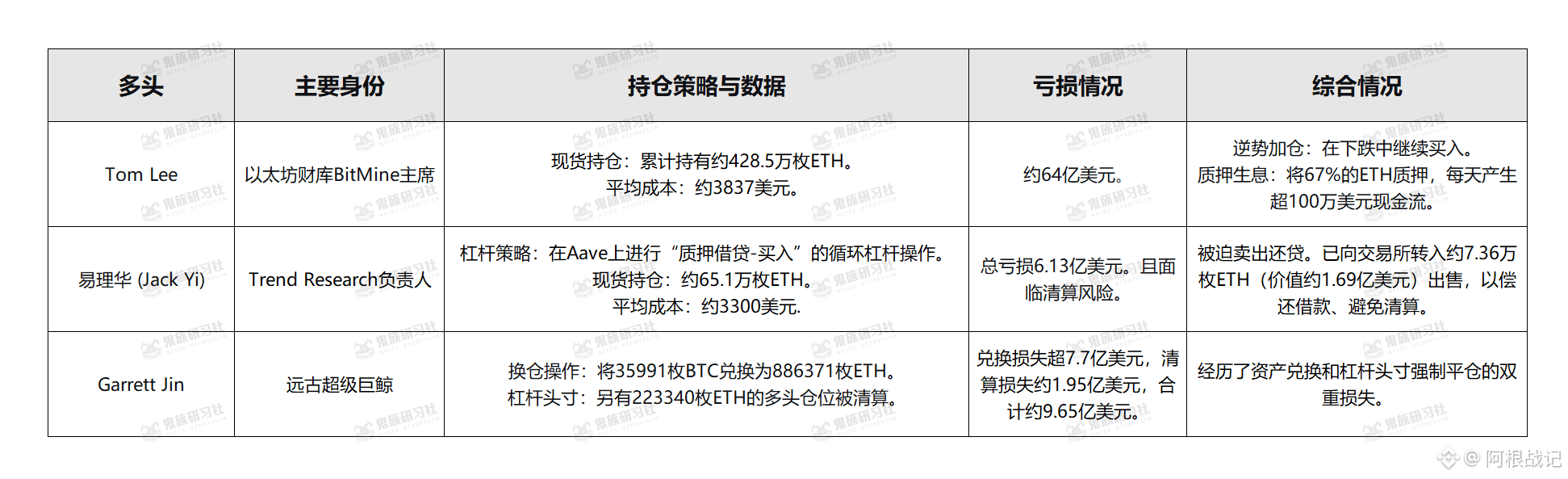

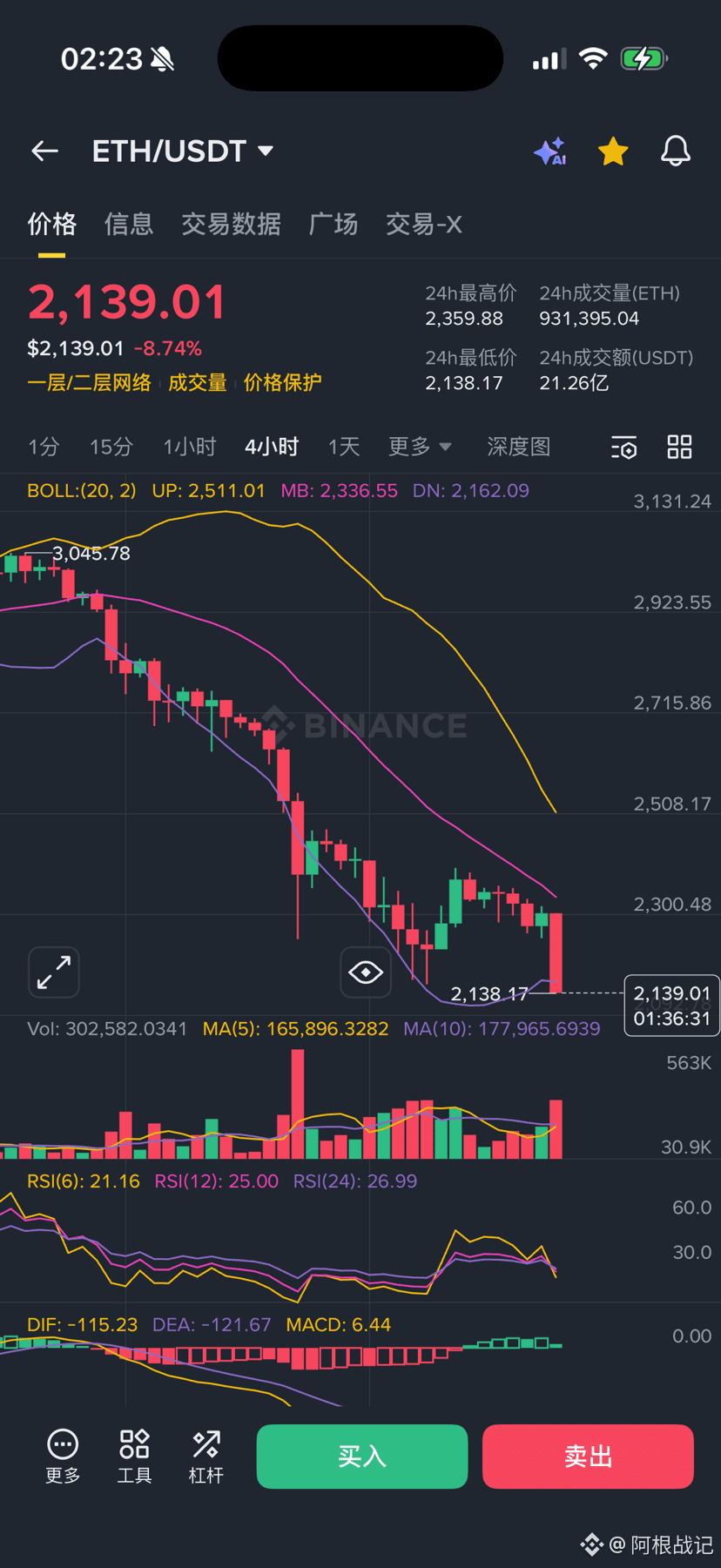

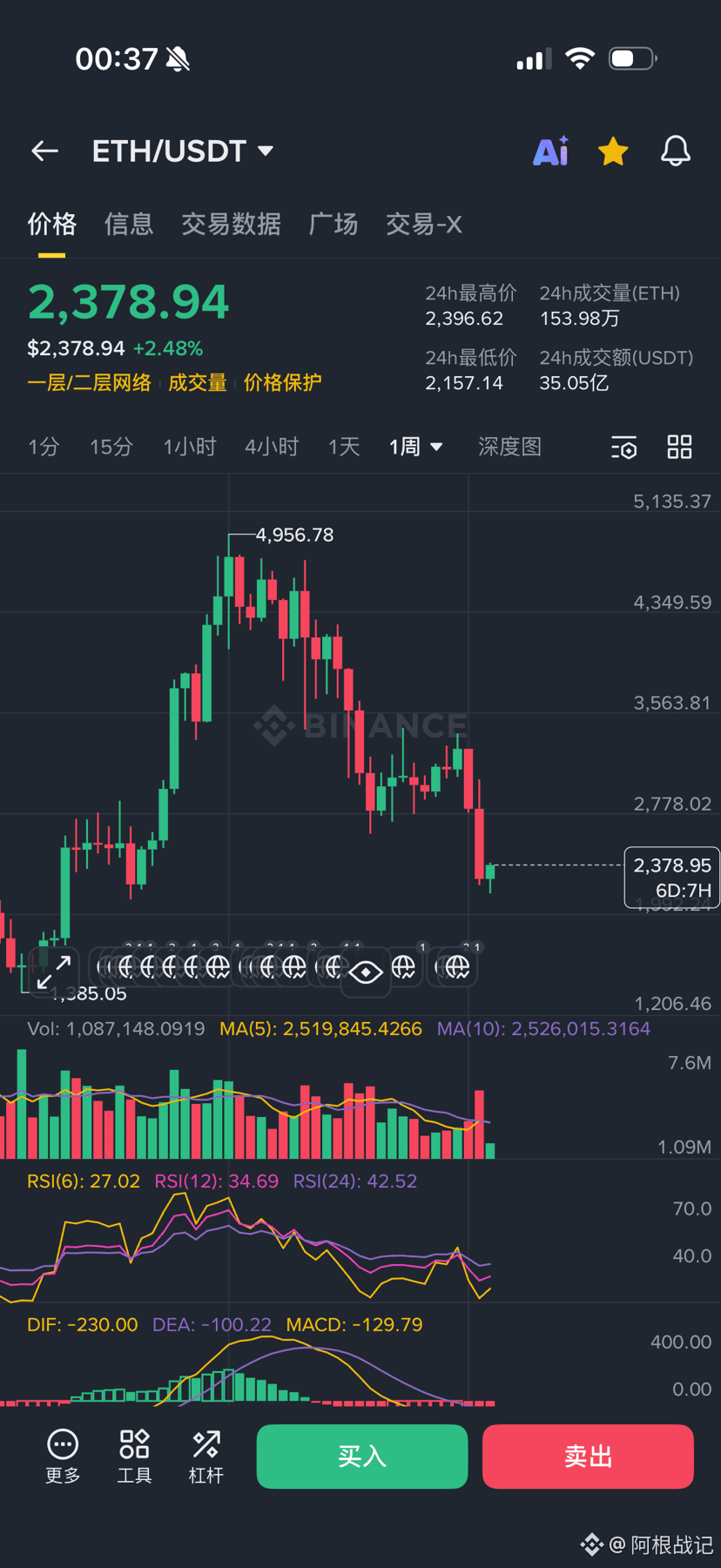

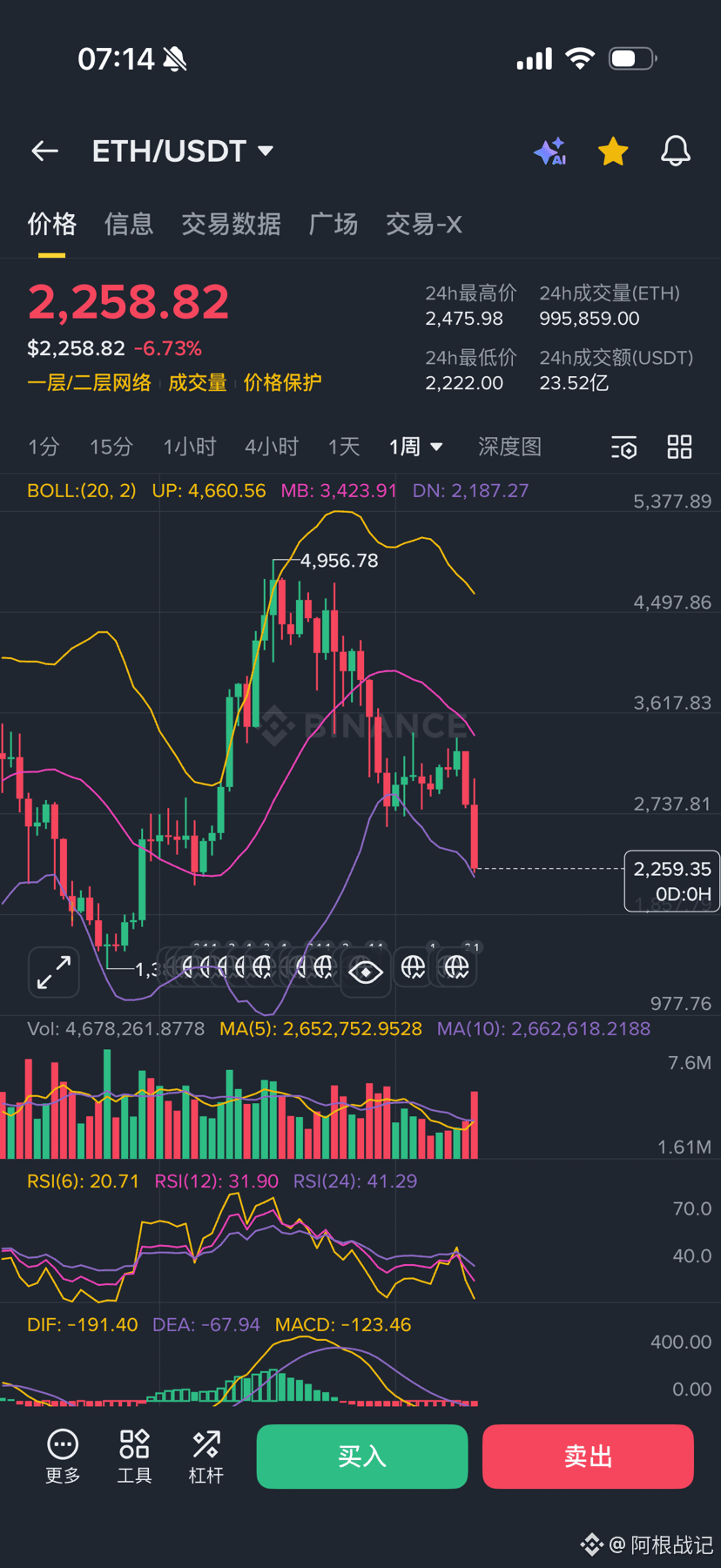

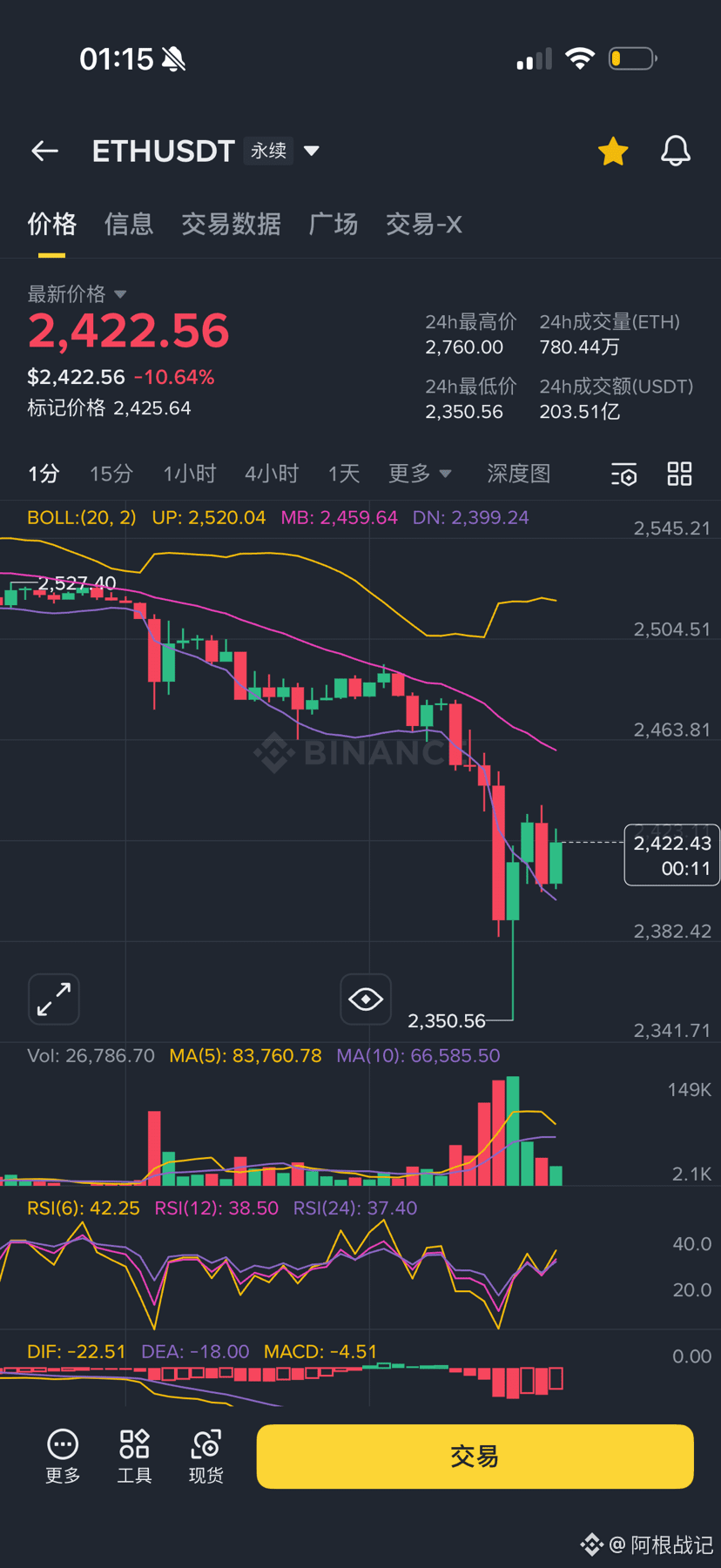

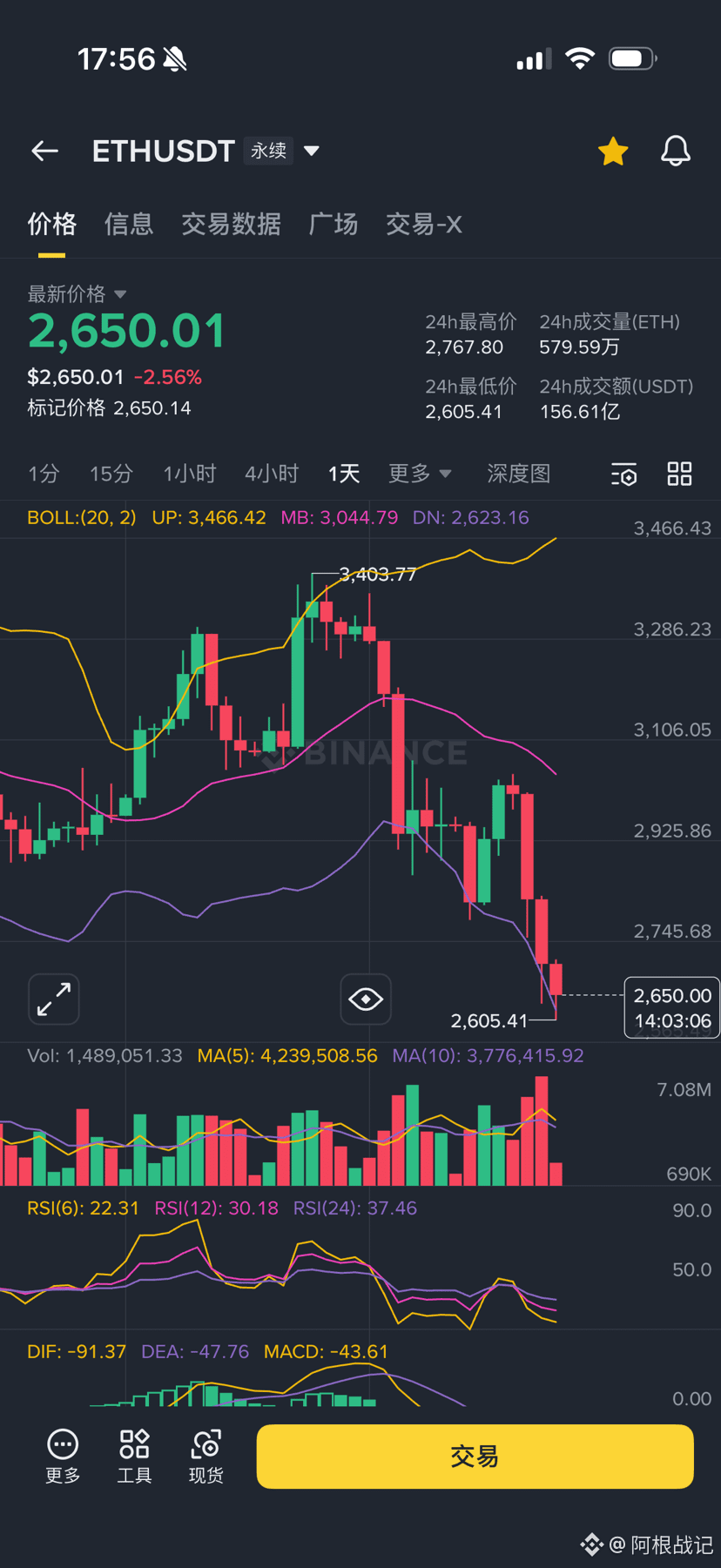

ETH whales have started selling to save themselves. Garrett Jin, Yi, and Tom Lee are either selling ETH to repay staking loans and avoid liquidation (as shown in Figure 2, created by Ghost Tribe Research Institute), or they have already lost nearly $1 billion. Yi has 650,000 ETH with a liquidation price of over $1800. If the price falls, he will be forced to sell ETH to repay loans, causing the market to spiral downwards.

Will larger market manipulators be targeting these whales?

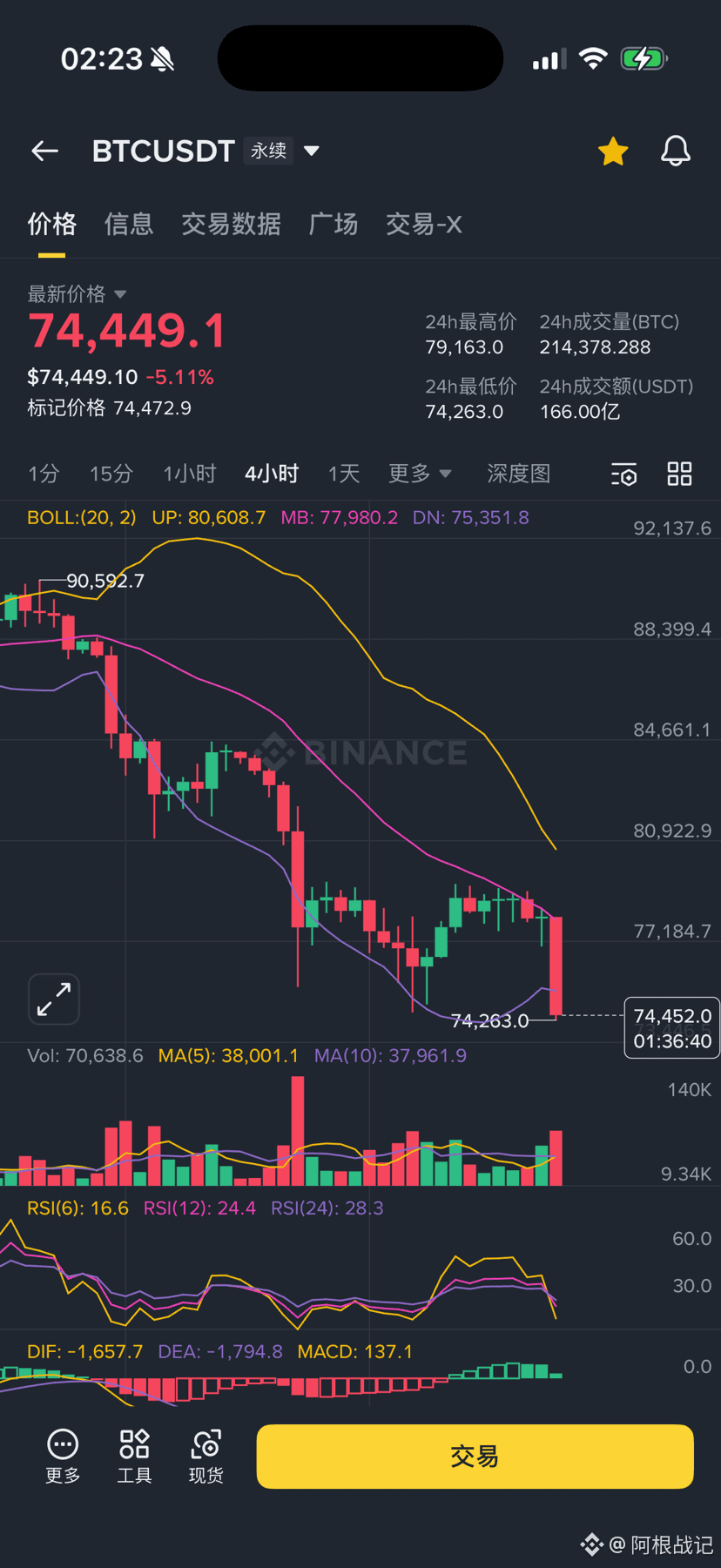

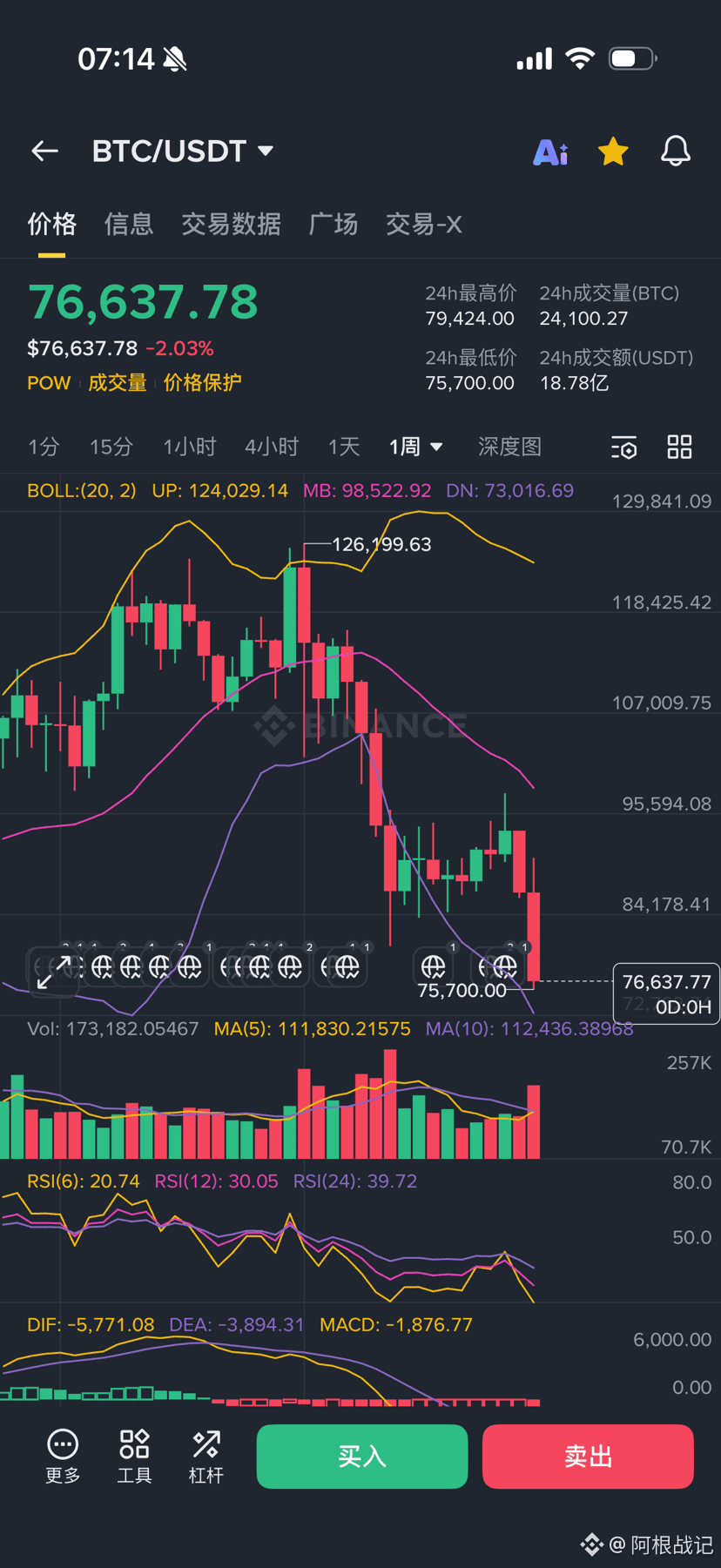

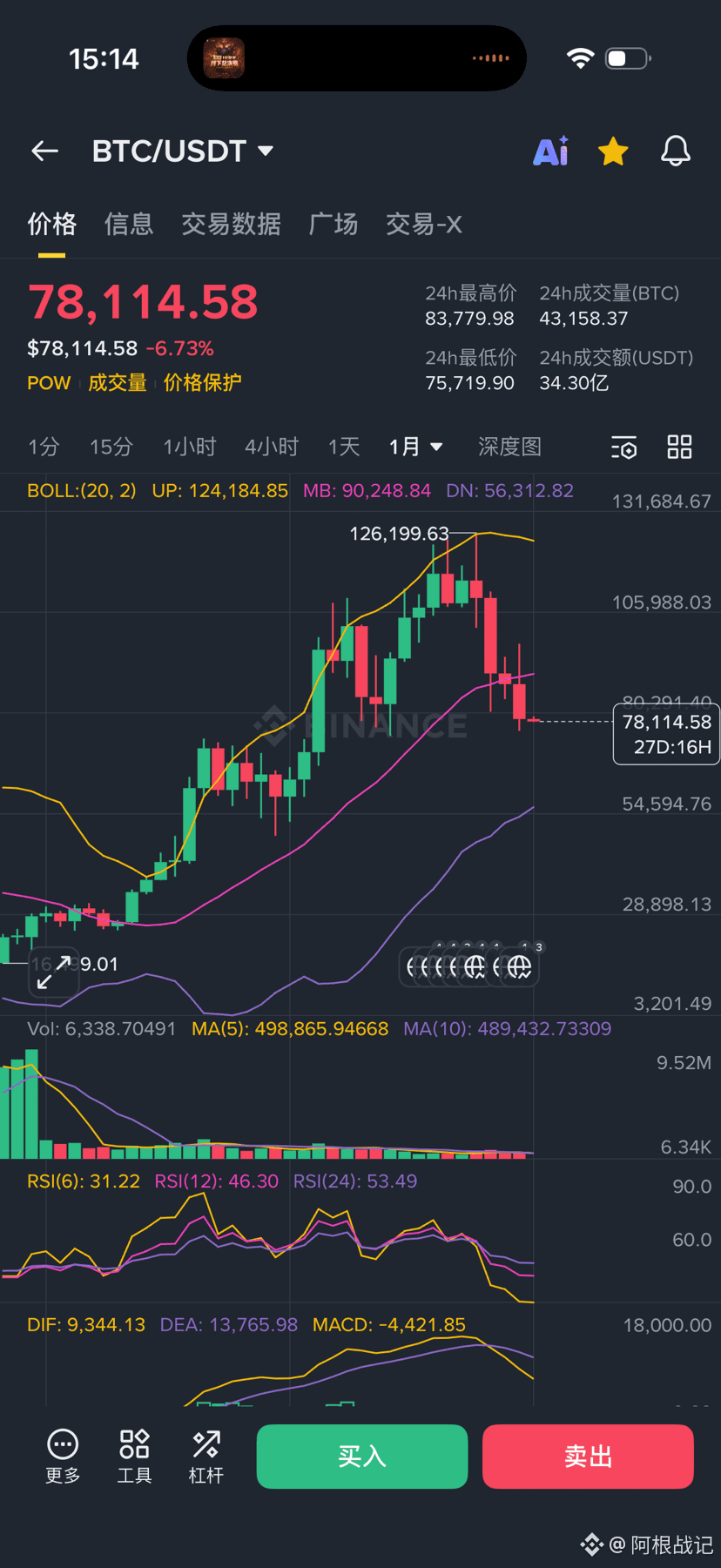

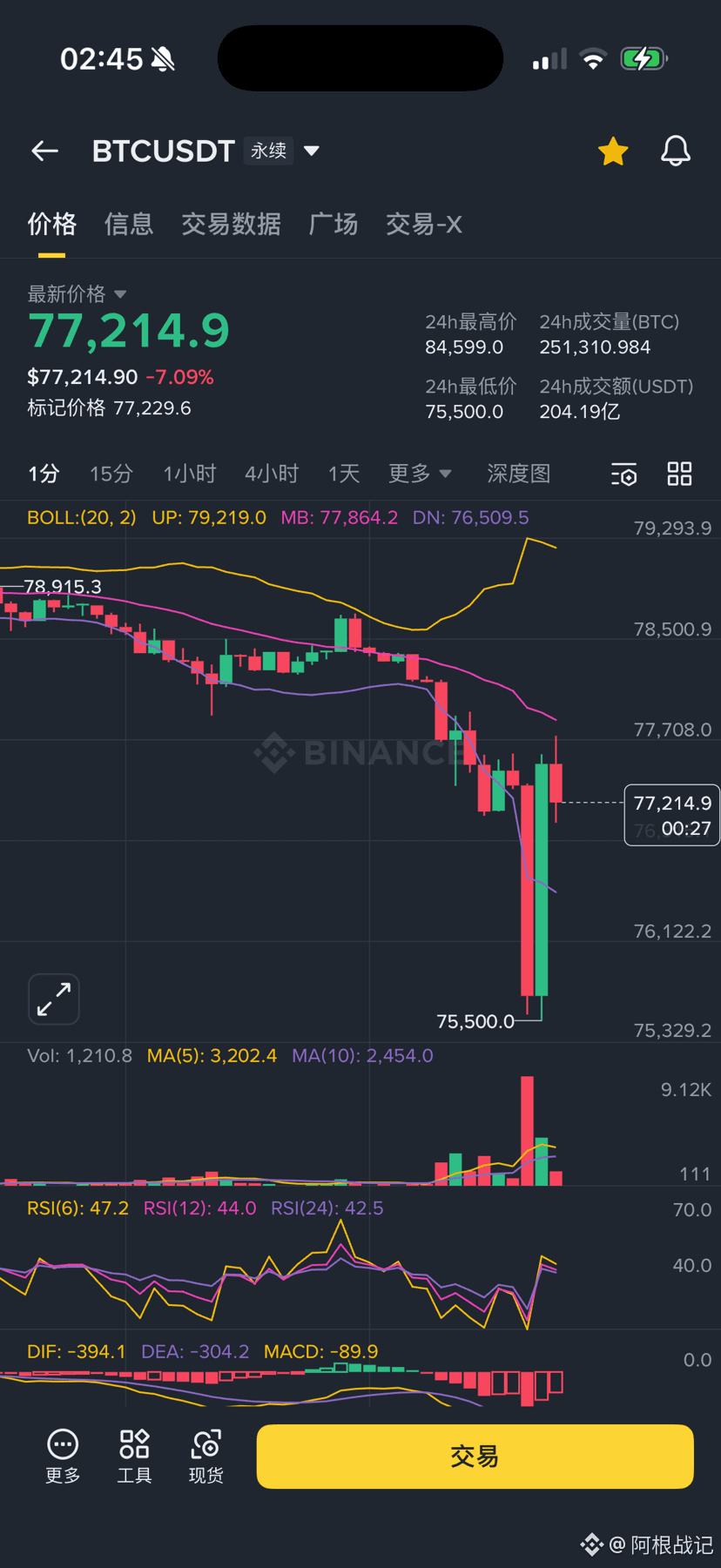

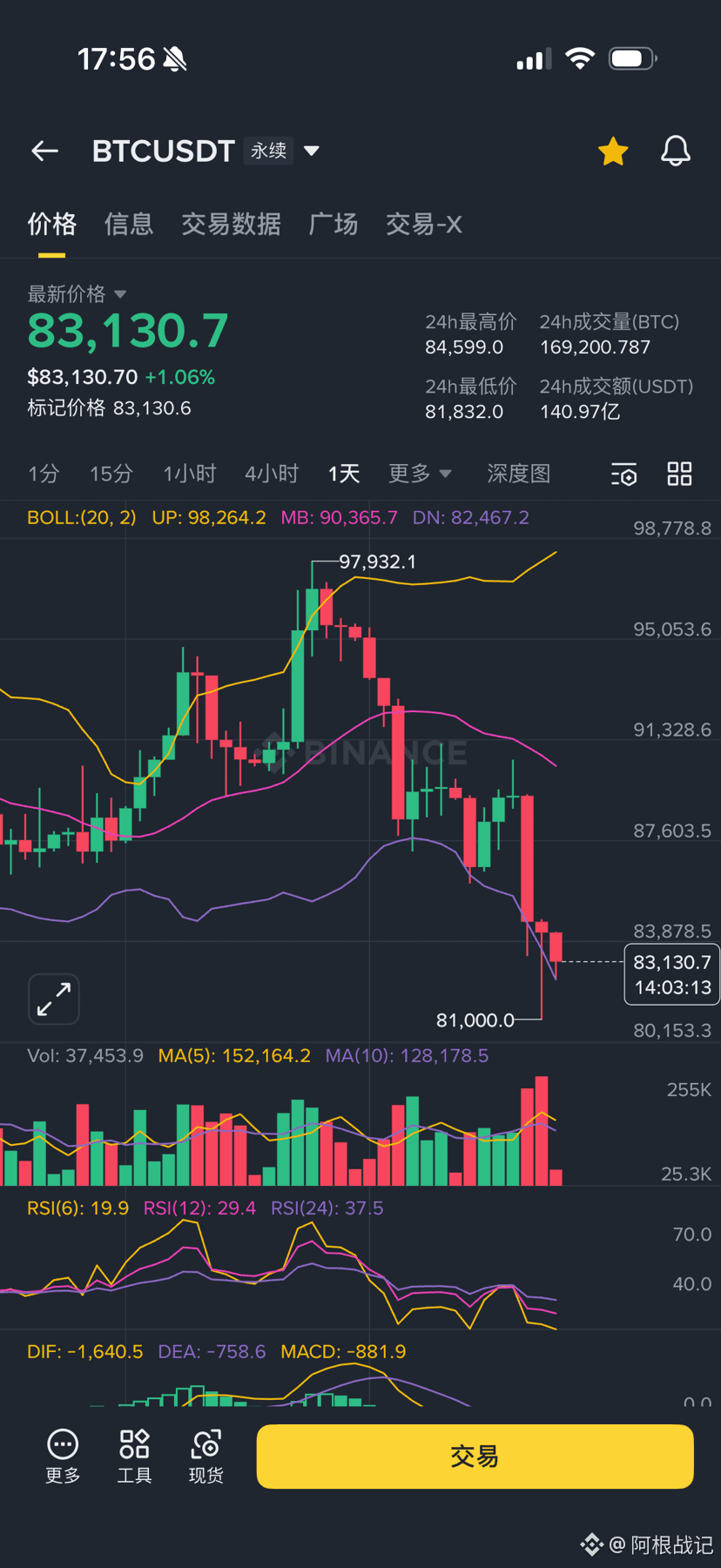

Currently, the net inflow of Bitcoin whale addresses is almost negligible, indicating that major players are not satisfied with the current price and need it to fall further before it's worthwhile to buy at the bottom!

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data