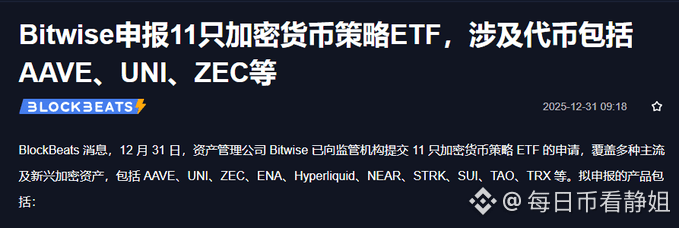

The ETFs applied for this time are quite interesting. AAVE and UNI are considered "blue-chip stocks" in DeFi, with their value moving along with on-chain lending and trading. ZEC focuses on the privacy sector, catering to allocations with specific privacy needs. It also includes tokens from emerging public chains like NEAR and SUI, clearly betting on next-generation blockchain infrastructure.

In terms of product structure, 60% is held directly in the tokens themselves, and 40% is held through compliant ETP products. This ensures real asset exposure while leveraging regulated products to improve liquidity and compliance. It also leaves some room for potential use of derivatives for risk management and enhanced returns.

From a regulatory perspective, Bitwise seems to be using a "small steps" strategy. From its earliest index fund to its separate XRP ETF application, then the approval of its multi-currency ETF which was subsequently suspended, and now this single-asset strategy ETF, it seems to be testing the waters with the SEC step by step. The acceptance of these products is gradually expanding the scope of assets that can be included.

If such products are approved, it could have a significant impact. Institutional investors would then be able to invest in specific crypto assets through compliant channels, not just Bitcoin and Ethereum. This could lead to a broader flow of funds into crypto assets, representing a crucial step towards the financialization of crypto.