October 23rd Market Research Report (Waiting for a Lower Breakout)

-----------------------------------

Good morning, everyone! The market has entered a period of chaotic correction.

Take a break, focus on small traders, and trade only within the corrective position. Don't bet heavily on the direction of the market.

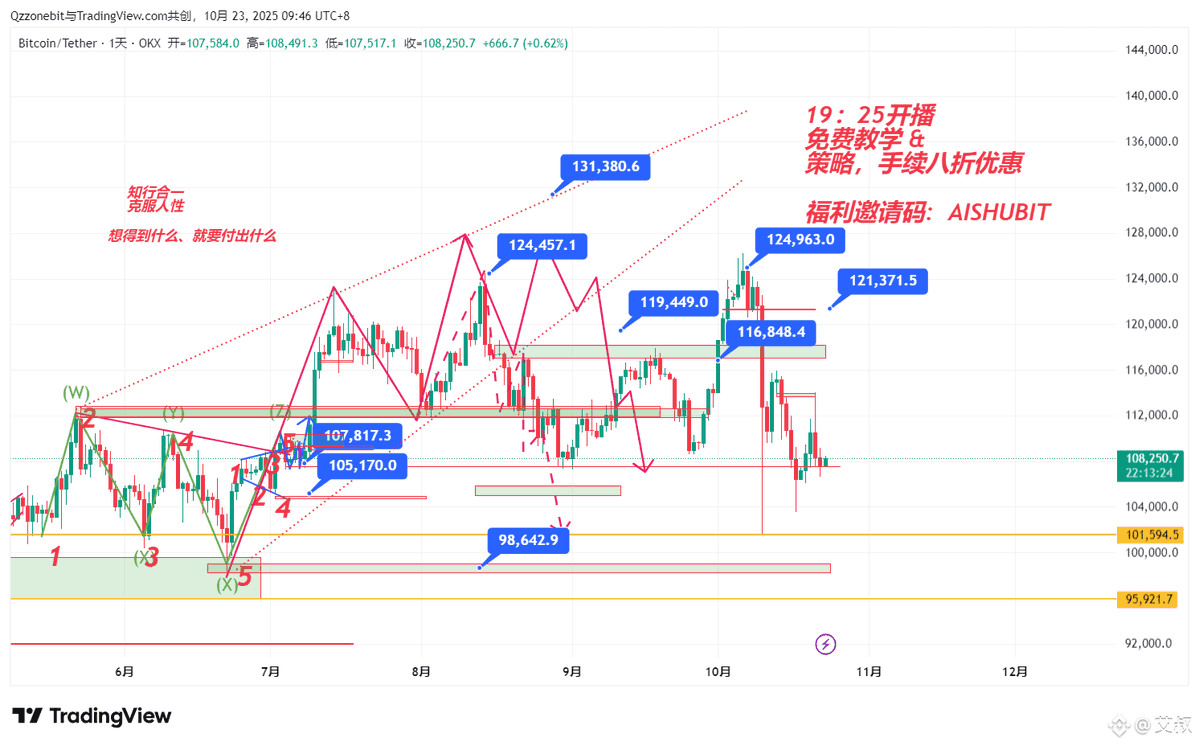

1. $BTC

The cyclical view remains unchanged. What's destined to go will eventually go. As I said, even if Jesus came, it wouldn't help.

Since Lao Ai's return, the recent strategy has been to follow the rhythm. Recently, to support newcomers, the strategy is to feed the market. The daily chart is currently testing support multiple times, with the daily bearish engulfing candlestick reaching support. The best scenario is a consolidation at support level without breaking, and a new high of 15m is reached. For example, a daily high above 10.95 is needed to consider a rebound.

Therefore, support levels are still viable. Operate with caution and move your stop-loss frequently.

This phase requires a bottoming out and testing the waters. If the price fails to break through, a rebound will naturally occur. The next phase will be to find a pullback test between 11.45 and 11.65.

There is absolutely no liquidity or volume. This is normal. The sell-off on the 11th was followed by a few days of emotional trading. Now we are returning to the chaotic fluctuations and subsequent market recovery after the liquidity depletion.

So, do we have the upper and lower levels to watch for within the day?

10.62-10.95

The breakout and breakthrough levels are also clear.

Down: 10.45, 10.2, 10, 9.9

Up: 10.95, 11, 11.4, 11.65

Thus, levels like 10.2, 9.85, 9.4, and 9.2 are good levels. Keep an eye on the upper levels of 11.45, 11.68, and 11.95.

2 $ETH

Ether is focusing on the resistance range of 3850-3880 during the day.

A rebound will be considered after this level recovers.

We will discuss the long positions at 3725 for a while, but reduce positions here.

The lower support remains at 3730.

Cyclic support: 3550, 3366, 3250