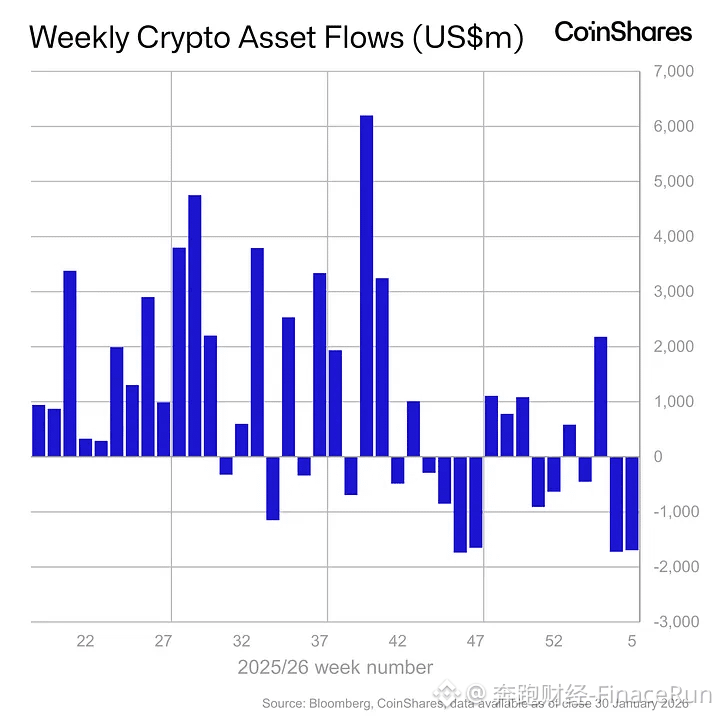

Global digital asset ETPs recorded net outflows for the second consecutive week, totaling $1.7 billion.

According to Coinshares' weekly report, global digital asset investment products saw net outflows for the second consecutive week, with a single-week outflow of $1.7 billion, directly causing the year-to-date flow to turn negative, with a cumulative net outflow of $1 billion.

Meanwhile, since the price peak in October 2025, the sector's assets under management (AuM) have evaporated by $73 billion, indicating a significant deterioration in investor confidence.

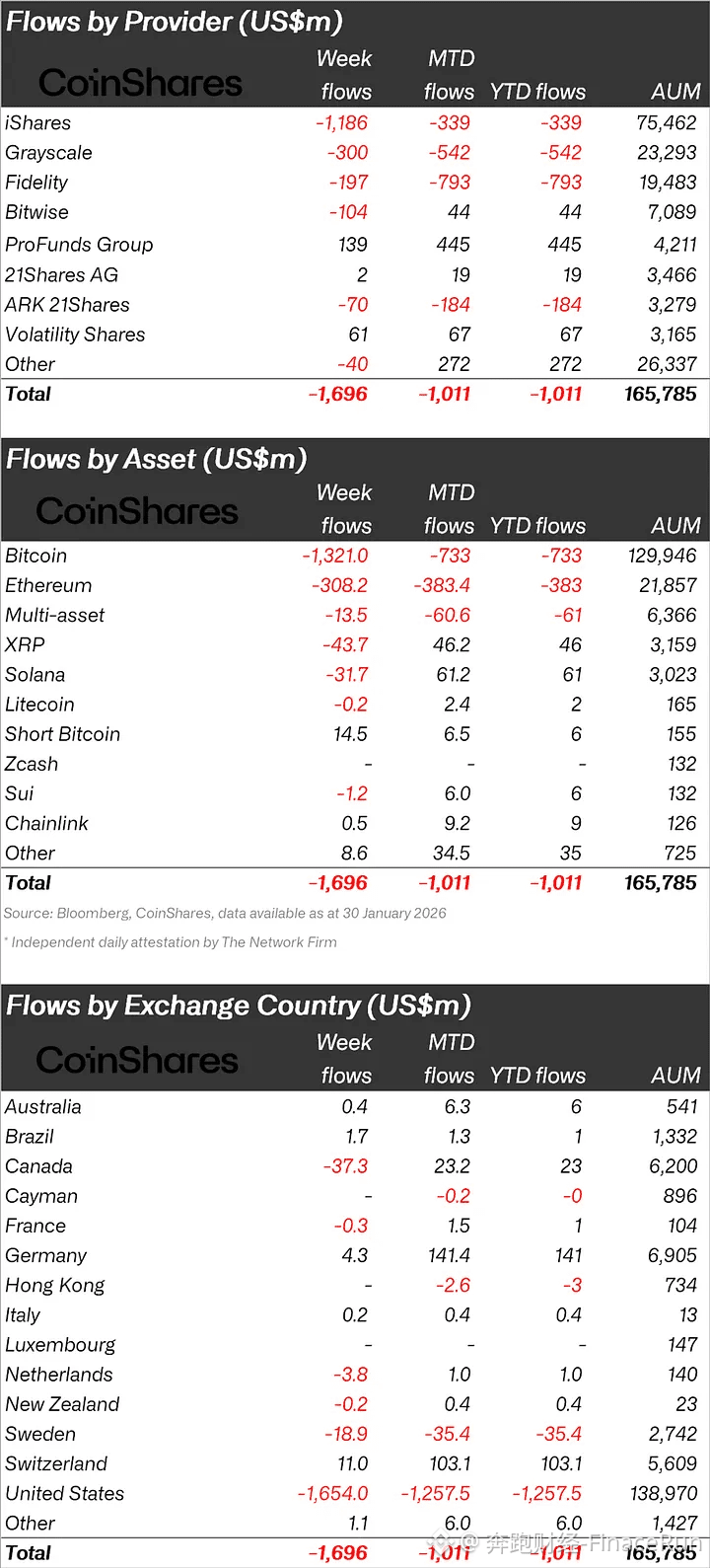

By country/region, the US market remains the hardest hit by outflows, with a single-week outflow of $1.65 billion; Canada and Sweden followed closely, with net outflows of $37.3 million and $18.9 million, respectively. Meanwhile, some European markets, such as Switzerland and Germany, recorded slight inflows of $11 million and $4.3 million, respectively.

Looking at asset classes, Bitcoin and Ethereum saw outflows of $1.321 billion and $308 million respectively last week; XRP and Solana, which have recently been popular, were also affected. This indicates that market caution has spread from individual assets to the entire cryptocurrency sector.

Against this backdrop, shorting Bitcoin saw a weekly inflow of $14.5 million, with assets under management growing by 8.1% year-to-date; while speculative products attracted $15.5 million thanks to the recent surge in tokenized precious metal sales.

The counter-trend growth of these two product categories reflects both some investors' use of defensive strategies to hedge against downside risk and the continued ability of specific narratives to attract structural funds in a weak market.

Analysts believe that the main reason for this sell-off is the reshaping of market interest rate expectations by the appointment of a hawkish new Federal Reserve chairman, coupled with a four-year cycle of whale selling and escalating geopolitical uncertainty, all contributing to the current defensive market environment.

Overall, the crypto market is gradually cooling down from its previous frenzy and entering a critical phase of risk reassessment. The restoration of overall market confidence still awaits clearer macroeconomic policy signals.

#CryptocurrencyETP #InvestmentTrends