The market has reached a point where even the most stubborn bulls have to admit that it's transitioning from an early bear market to a deeper one!

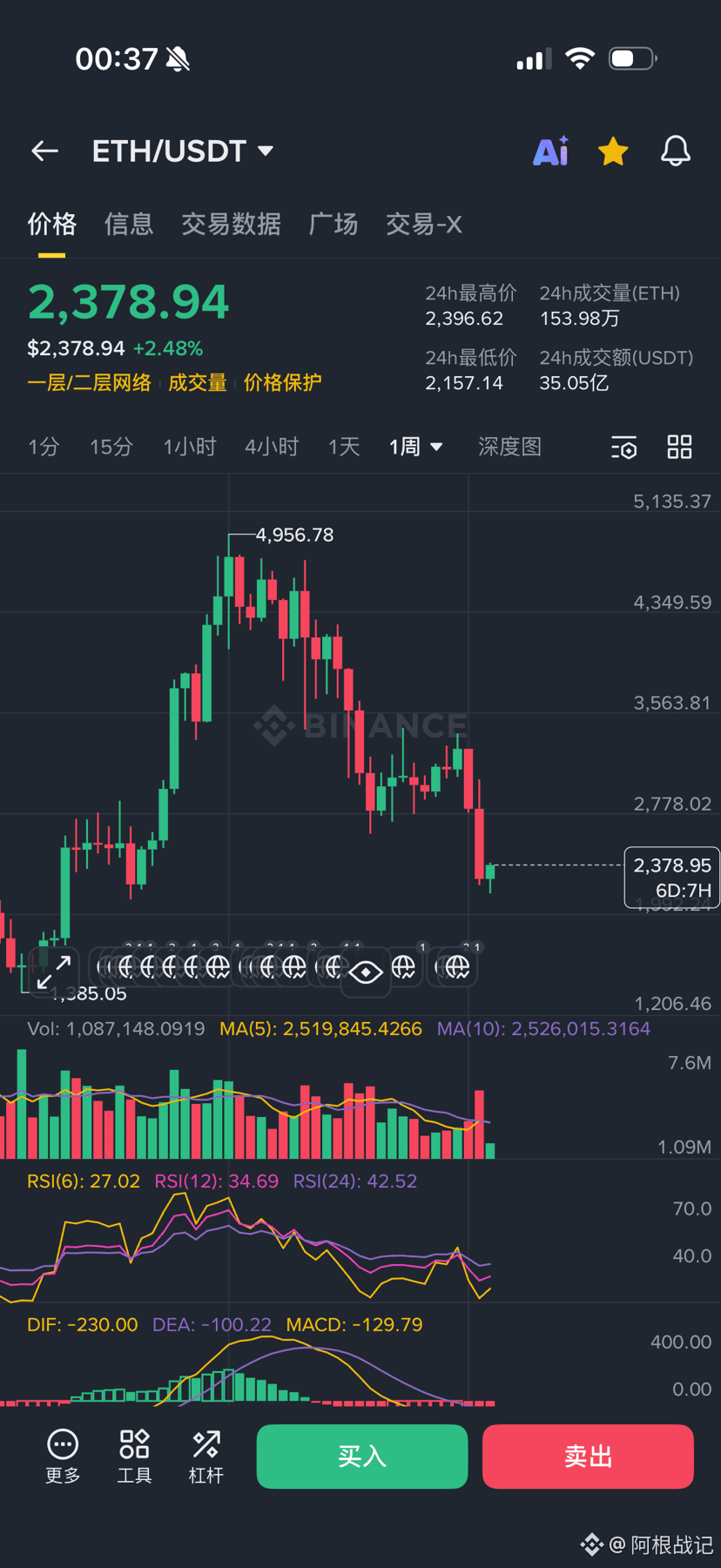

Looking at the weekly charts for Bitcoin and ETH, a head and shoulders pattern is clearly forming!

Bitcoin's April low was $74,508, and the current low is $74,604, a difference of only $100, or 0.1%.

Correspondingly, ETH's April low was $1,385, and the current low is $2,157, which seems more like the June low of $2,111. From this perspective, ETH appears stronger, but it could also be argued that ETH hasn't bottomed out yet, and whether it will experience a further decline remains to be seen.

If we follow a pattern, the bottom of a bear market often arrives about a year after the peak of a bull market. In October 2025, the peak was $126,199, so the bottom might not be reached until October 2026!

Currently, Bitcoin has fallen 40.8% from its high, and ETH 56.4%. Historically, after Bitcoin enters a bear market, the maximum drop is typically 70-80%. The previous three halvings saw maximum drops of 86%, 83%, and 77% respectively (see Figure 3). This time, with institutional entry, the drop is expected to be smaller, possibly 60-70%, or a decrease from 50,000 to 37,000!

Understanding the overall market trend is crucial for making trading decisions; this is called the "big picture trading method"—a veteran Dota player here.

For at least the next six months, the primary strategy should be shorting at higher levels, then attempting to profit from rebounds at key support levels. However, whether going long or bottom-fishing in the spot market, one should not be too overly ambitious and should take profits when appropriate.