The recent market conditions have been truly baffling. Major altcoins have plummeted, with some dropping more than tenfold since their bull market peaks, and most major coins have also fallen by more than 100%. However, $TRX has remained remarkably stable.

Analyzing $TRX's performance reveals the underlying logic of Tron.

First, TRX's pricing is no longer solely based on narrative.

For many blockchains, price is largely a function of expectations and imagination; but a significant portion of TRX's pricing comes from real, sustained usage intensity.

Stablecoin settlement, energy leasing, staking, DeFi lending, USDT transfers—these are not bull market-specific needs; on the contrary, they are used even more frequently in bear markets.

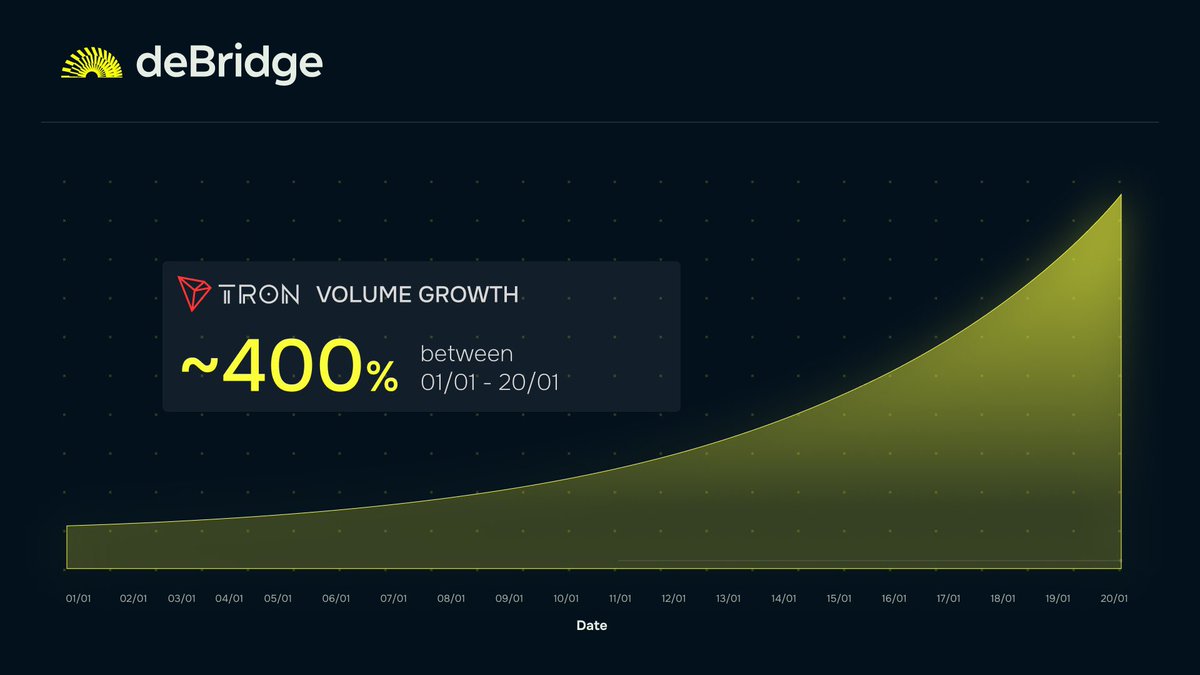

While other blockchains are waiting for the next story, Tron is focused on daily trading volume, fees, and settlement scale.

The result is straightforward: TRX's motivation to actively sell is inherently weaker than others.

II. TRX's token structure is unsuitable for a sharp decline.

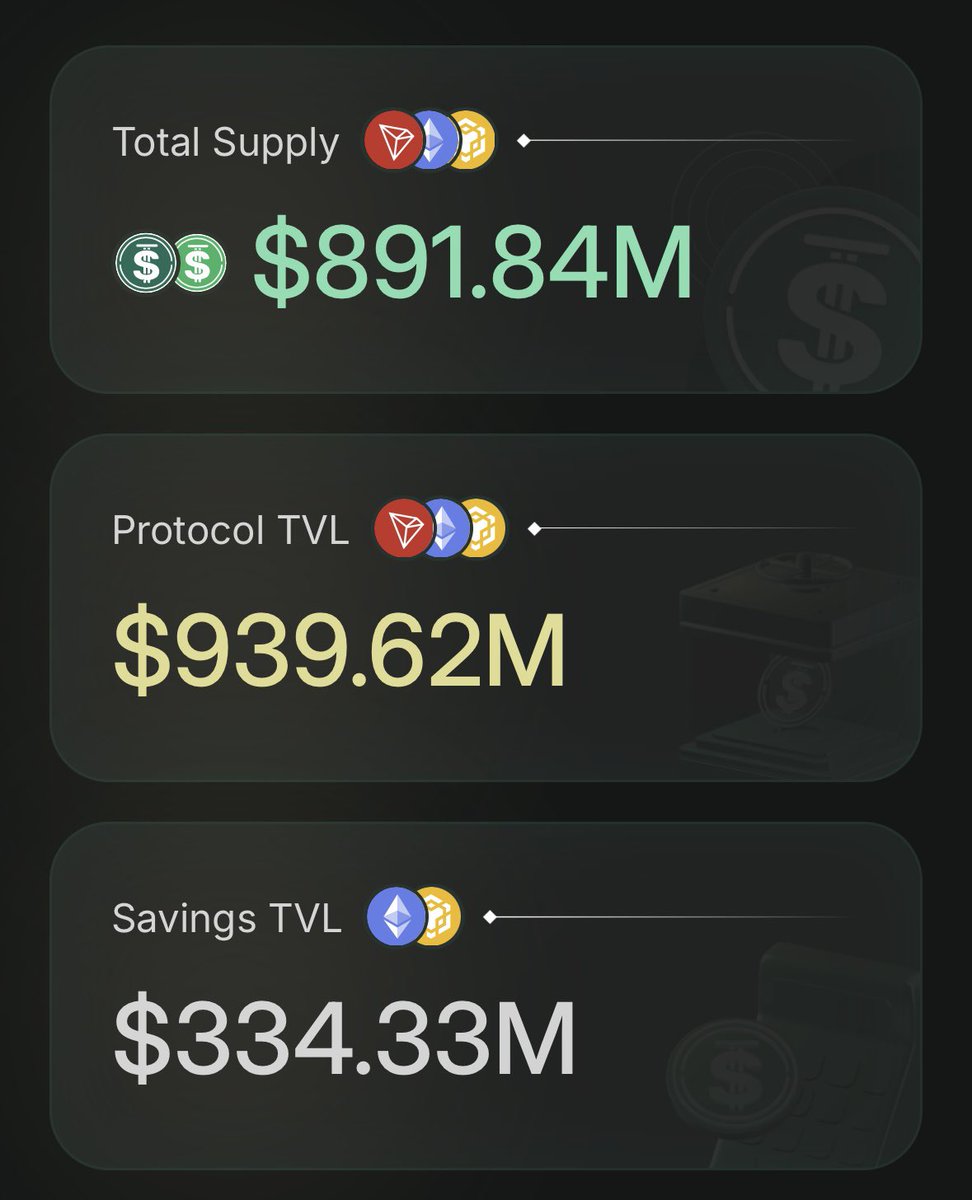

A large amount of TRX is not actively traded in the secondary market for short-term speculation, but is locked in staking, power generation, protocol circulation, and ecosystem applications.

This means that once sentiment weakens, there aren't many freely available tokens that can be dumped at any time.

Therefore, what you see isn't people frantically buying the dip,

but rather—very few people are willing to sell at low prices.

This structure is extremely rare in a bear market.

III. And the most crucial point: TRON's essential role in a bear market.

In a bear market, funds prioritize three things: low cost, stable settlement, and global availability.

These three points are precisely TRON's strengths:

The largest USDT circulation network, low fees and high throughput, and real cross-border payment and capital flow needs.

Therefore, TRX's stability is not essentially due to market manipulation, but rather because the underlying user demand hasn't disappeared with the bear market.

▰▰▰▰▰▰▰▰▰▰

To summarize TRON's current state in one sentence:

When the market bubble bursts, TRON is already being used as infrastructure.

This also explains a phenomenon: many coins are brought back to their original levels during bear markets, while $TRX seems to be adapting to the bear market environment in advance.

In the short term, it may not explode;

But from market structure to ecosystem positioning,

TRON is taking a path of increasing stability as the market cools down.

When the next wave of market sentiment truly returns,

there will be very few chains that can still be used as the underlying network.

@justinsuntron #TRONEcoStar

@justinsuntron Sun, TRX is so stable in a bear market, will it reach $1 in a bull market? 😄

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data