In the past 7 days, spot BTC funds have seen an outflow of 1.017 billion, while futures funds have seen an outflow of 4.933 billion, 4.8 times that of futures. Clearly, the current market is entirely supported by futures. On October 11th, a large number of futures users were liquidated, and those who tried to buy the dip in the following days were also liquidated. Since then, fund flows have become much more sensitive.

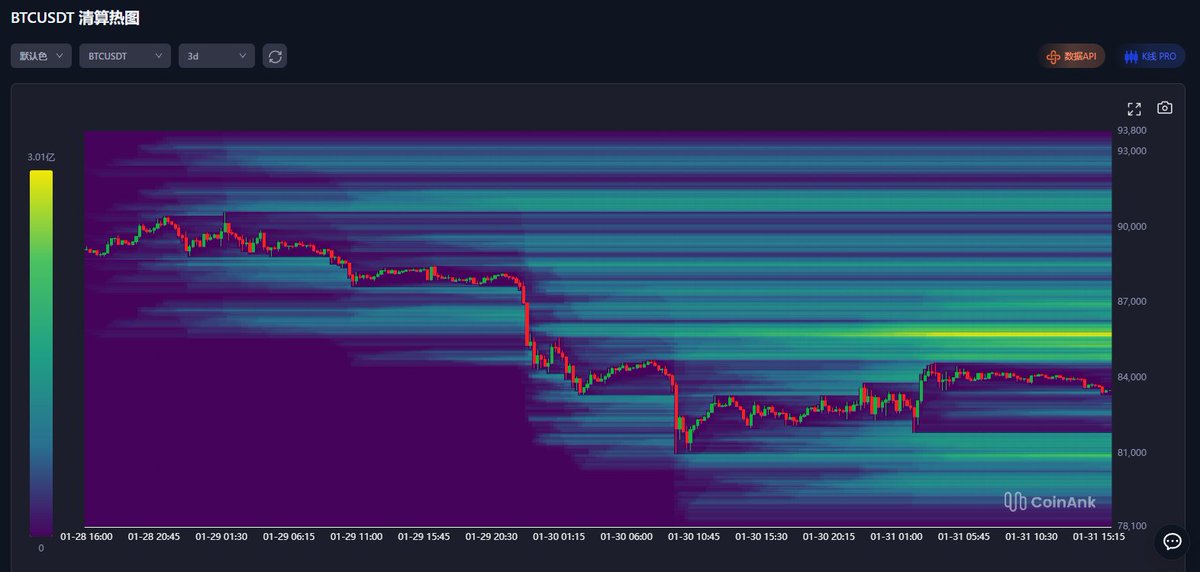

I just glanced at my watchlist, and altcoins and mainstream coins (excluding BTC and ETH) have started to show negative fees. Short sellers are turning to short, and those adding to their short positions will likely push the price down to below 80k, or even 74k. The 3-day liquidation chart shows a one-sided trend, with all the liquidity above being short positions.

Over 90% of the sentiment is pessimistic. BTC's monthly support is at 83k. Today is the last day of January, and this situation could easily lead to another sharp drop followed by a short squeeze. I think it's best to wait until 6 PM on Sunday to see if there's a rebound that doesn't fall below 85k, then shorting is advisable.