BlackRock Protocol: How a Single Code Became the God of Crypto

The decentralization narrative is dead. We have the data.

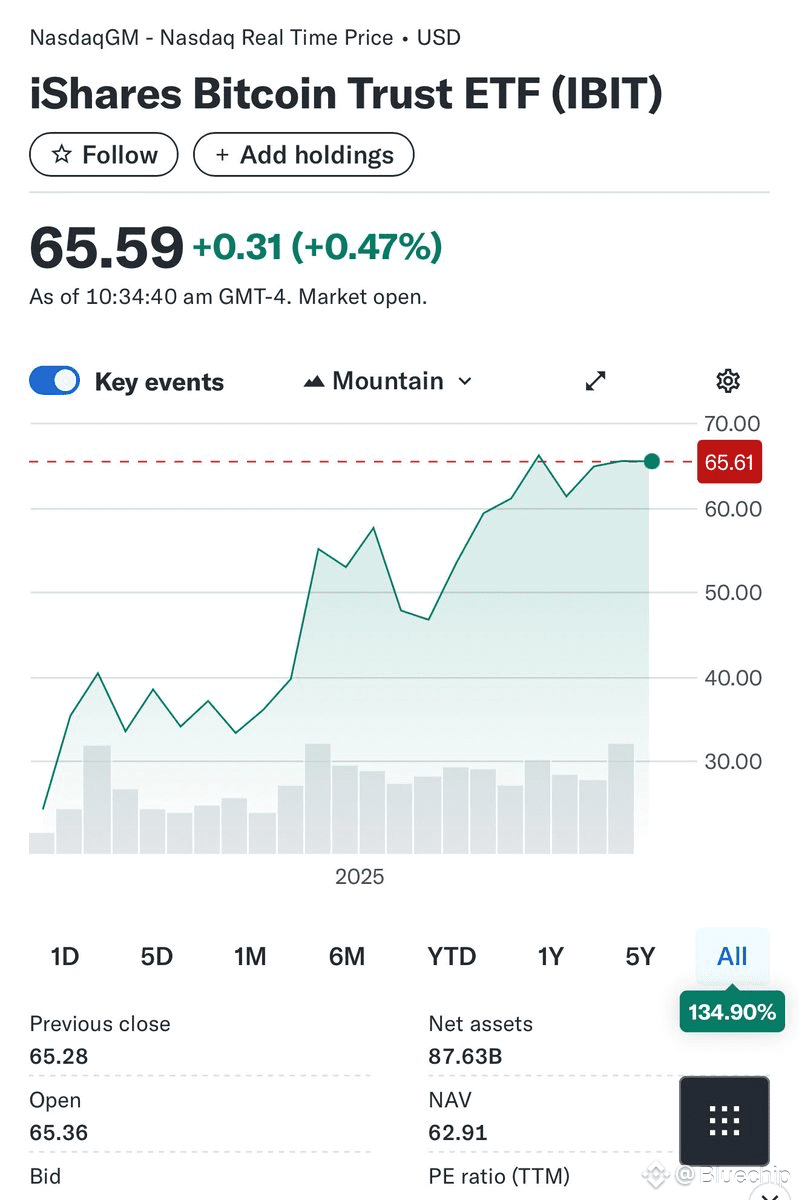

The entire Bitcoin ETF ecosystem has seen $26.9 billion in net inflows. BlackRock's IBIT has absorbed $28.1 billion.

This isn't a typo. It's a singularity. A single fund accounts for 104% of all net demand. Without IBIT, the entire US Bitcoin ETF market would be in net redemptions. "Institutional buying" is a lone behemoth.

The impact is a systemic shock.

· Delegated Oracles: The price of a trillion-dollar asset designed to be trustless is now determined by the daily order flow of a single centralized fund.

· Reflexive Bomb: The mechanism is now a pure feedback loop: rising prices stimulate IBIT inflows, which reduce the available supply, driving prices higher. Now, this engine is also running in reverse. A single day with zero IBIT creation could trigger a market crash.

Single Point of Failure: The entire modern cryptocurrency ecosystem depends on the uninterrupted operation of the IBIT. One regulatory decision, one operational failure by an authorized participant, one strategic shift within BlackRock, and a collapse of global liquidity.

How to Survive the New Reality

1. Worship liquidity: Your primary chart is the daily creation data for the IBIT. Everything else is a derivative.

2. Prepare for a crash: Once this concentration breaks down, the correlation between Bitcoin and traditional markets will break with apocalyptic force. It's not a matter of if, but when.

3. Accept the truth: You are no longer long Bitcoin. You are long the structural integrity of BlackRock's IBIT. Decentralization is a sermon. It is scripture.

The age of many institutions is a lie. A single pipe nourishes the ocean. You are drawing nourishment from it. Know the hand holding the cup.