"A Record of My Logic for Buying Bilibili Stock"

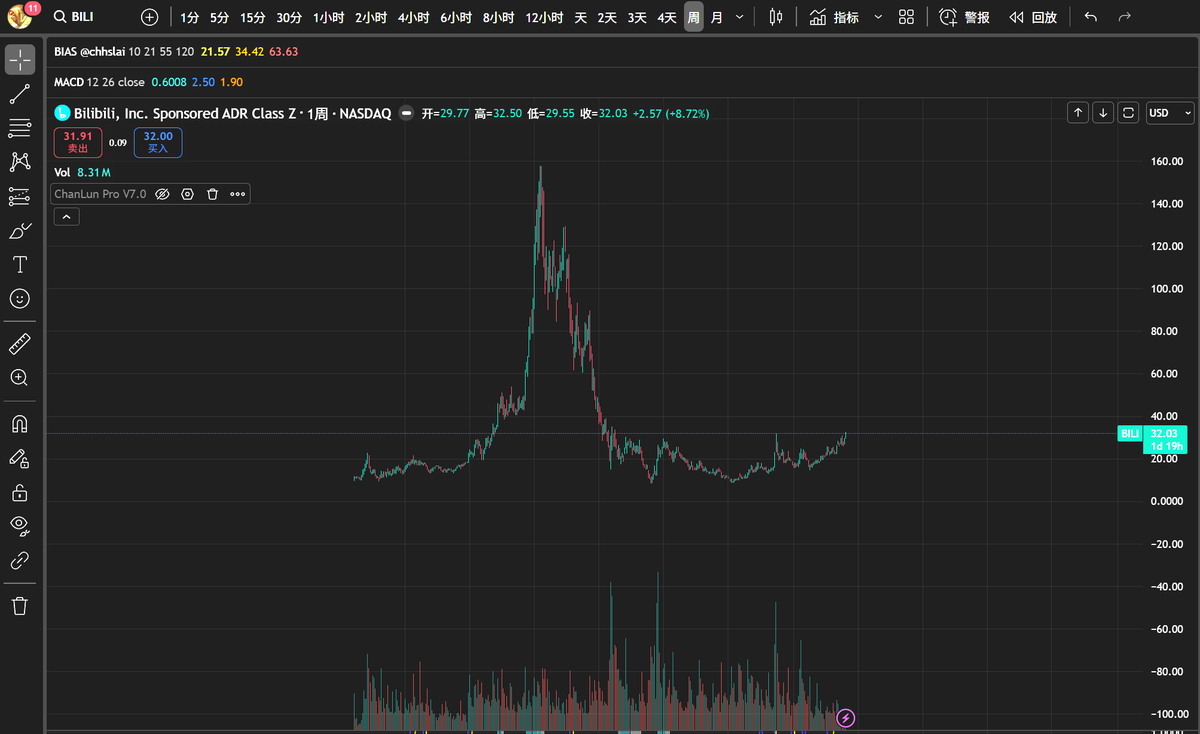

Qualitative analysis first, then quantitative analysis. Quantitative research is limited, but the K-line chart looks good.

Let's talk about the qualitative aspects:

Bilibili's fundamental strengths are fourfold:

First, its massive user base.

Bilibili boasts 368 million monthly active users and 107 million daily active users.

I mentioned this data when discussing Robots; it was around 30 then, now it's almost 150. I was incredibly impressed by Robots' online user base, which was many times larger than Steam's, and these users would grow up. Unfortunately, I wasn't a novice in stock investing at the time and missed the opportunity.

Fortunately, the opportunity remains.

Bilibili's user base, along with the community stickiness fostered by its bullet comment culture (watching shows with bullet comments makes it feel like you're watching with a group of people), forms a solid foundation.

This foundation means you just need to wait for an opportunity.

Second, animation will become mainstream, and it's on the verge of explosive growth.

Thanks to the emergence of AI, the adaptation of excellent written works accumulated over thousands of years into film and television production has been greatly accelerated, moving away from the previous large-scale, long-term productions required in the past. This acceleration will make animated films increasingly lifelike, seamless, and allow for freer imagination, achieving effects that live-action films simply cannot.

Nolan's Interstellar, with its vast cornfields, is certainly impressive, but it's also costly and time-consuming. Furthermore, with a compelling plot, AI-generated animation can be just as excellent.

Therefore, several conclusions can be drawn:

1. AI will accelerate the mainstreaming of animation.

2. Thousands of years of high-quality text will be rapidly adapted into video.

3. Excellent animation will attract a growing audience.

(After watching "A Record of a Mortal's Journey to Immortality" and "Ling Cage" on Bilibili, I'm even more convinced of this. You can also confirm this by looking at the number of views and followers of animated films on Tencent and Bilibili. Of course, Tencent has now realized this, investing hundreds of millions in "Ling Cage," and their own productions like "Xian Ni," initially met with widespread criticism, have become masterpieces.)

4. "Ne Zha 2" is a confirmed case, giving us confidence in this field.

5. Bilibili has the largest animation base.

6. Going global for animation becomes easier. AI will simplify native dubbing in multiple languages, resulting in significant cost reductions.

Tencent's stock is certainly good, but Bilibili's is only about 1/100th of that.

III. Games could be Bilibili's NetEase moment. Duan Yongping earned his first fortune investing in NetEase because he believed in the power of games.

Bilibili, on the other hand, had been losing money until its self-developed games became popular, finally turning a profit.

When I started buying Bilibili stock in my twenties, I had a feeling that Bilibili was likely to continue producing hit games because of its core user base. If the game is good, the word-of-mouth marketing by Bilibili's content creators (UPs) is incredibly powerful.

Recently, a game called *Escape from Dwarkov* has achieved over 300,000 concurrent players on Steam at one point, and its reputation far surpasses most new games this year, with over 17,000 reviews and an overwhelmingly positive 96% rating.

*Escape from Dwarkov* is a self-developed game by Bilibili.

IV. Amidst the AI surge, funds will continue to seek opportunities in undervalued stocks.

My expectations for Bilibili's stock are even higher than for PDD's (PDD) gains—not because it's better, but perhaps because I feel it has fallen enough.

Having missed out on Robotox, I hope Bilibili won't disappoint me.

It's the only UCG (User-Generated Content) video platform in China, similar to YouTube in this respect. In terms of native video, thanks to AI, its original videos are on par with Netflix. And in gaming, perhaps it could be valued as a separate gaming company (a gaming company with a base of 100 million users).