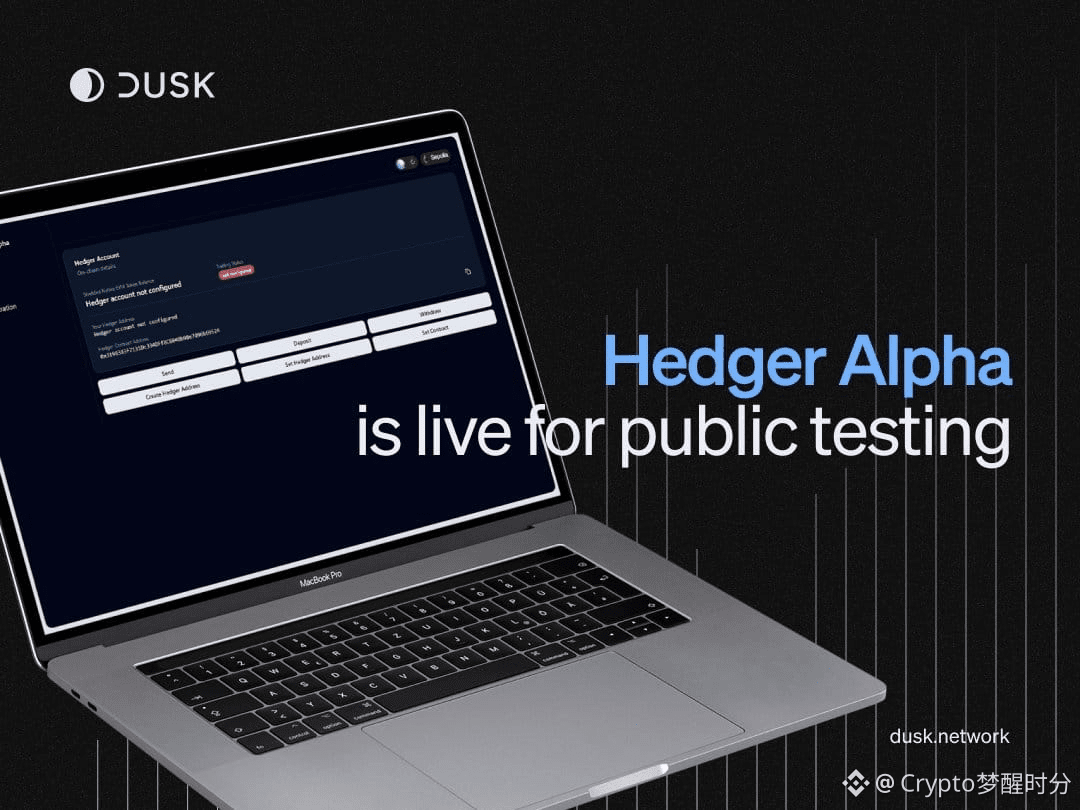

#dusk $DUSK 2026 is a decisive watershed year for Dusk, with the mainnet upgrade in the first quarter becoming the core battleground for testing its technological strength. This upgrade is not a simple iteration, but focuses on three core areas: high-load performance of DuskEVM, scenario adaptation of the Hedger privacy engine, and stability of cross-chain bridges. These directly determine whether the ecosystem can support large-scale institutional funds and applications. DuskEVM needs to maintain its EVM compatibility advantages while compressing transaction finality to within 15 seconds and reducing the execution cost of privacy contracts by 25% to match the high-frequency demands of institutional-grade securities trading. The Hedger engine needs to optimize the programmability of privacy strategies to achieve full-scenario adaptation from securities tokenization to the creator economy. The cross-chain bridge upgrade will rely on the Chainlink CCIP protocol to enable seamless flow between DUSK tokens and EURQ stablecoins on mainstream public chains, solving the problem of ecosystem liquidity silos. The market has high expectations for this upgrade, with the DUSK token recently rising 25.68% in 24 hours, a direct reflection of the anticipated technological implementation. This breakthrough will determine whether Dusk can transform from a compliant infrastructure provider into a core player in the trillion-dollar European RWA market. #Dusk @Dusk_Foundation