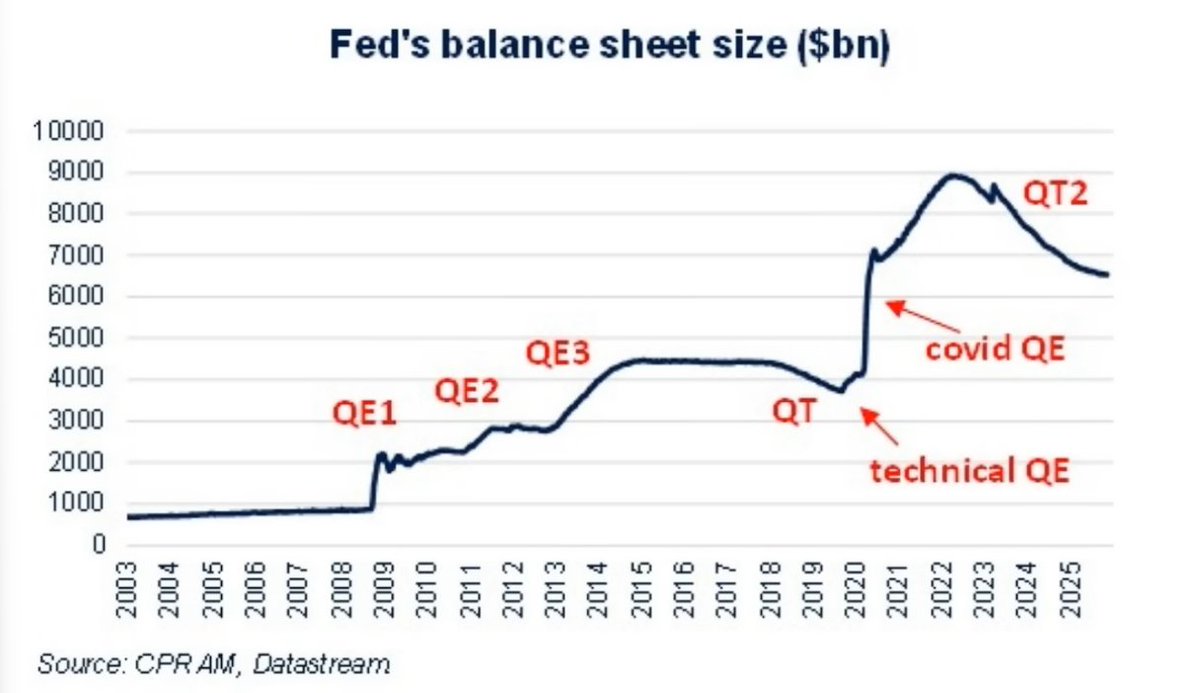

Why is Liquidity Returning?

The Fed's move is not to stimulate the economy, but to prevent the collapse of the financial system's "pipeline."

Low bank reserves (cash holdings) are putting pressure on the money market.

To address this, the Fed must inject funds, meaning more liquidity will return to the market, whether they call it "quantitative easing" (QE) or "technical operations."

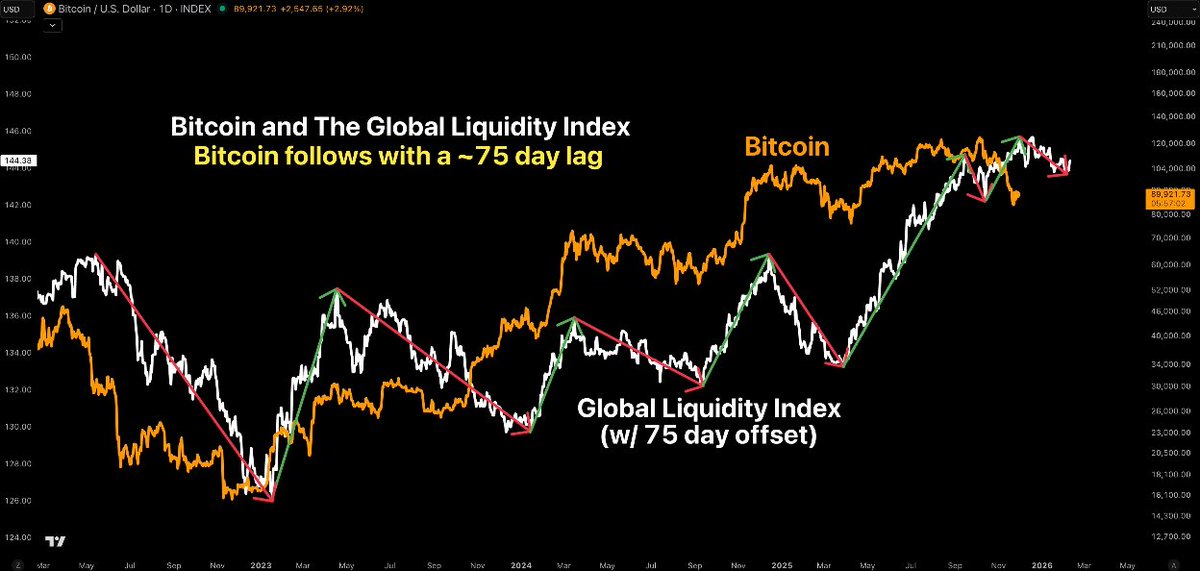

What does more liquidity mean for cryptocurrencies?

Liquidity is the lifeblood of risky assets. Historically, when the Fed expands its balance sheet (prints money):

▫️ Real yields decline.

▫️ Risk-taking increases.

▫️ Financial asset valuations rise.

Bitcoin prices and the entire cryptocurrency market are expected to face upward pressure, just as during previous periods of loose monetary policy.

🚨 Warning: Risk of a Surge!

Renowned investor Ray Dalio (@RayDalio) warns that the simultaneous occurrence of high inflation, huge deficits, and new liquidity foreshadows an "asset surge."

This means that asset prices such as stocks, cryptocurrencies, and gold will experience a strong but potentially bubble-like surge, followed by a significant pullback. The key is: positioning is more important than predicting the top.

Our Crypto Market Action Plan:

1. Focus on Liquidity: Ignore news headlines; focus on the flow of funds into the system. The market will see this as a catalyst.

2. Buy on Dips: Don't chase price spikes. Establish positions in Bitcoin and cryptocurrencies during pullbacks.

3. Diversify: Don't put all your money into a single asset. In a liquidity-driven environment, stocks, precious metals, and cryptocurrencies (BTC, ETH, etc.) all have the potential to rise.

~ NFA, please research independently!