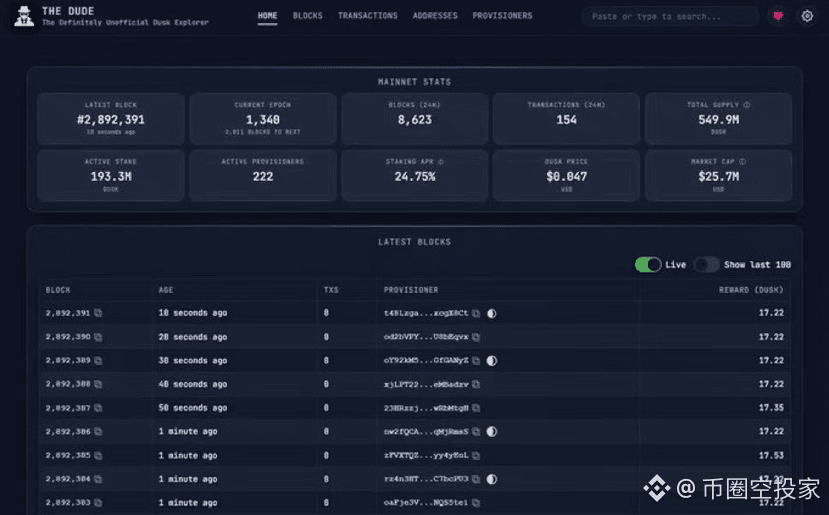

Dusk Seizes a Trillion-Dollar Market for Tiered Asset Transfer in RWA 2.0

Targeting the trillion-dollar market of the RWA 2.0 era, Dusk is gaining a competitive edge through its differentiated strategy! Currently, infrastructure assets account for 38% of the $26 billion RWA market, which is projected to exceed $100 billion by 2026. Dusk is becoming a core hub for tiered asset transfer.

For standardized assets, DuskTrade supports 24/7 trading of tokenized stocks and bonds, facilitating cross-chain circulation. For non-standardized assets, customized privacy solutions address pricing and transfer challenges, attracting private equity, real estate funds, and other asset classes. Integration with Quantz's EURQ stablecoin completes a compliant settlement system, forming a closed-loop process.

BCG predicts the RWA market will reach $16 trillion by 2030, and Dusk, with its €300 million in successful implementations and compliance advantages, has become the preferred choice for institutional asset on-chaining. As the core value carrier of its ecosystem, $DUSK will capture significant profits in this wave of asset digitization! #Dusk $DUSK @Dusk_Foundation

{spot}(DUSKUSDT)