I used to think that the risks of quantum computing (QC) to Bitcoin were a pipe dream, but I no longer think so.

The common counter-argument is this: quantum computing won't pose a threat in the next few years, and even if it did, the entire financial system is already teetering on the brink. This nihilistic way of thinking might comfort some, but it ignores the essence of the problem.

Large banks haven't stood idly by. They've been investing in quantum research, building internal teams, collaborating with quantum computing developers, and considering how to gradually strengthen their systems. They're far from being "quantum-safe"—but they're not starting from scratch either.

Bitcoin is different. Technically, it can be upgraded. But this requires slow and cumbersome coordination within a decentralized network. There's no risk committee, no mandatory regulations, and no one can simply declare, "Let's switch now."

So, I'm not saying this out of panic, nor am I pretending to know the exact timeline. Perhaps quantum computing is still five years away, perhaps fifteen. The problem is that while quantum risks are low in probability, their impact is enormous—and this is precisely the kind of risk that decentralized systems struggle to address in their early stages.

If we add artificial intelligence, the timeline might at least shorten, not lengthen.

Interestingly, the gap between developer confidence and institutional behavior is widening. Even if developers believe the probability of a quantum threat occurring within the next five years is zero, some institutions are clearly valuing it much higher.

CLSA strategist Chris Wood recently decided to remove Bitcoin from his highly-watched portfolio due to quantum computing risks. This decision, seemingly "reckless," is significant. It shows that quantum risk is entering institutional risk frameworks—even when opinions differ.

And these opinions do indeed differ. There are numerous counterexamples. Harvard University reportedly decided to increase its Bitcoin holdings by approximately 280%, indicating that institutional support for Bitcoin hasn't disappeared. What has changed is not demand. But decentralization—my guess is that as quantum risk rises, the divergence among institutions on how to price tail risk will widen further.

Harvard's decision could also be entirely unrelated to quantum risk. The mere factor of declining volatility would be enough to fit their asset allocation framework, thus increasing its weighting.

There are many nuances and deep technical understandings involved here, which I am still working through. But raising these questions is reasonable. @caprioleio has been pushing this issue, questioning the validity of this indifference.

What's unreasonable is assuming JPMorgan Chase and Bitcoin face the same problems. JPMorgan Chase can prepare in advance and enforce change, while Bitcoin must convince everyone beforehand that the future threat warrants action.

This raises the issue of incentives.

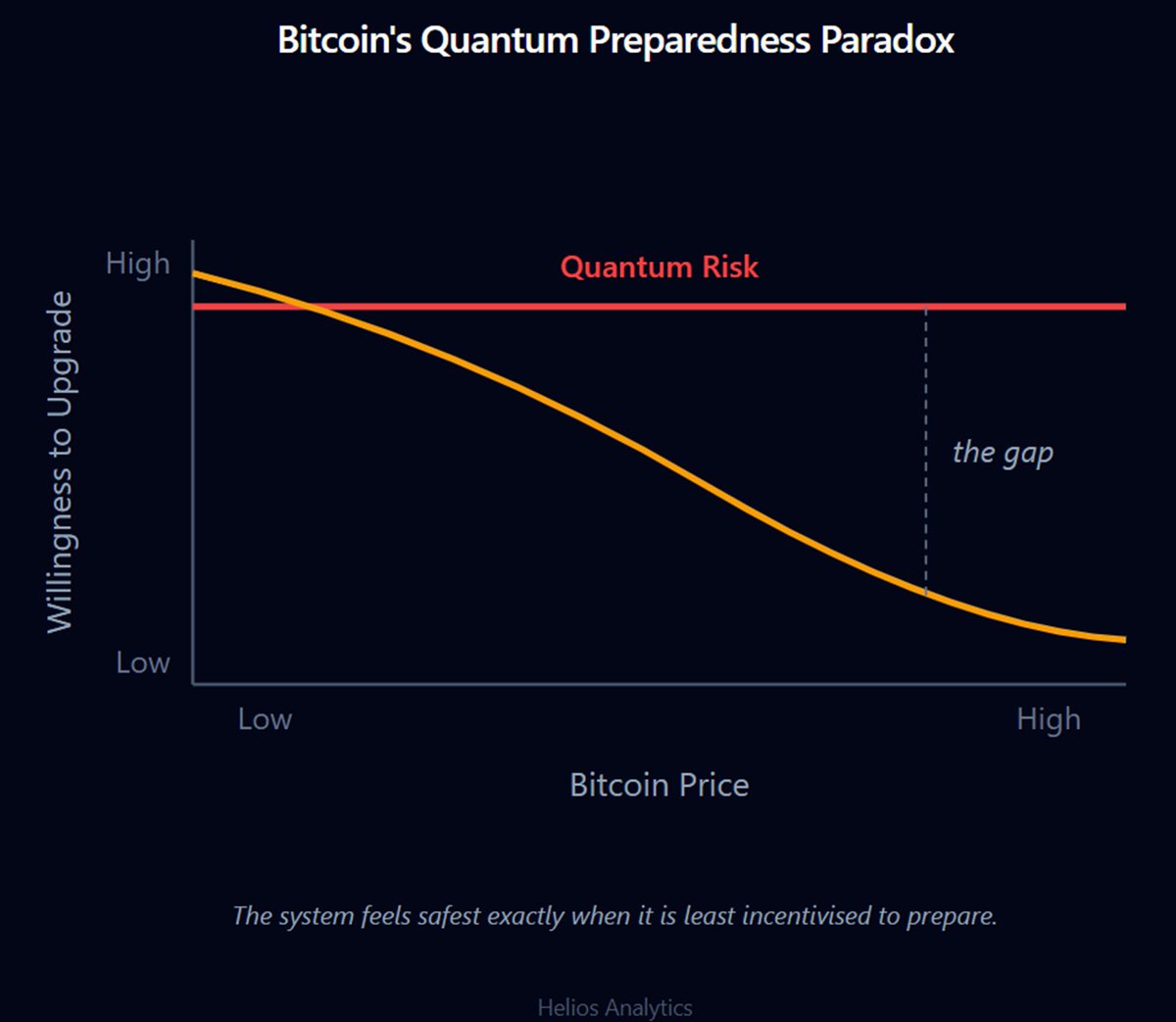

As Bitcoin's price rises, confidence increases—while the willingness to push for disruptive, preventative ratings decreases. A system feels safest when it lacks the most incentive to be prepared.

Quantum risk does not fluctuate with price.