Bitcoin fell approximately 7% on Saturday, hitting $75,000, and Strategy's $10 billion BTC holdings briefly faced unrealized losses.

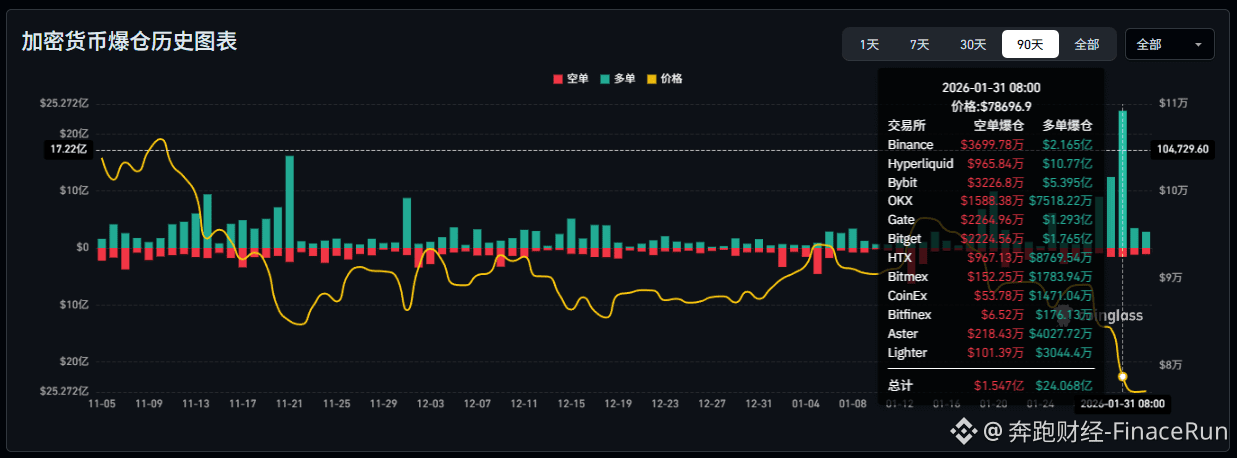

The Bitcoin market experienced a severe liquidity shock over the weekend, with prices briefly dipping below $76,000, marking the first time it had tested the $75,000 level since April 2025. This plunge of over 7% also led to the liquidation of over $2.5 billion in leveraged positions, further worsening market sentiment.

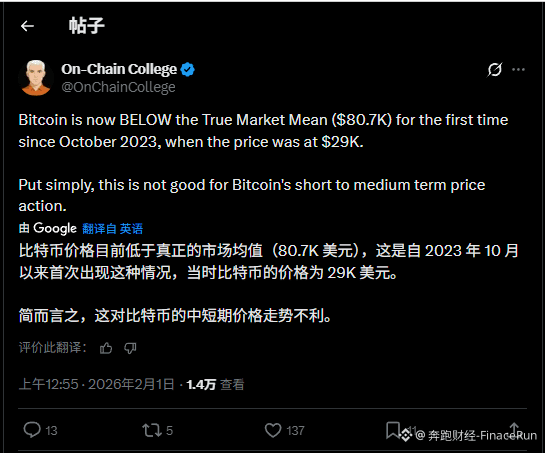

The key factor in this decline was that Bitcoin's price not only broke below the psychological level of $80,000 but also fell below the crucial "true market average" (the average cost of holding all currently circulating Bitcoin) of $80,700.

On-Chain College, an on-chain analytics firm, pointed out that this is the first time since October 2023 (when Bitcoin was around $29,000) that its current market price has fallen below the average cost of holding, a negative signal for short- to medium-term price movements.

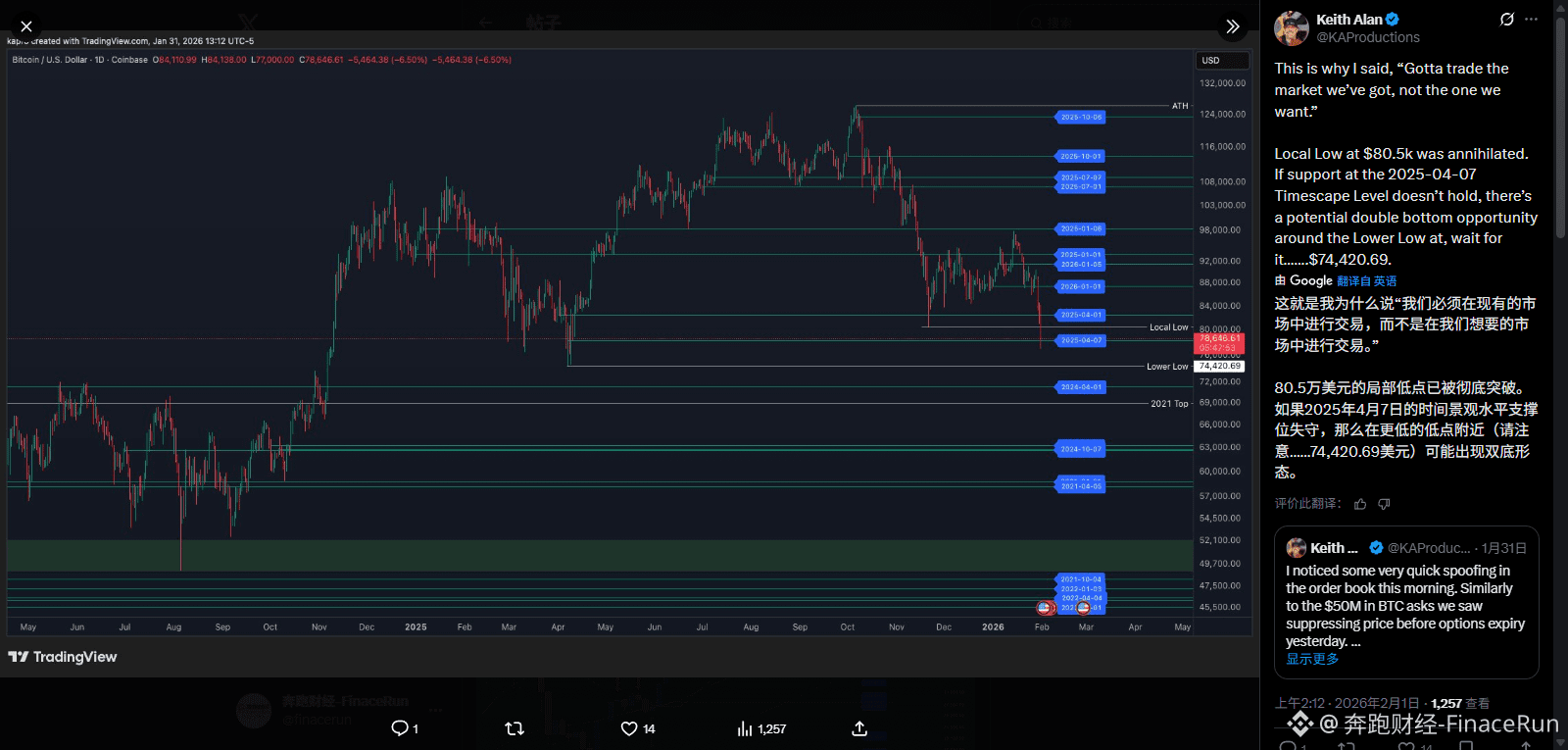

Trader Keith Alan warned that if the decline continues, the next key support level will be the previous bull market peak of $69,000.

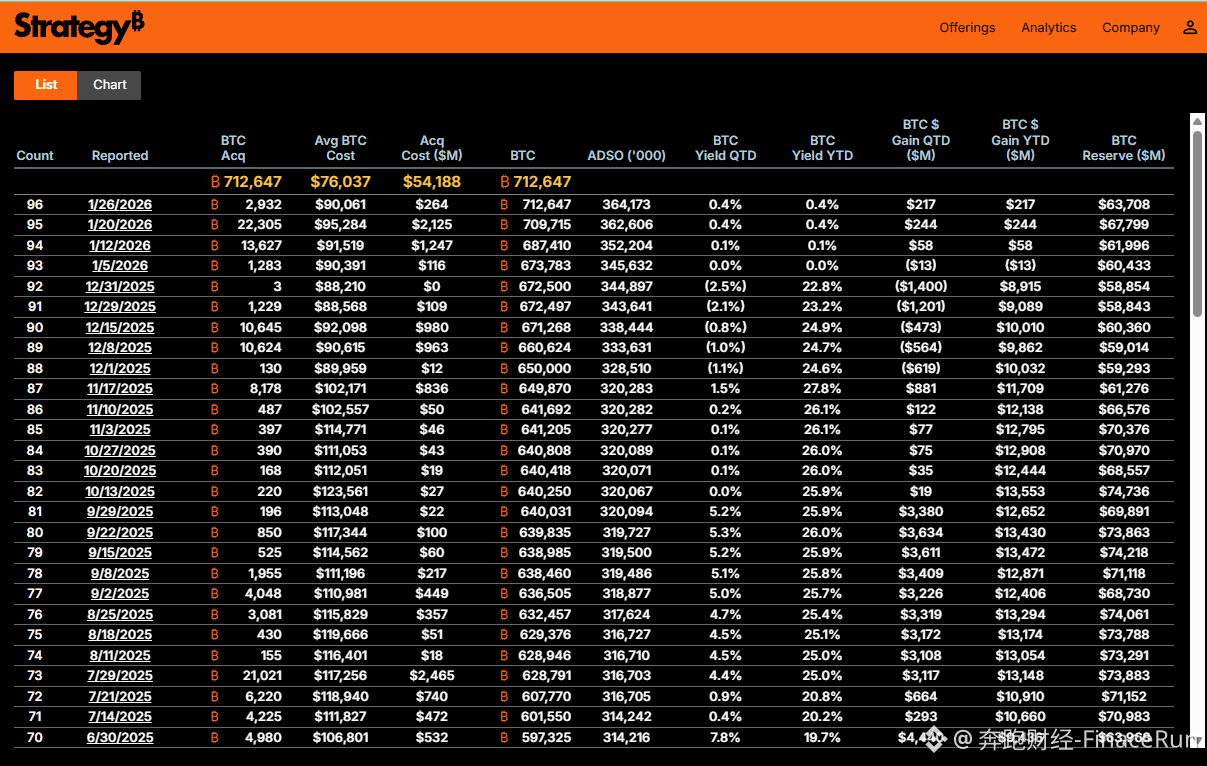

Market focus then shifted to Strategy, the largest corporate holder, which holds 712,647 Bitcoins at an average cost of approximately $76,037. With the price briefly breaching this crucial level, its massive holding has turned from a paper profit to a paper loss.

Although Strategy is a publicly traded company deeply tied to Bitcoin, the market clearly sensed the risk beforehand. Its stock price has plummeted nearly 70% from its July high, reflecting deep investor concerns about the viability of its Bitcoin strategy.

Overall, the current Bitcoin market is facing pressure from multiple factors, including the breach of key cost moving averages, increased selling pressure during quiet trading hours, and even Strategy, the most ardent holder, experiencing a crisis of insufficient holdings.

While some believe that current prices are approaching the bottom range of April 2025 and a rebound is imminent, restoring market confidence will not happen overnight and will require time and clearer signals of a bottom to support it.

#BitcoinCrush #Strategy