There will be one last interest rate cut in 2025, which is the day after tomorrow. What we can expect in 2026 is continued loose economic policies, token securitization, and the tokenization of securities, such as the on-chaining of everything (like gold). If any of these things can be implemented, 2026 won't be too bad.

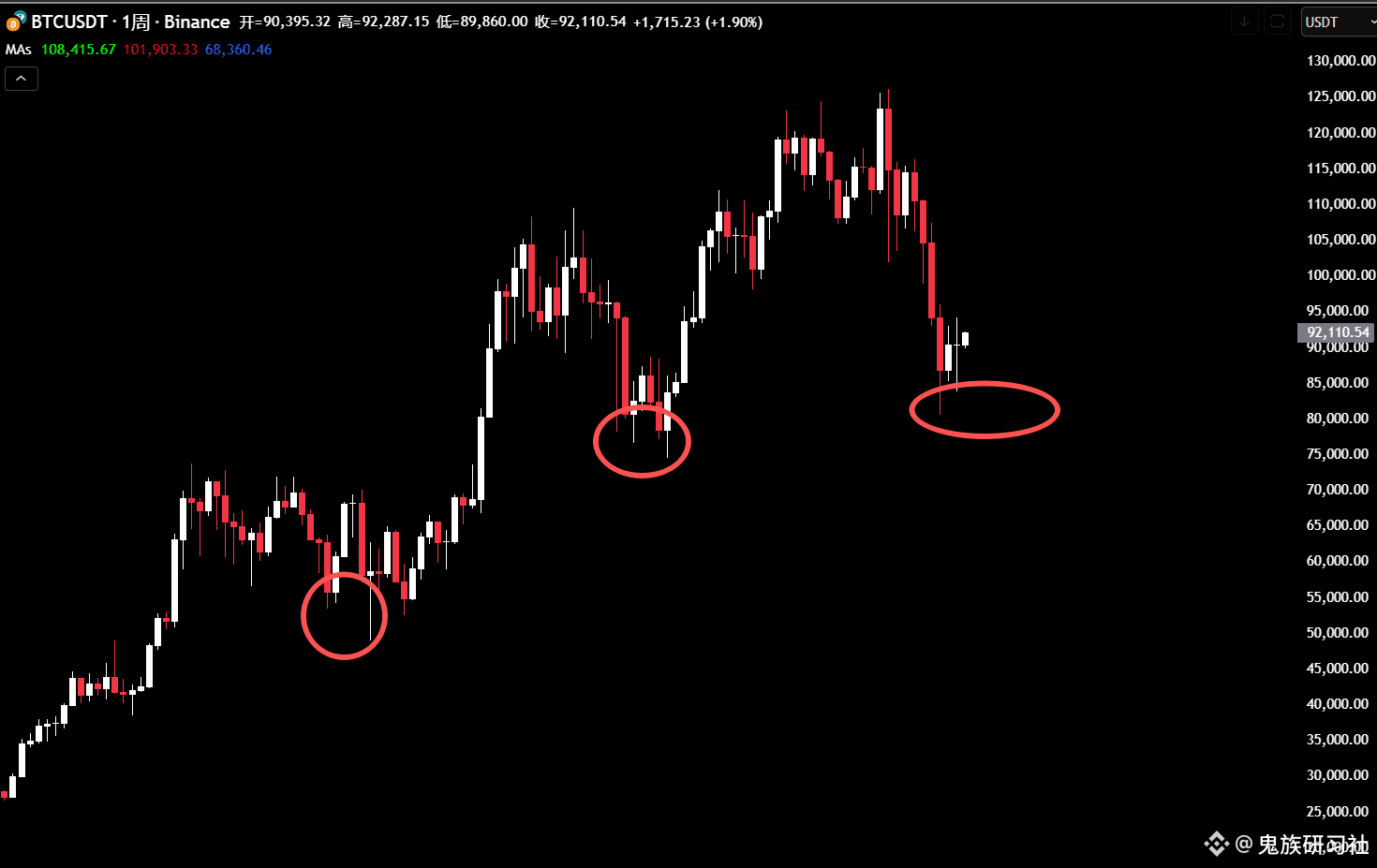

Looking at the previous weekly chart bottoming patterns, a new low was usually reached before a real reversal began. Following this script, the major players might create another wave of panic this month, or at the latest next month, before the Chinese New Year, to initiate a real upward trend. Therefore, don't worry too much about this direct bottoming out and then being gone forever; there will be other opportunities. The real danger is that when the opportunity comes, you scare yourself away.

Finally, what could create the current bear market environment is either the collective action of on-chain whales or the mid-to-late or late-stage of the interest rate cut cycle. The so-called four-year cycle pattern is becoming increasingly ineffective as time goes on. After all, the signals for the start of a future bull market are no longer centered on the BTC halving. Currently, even if BTC production halved, its impact on overall market trading is less than 0.1%. The halving news primarily affects perceptions and formalities, with little substantive impact. The next four-year cycle will gradually fade from view, perhaps starting after this event. #CryptoMarketWatch #FedRestartingInterestRateCuttingPace #WhaleMovement