“What is a reasonable TGE FDV?”

Everyone needs to answer this question before participating in a protocol airdrop.

I'm participating in the first season of airdrops from @infiniFi, @solsticefi, and @Neutrl.

Here's how I estimate their FDV to determine if it's worth investing time.

🧵👇

Let's review the history:

FDV:TVL Ratio (at launch)

➢ Ethena: 1:2

➢ Usual: 2:1

➢ Resolve: 1:1

➢ Reservoir: 2:1

➢ Gaib: 1:1

➢ Almanak: 1:3

➢ Falcon: 3:1 (crashed to 1:1 within 24 hours)

Thanks to @DefiLlama for making it easy to overlay the FDV and TVL data.

The ratios range from 1:1 to 2:1, with exceptions such as Almanak (lower) and Ethena (higher).

Note: These ratios deviate significantly from TGE.

Today's FDV:TVL ratios:

➢ Ethena: 1:2

➢ Usual: ☠️

➢ Resolve: 1:5

➢ Reservoir: 1:4

➢ Gaib: 1:5

➢ Almanak: 1:5

➢ Falcon: 1:2

The difference is significant.

When I looked at airdrops, I assumed a 1:2 ratio in a bear market and a ratio between 1:1 and 2:1 in a bull market.

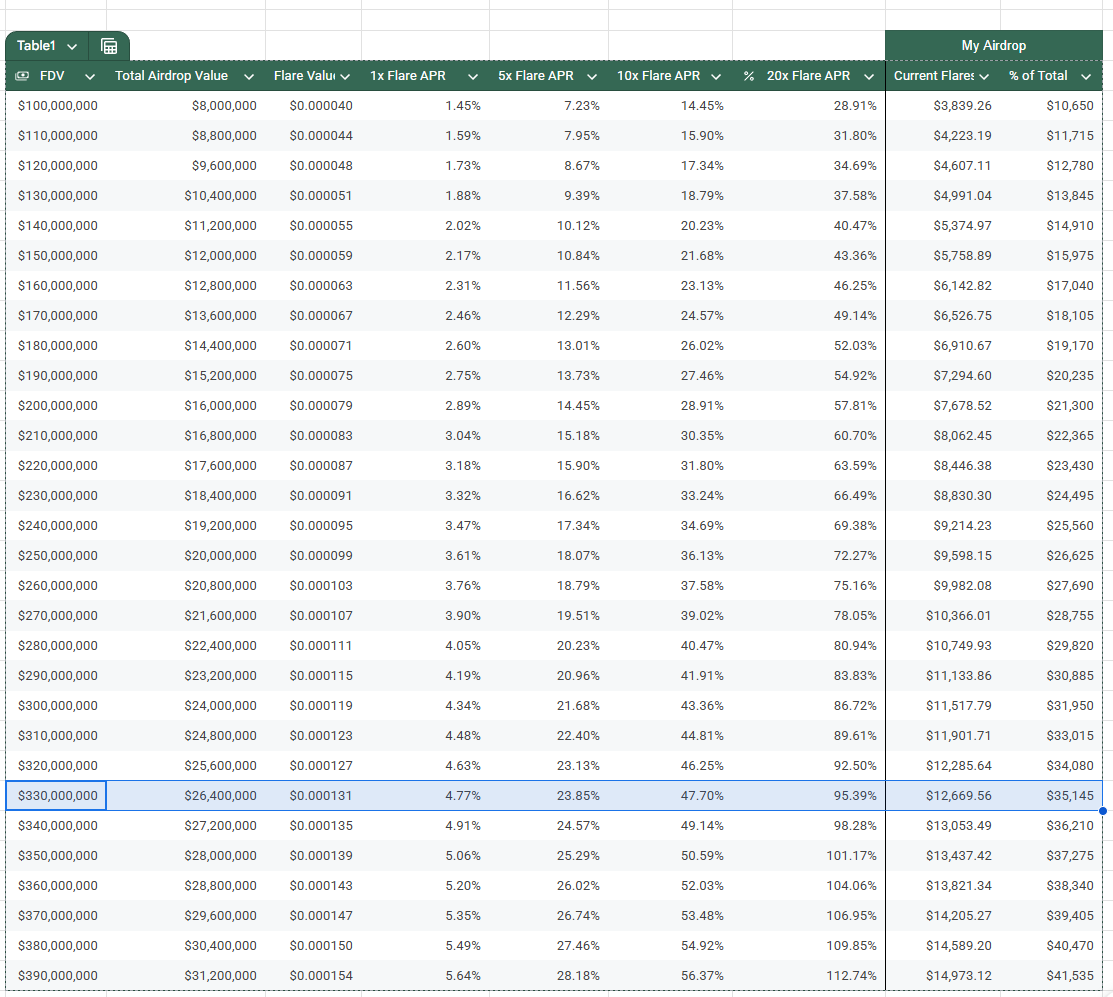

These numbers are fantastic for @solsticefi.

Bear Market Scenario (1:2)

5x Pips: Annualized Return +10.6%

10x Pips: Annualized Return +22%

20x Pips (@ExponentFinance): Annualized Return +43%

Baseline Scenario (1:1)

5x Pips: Annualized Return +24%

10x Pips: Annualized Return +48%

20x Pips: Annualized Return +96%

I won't offer an optimistic analysis, but my gut feeling is that YT is currently mispriced.

Furthermore, @infiniFi YT is clearly a buy in the baseline scenario. I assume their Total Value Locked (TVL) will reach $200 million or more at launch.

They recently extended their 12x pip offer on iUSD YT by at least one week.

Bear Market Strategy (1:2)

► 12x Points: +18% Annualized Rate of Return

► 6x Points: +9% Annualized Rate of Return

Base Strategy (1:1)

► 12x Points: +36% Annualized Rate of Return

► 6x Points: +18% Annualized Rate of Return

While I haven't calculated it for @Neutrl yet, I do hold some YT because I feel the current YT returns aren't very high, and I particularly like Season 1 YT.

In short, if you're farming other Season 1 YT, please let me know your predictions.

I know YT returns depend more on investing in TGE than on farming through a principal-protected method, so please keep that in mind.

Also, while I'm quite confident in my calculations, valuations fluctuate wildly during and after TGE, so please be aware of this. Furthermore, if you hedge with Almanak before TGE, the returns will be better, but anything can happen.

Note: I am a points farmer, a YT holder, and an ambassador for the three stablecoin protocols mentioned in the article.

That being said...