This surge in on-chain transaction volume on TRON is not accidental, but an inevitable result of the ecosystem's takeoff.

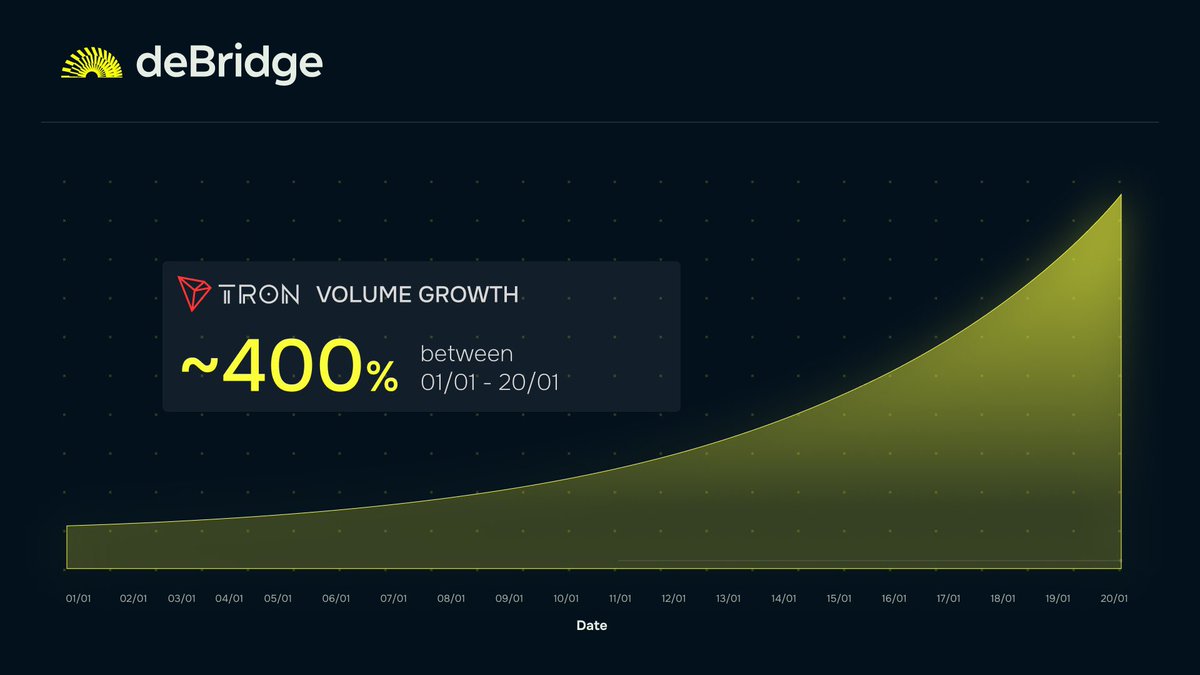

From January 1st to 20th, 2026, the transaction volume on the Tron chain increased by nearly 400%, with the curve jumping from a stable level to exponential growth. On the surface, it appears to be a data boom, but in essence, it's an inevitable result of structural maturity.

The question isn't whether it increased or not, but—why TRON specifically? 🤔

The answer is actually quite clear: three things happened simultaneously!

>First, cross-chain friction was systematically eliminated.

Deep integration of deBridge with TRON doesn't just add another cross-chain channel; it elevates efficiency to the core.

TRON itself is the world's largest USDT network ($83B+), and now it can facilitate native, unencumbered real-time asset transfers with 25+ mainstream chains such as Ethereum and Solana. Shorter paths, lower slippage, and higher certainty.

Stablecoins and DeFi funds don't rely on hype; they simply flow to where costs are lowest and efficiency is highest.

>Secondly, the TRON entry layer has truly been deployed.

WalletConnect's support for TRON in early 2026, coupled with the rapid integration of Trust Wallet and Binance Web3 Wallet, didn't just improve usability; it eliminated the barrier to entry.

When cross-chain transactions, payments, and interactions no longer require a learning curve, transaction volume will naturally amplify from both retail and institutional ends.

>Thirdly, TRON itself is the most suitable platform layer.

Low fees, high throughput, 361 million accounts, and billions of dollars in stablecoin transfers daily—this isn't a network designed for a single application; it's born for high-frequency demands like global payments and cross-chain settlements, with particularly significant advantages in emerging markets.

Therefore, this round of growth is not merely about on-chain data growth; it's more like a signal 📡 telling us:

The multi-chain world is rapidly converging towards lower friction, higher liquidity, and a greater focus on payments and settlements.

And @trondao is precisely at this structural inflection point.

@justinsuntron #TRONEcoStar