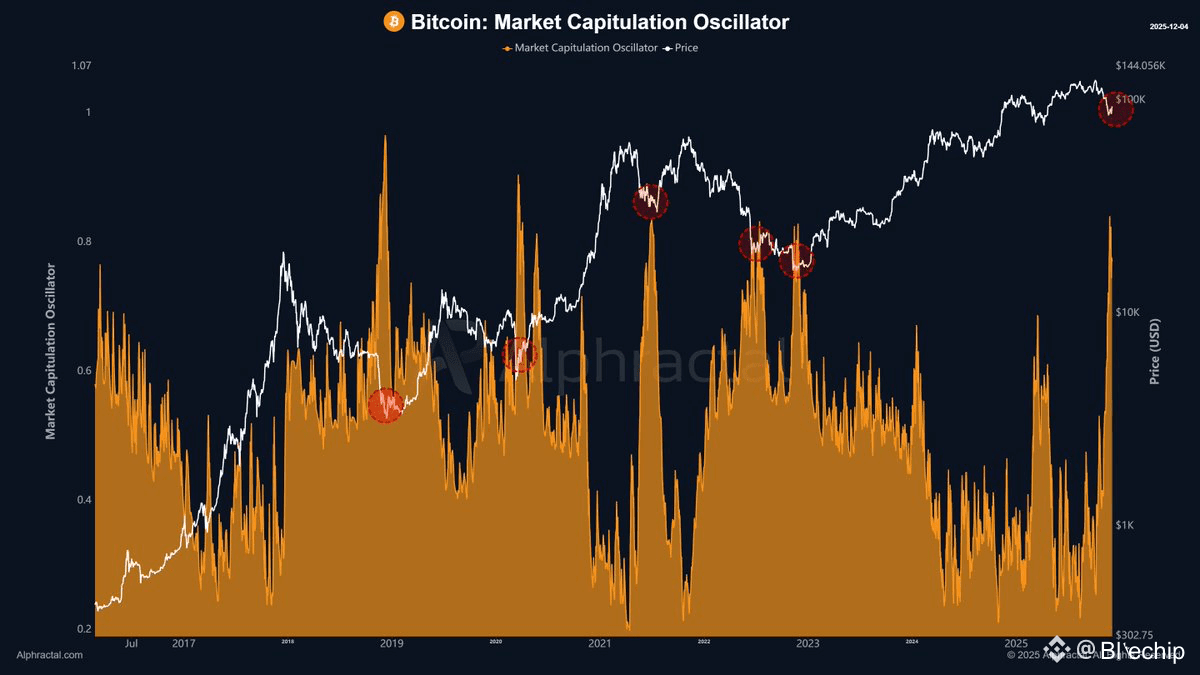

🧨 The recent Bitcoin crash is not "just another pullback."

It was a clear capitulation sell-off.

You can see this by observing these three rare simultaneous signals:

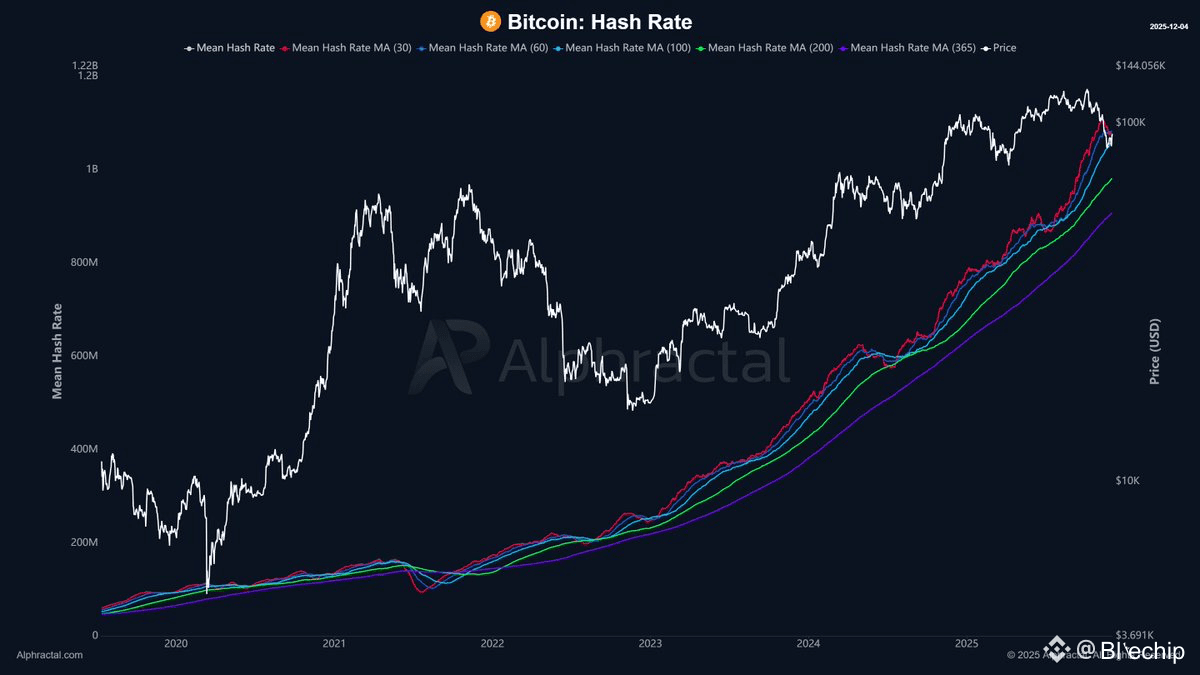

1️⃣ Hashrate plummets in 30 days

Miners shutting down their rigs = real stress on the ecosystem.

When miners start losing money, it usually means the market has bottomed out.

2️⃣ Price drops to extreme levels

Prices fall rapidly and drastically, far exceeding historical medians.

This isn't technical volatility…it's pain. This is a forced sell-off. This is liquidation.

3️⃣ Active supply surges

People who have typically held Bitcoin for months (or even years) start selling.

This behavior only occurs when market sentiment is out of control.

When these three signals occur simultaneously, the capitulation oscillator spikes, almost always marking the final stages of a downtrend or a flattening phase like in 2021.

Of course, this doesn't guarantee that the price will bottom out immediately.

However, historically, this situation is rare... and often presents an opportunity that only occurs once or twice per cycle.

If you pay attention to on-chain data, you'll understand what this means.

$BTC