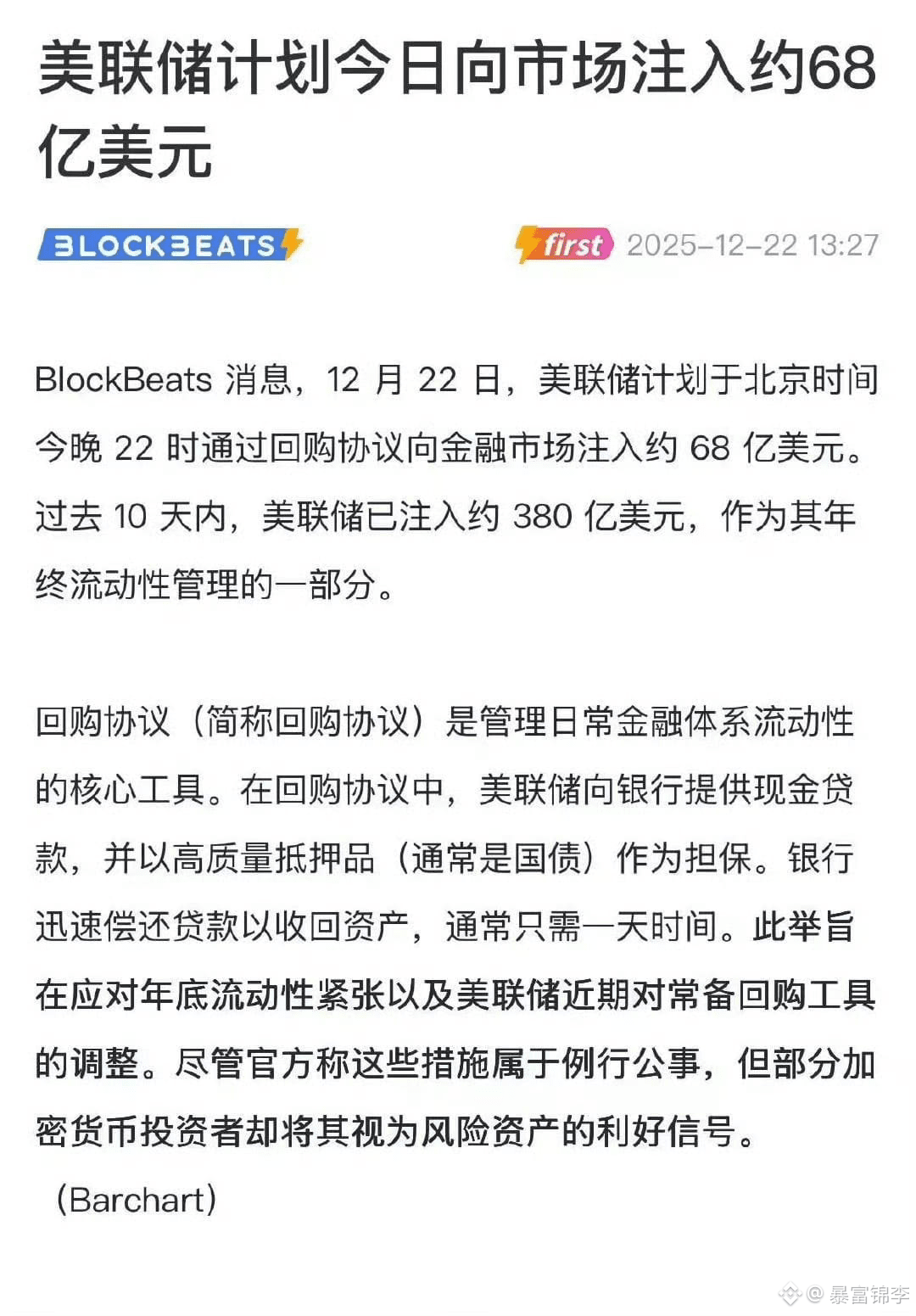

The Federal Reserve injected $6.8 billion in liquidity yesterday, bringing the cumulative total over ten days to $38 billion. But where did all that money go? It's a complete mystery.

Look at the Bitcoin spot ETF: it saw net inflows on four out of the ten days. Even on days with outflows, the daily figure didn't exceed $500 million. Even if you include the outflows from Ethereum and ZTE ETFs, at most $1 billion a day, the liquidity gap over ten days would only be $10 billion. The remaining $28 billion rushed into the market, yet it barely made a ripple. Something's definitely not right.

Is this a trap, waiting for retail investors to succumb and buy in? Or is it a deceptive tactic, using this limited liquidity to barely prop up the market and prevent a complete collapse? Everyone's wondering.

Everyone says there's heavy selling pressure right now, but is there really that much selling pressure? Bitcoin has been trading sideways since its drop on November 21st. Logically, with so much liquidity entering the market, Bitcoin should be the primary reservoir for this liquidity, yet it can't even hold above the $90,000 mark.

Ultimately, this is definitely part of a larger strategy. During these volatile days, there's a cacophony of voices—bearish and bullish—but that's the market for you—if everyone agrees on one direction, everyone ends up getting burned. The agonizing process of this market downturn is indeed tough, but patience is key; a new upward trend will eventually follow.

#BTC #ETH