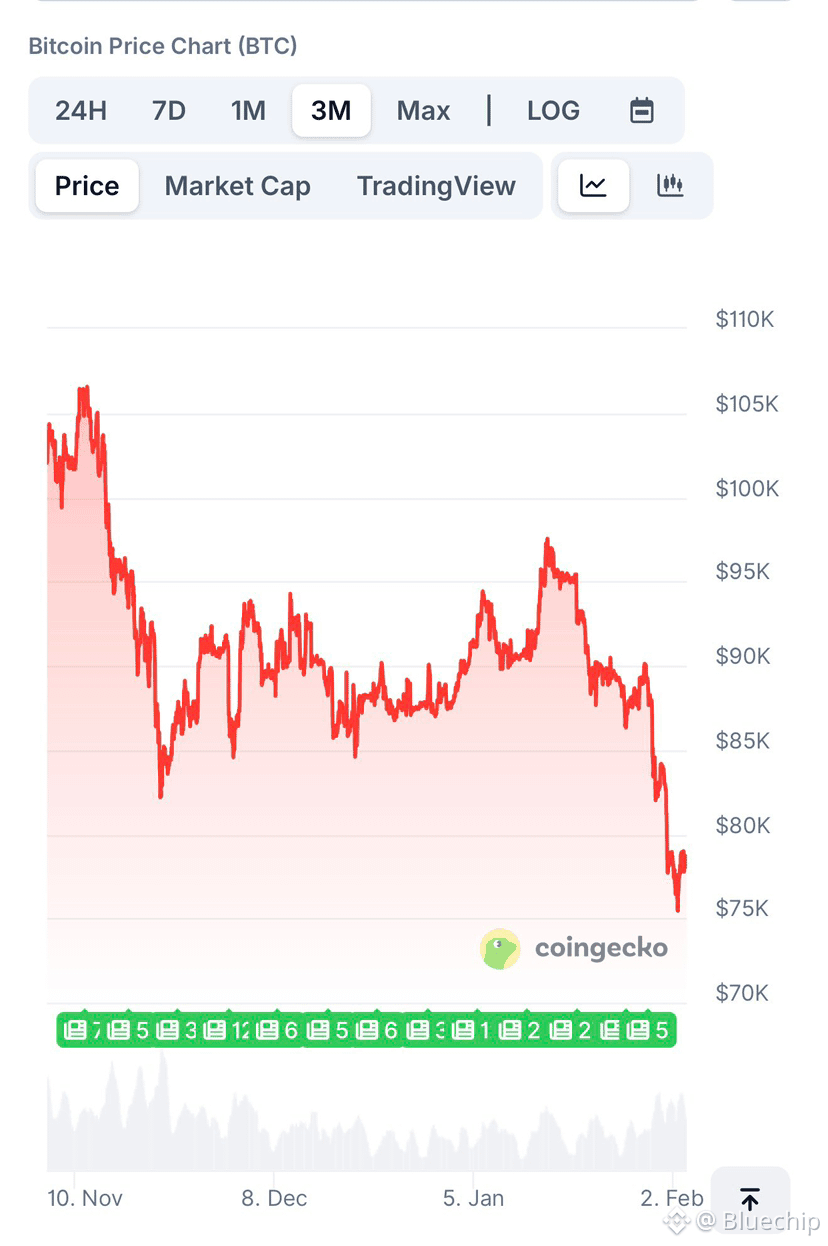

Analysis: The return after the 2024 halving was +31%, while the historical average return was a staggering +300%. This wasn't a delay, but a regime change.

Culprit: 20% to 56% of ETF inflows weren't genuinely for Bitcoin adoption, but rather for basis trading chasing a 25% annualized return. Hedge funds bought spot ETFs while simultaneously shorting CME futures. Delta was neutral, indicating a complete lack of confidence.

Evidence: Data from the Commodity Futures Trading Commission (CFTC) shows that leveraged funds had a short-to-long ratio as high as 5:1. This wasn't institutional confidence in Bitcoin, but rather arbitrage trading with expiration dates.

The return plummeted from 25% to 0.37%.

Arbitrage trading is dying out. What was once the "institutional bottom line" is now the withdrawal of arbitrage capital. The correlation between ETF outflows and basis compression is as high as 0.878. This isn't market sentiment, it's mathematics.

Final conclusion: The correlation between BTC and the Nasdaq index has reached 0.75. Bitcoin is no longer affected by the halving mechanism, but by the Fed's policy. It's like a leveraged version of QQQ in a hardware wallet.

Everyone waiting for the "cycle" to arrive is desperately searching for 2026 with a 2017 map.

The next bull market won't stem from supply dynamics, but will only arrive when the basis exceeds 7%, put/call options fall below 0.6, and mechanical selling exhausts itself.

Falsifiable prediction: If the price of Bitcoin exceeds $150,000 by the second quarter of 2026 without the Fed easing monetary policy, then my prediction is wrong, and the cycle still exists.

Save this article.

$BTC