Last night, BTC had just touched 96k while I was getting some fresh air downstairs in my apartment complex when I saw the news of "shorts getting wiped out en masse," which immediately woke me up... Someone in the group chat was suggesting chasing it, so I immediately turned off my leverage 😂. In this kind of market, the biggest fear is slippage and thin liquidity, which means all your profits are fed to the market.

So this week I'm focusing more on "trading platforms." @OrderlyNetwork is holding its Q4 Community Call today (January 15th, 1 PM UTC, approximately 9 PM Beijing time), where Ran Yi will discuss the Q4 recap and the 2026 direction. Recently, they've made XAU/XAG (gold/silver) tradable on Orderly-related DEXs, and on-chain derivatives are starting to move closer to "real assets."

Siyuan believes Orderly's two most valuable aspects are:

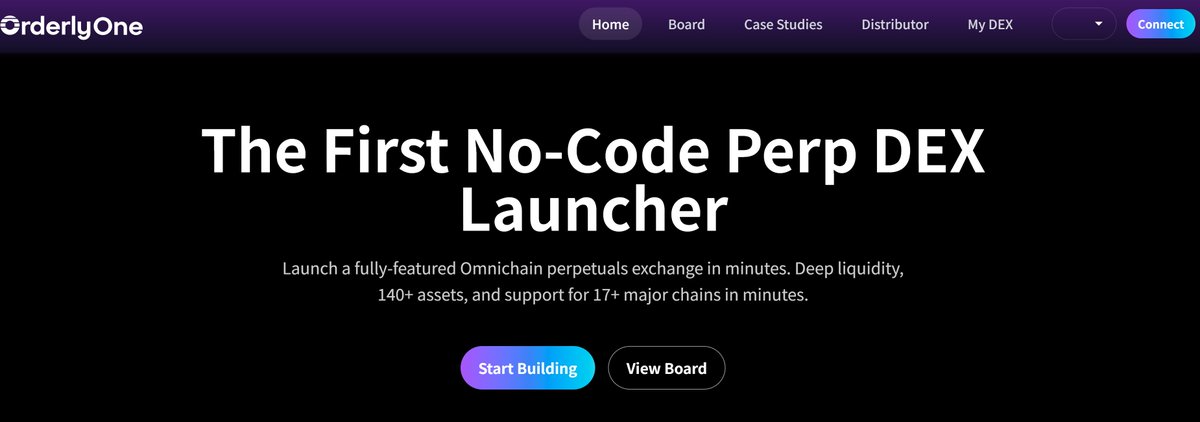

1) Orderly ONE transforms the process of "opening a perp DEX" from a money-burning R&D endeavor into a matter of minutes (unified order book + shared liquidity, a boon for zero-code enthusiasts);

2) OmniVault is more like "behind-the-scenes market-making with profit sharing": USDC is run by strategies, earning real transaction fees/spreads, without relying on hard-sell incentives.

Do you favor ONE's "opening a store" model or Vault's "passive income" model?

#Orderly