➣ TermMax is reshaping the funding logic of DeFi.

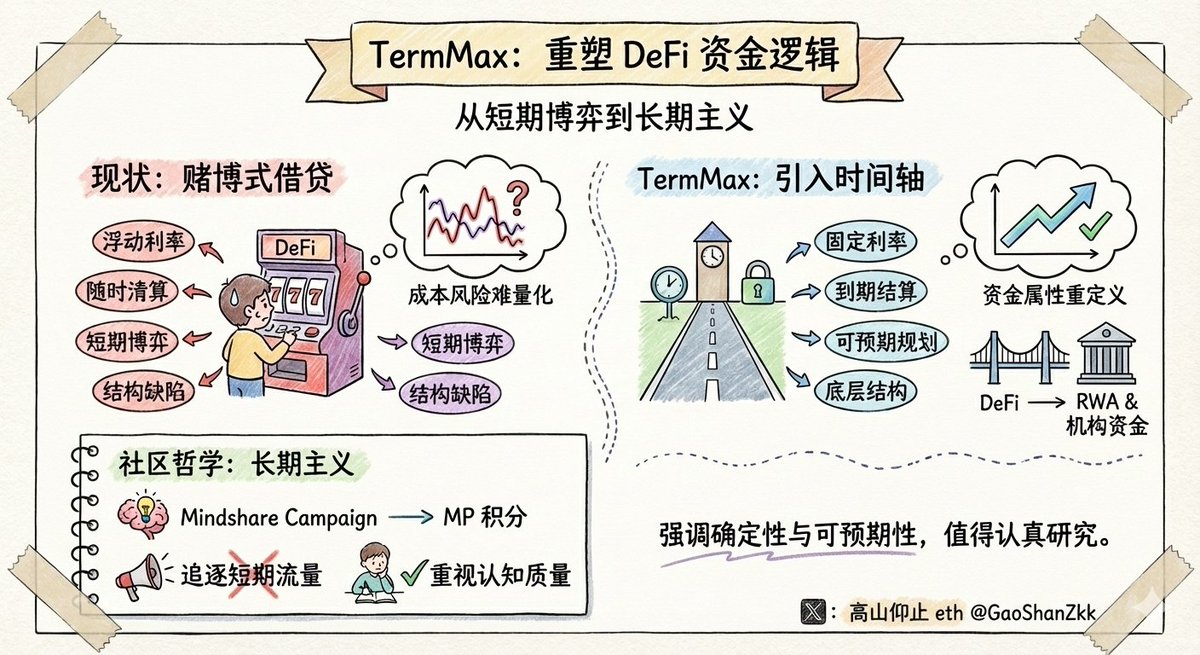

Currently, DeFi lending is essentially a short-term game revolving around probability.

The mechanism of "floating interest rates, unlimited terms, and instant liquidation" works smoothly in a speculative and leveraged environment, but once long-term capital allocation is involved, structural flaws are exposed: costs cannot be locked in, risks are difficult to quantify, and funds naturally do not want to stay long.

It is against this backdrop that @TermMaxFi has taken a different path.

Instead of patching up the existing model, it has chosen to introduce a timeline to DeFi—by using fixed interest rates and maturity settlement mechanisms, it restores lending relationships to a predictable and plannable financial structure.

The significance of this step is not just reducing volatility, but more importantly, it redefines the attributes of funds:

Funds are no longer just liquidity tools, but asset forms with clear terms and expected returns.

This is the underlying structure that RWA and institutional funds truly need.

🌟 At the community level, TermMax also continues the same long-termist approach. The “Mindshare Campaign” doesn't simply use incentives to generate buzz; instead, it encourages participants with genuine product understanding and a willingness to share their insights through MP points.

Compared to chasing short-term traffic, this emphasis on the quality of understanding has more sustainable value.

If you're tired of the high volatility and uncertainty of "gambling-style lending," then protocols like @TermMaxFi, which emphasize certainty and predictability, are definitely worth your time and serious study.

#TermMax #MP #DeFi