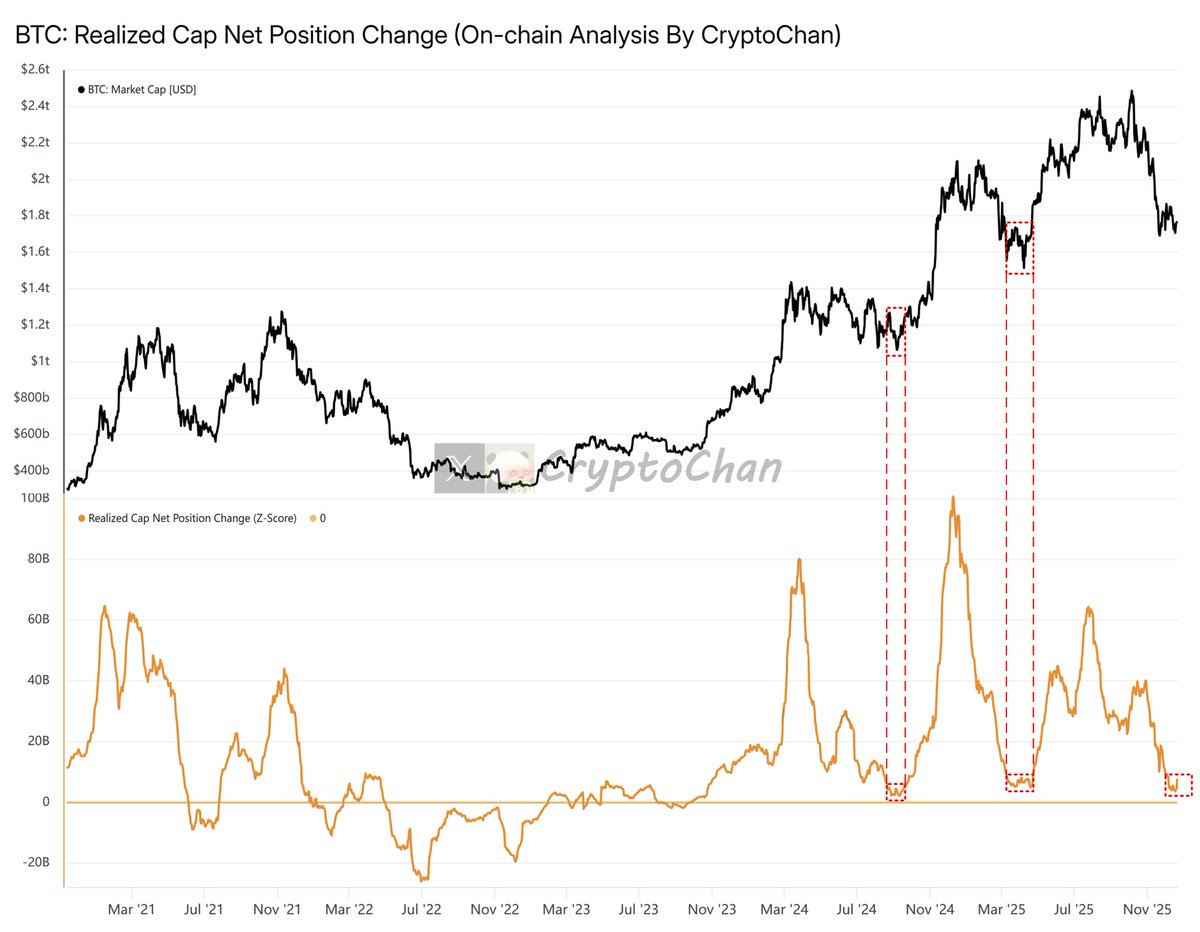

The first two waves of this round saw low levels of 30-day market inflows.

Bitcoin's Realized Cap 30d Net Change is an on-chain metric that acts like a "money flow meter," reflecting the real-time inflow and outflow of funds within the Bitcoin network.

Simply put, this metric tells us whether investors have been injecting or withdrawing funds from the market over the past 30 days.

Positive values (increase): Indicate that the price of the coin when it changes hands is higher than its price when it last moved. This means new funds are entering the market, absorbing selling pressure and raising the overall market holding cost. This is typically characteristic of bull markets or rallies.

Negative values (decrease): Indicate that the price of the coin when it changes hands is lower than its price when it last moved (i.e., investors are selling at a loss). This means funds are flowing out of the network, or the market lacks sufficient buying power to support trading at high levels. This typically occurs in bear markets or during periods of sharp market corrections.

Sharp positive peaks: Often appear in the mid-to-late stages of a bull market. At this point, a large amount of profit-taking occurs (old coins move), while new entrants buy at extremely high prices, causing the realized market capitalization to surge. If this value is too high, it may indicate a market overheating. A drop below the zero line and a continued decline is a signal of "capitalization." When this indicator turns from positive to negative, it indicates that the market has entered a loss-leading exit phase, and sentiment has shifted from optimistic to pessimistic.

Realized market capitalization differs from general market capitalization. It is not calculated by multiplying the current market price by the supply, but by the price at the time of each coin's last move.

Therefore, the 30-day net change actually reflects the dramatic fluctuations in the average cost basis of all network investors over the past month.

In summary, you can think of it as a change in the "total blood volume" of the Bitcoin market.

If the value is increasing, it indicates that the market is "replenishing blood," and the price is supported;

If the value is shrinking, it indicates that the market is "bleeding blood," and even if the price is rising, it may just be short covering or a weak, unsustainable rise.