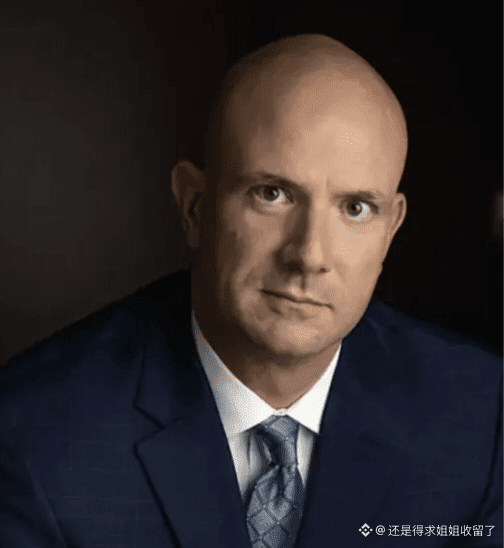

In mid-to-late November 2025, Luke Gromen, a macro analyst with a long-term bullish view on Bitcoin and gold, sold off the vast majority of his Bitcoin holdings—not a complete sell-off, but a clear phase of reduction, sparking considerable discussion in the market. Yesterday, in his final video of 2025, Luke systematically explained the thought process behind this decision for the first time.

He didn't liquidate his entire Bitcoin portfolio, remaining bullish on its long-term value, but based on a reassessment of the current economic environment, he sold off most of his holdings in the short term. The core reason is that Bitcoin exhibits high-beta tech stock characteristics in a deflationary environment, occupying the most vulnerable "equity tier" of the capital structure, and bearing the brunt of leverage in a system.

What truly prompted this shift in judgment was the exponential deflationary pressure brought about by AI and robotics—this type of deflation, driven by technological efficiency, impacting employment, and spreading rapidly, effectively tightens policy. Against this backdrop, he believes that a large-scale monetary response ("nuclear-level money printing") is not imminent, therefore choosing to temporarily exit the high-risk asset tier and await clearer turning points.

Meanwhile, the author prefers to hold silver due to its support from supply and demand imbalances: rising industrial demand coupled with limited supply elasticity presents a more direct and solid logic.

At a deeper level, the world is shifting from a "financial priority" to a "return to realpolitik," with national competition, supply chain security, and industrial base becoming new policy focuses. This shift implies a potentially more volatile and volatile future, but it is also closer to reality.

The conclusion emphasizes that the goal is not to pander to optimism, but to honestly express logical judgment—he is still preparing for the final turning point, but currently chooses to observe and see the true trajectory of this deflationary cycle. $BTC

{spot}(BTCUSDT)

$AI

{future}(AIUSDT)

$IO

{future}(IOUSDT)