It's been a while since I've done an in-depth market analysis.

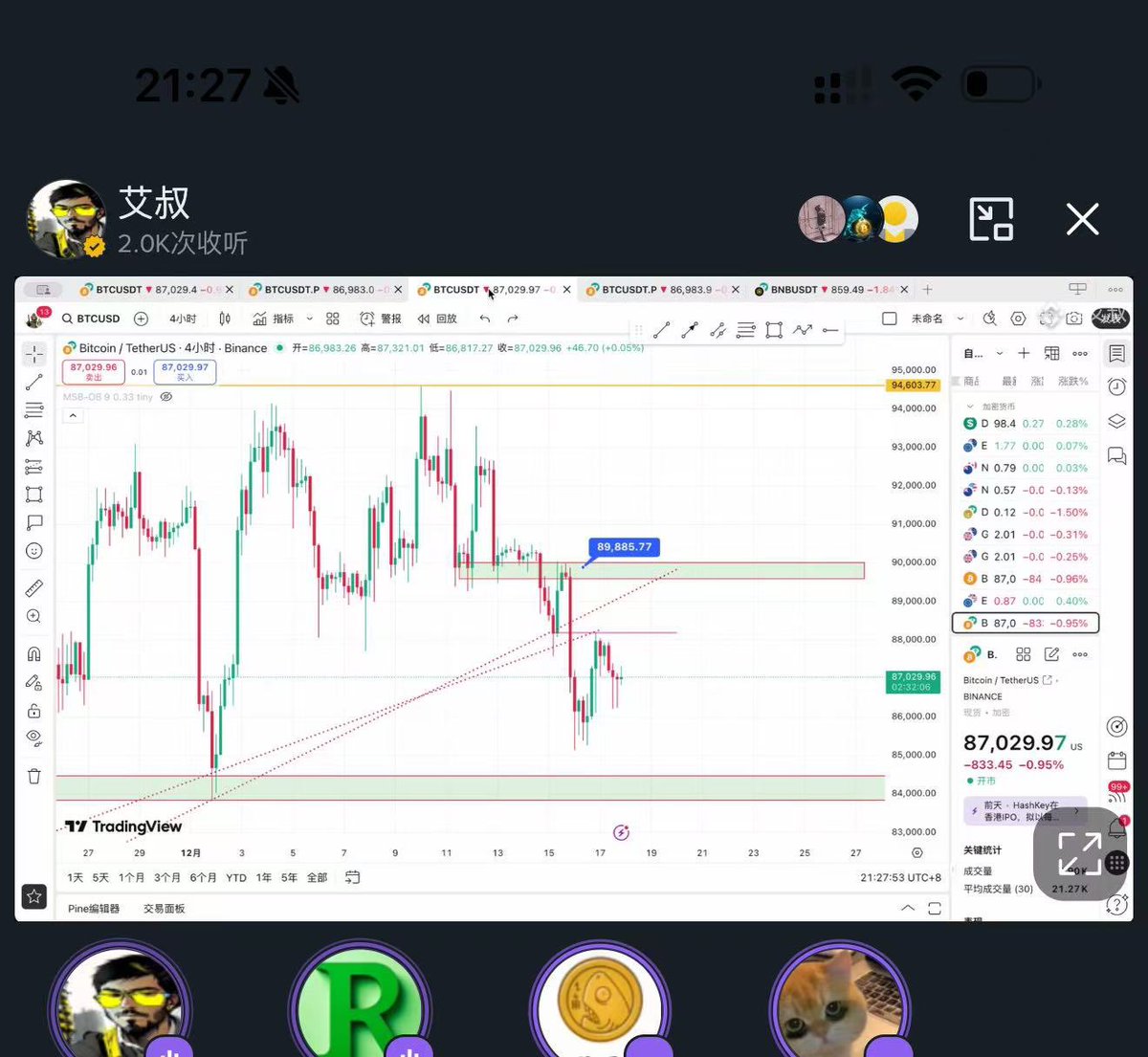

Let's talk about the potential expectations for Bitcoin: Beware of a false breakout trap at 99.

On the daily chart, it's been in a wide range of fluctuation between 84 and 94 (around 10,000 points) for two months.

The weekly channel has been broken, but a demand zone has also formed.

So, the two key levels on the daily and weekly charts are 9.4 and 9.9. One indicates the start of a move from a low to a high, and the other indicates a strengthening market.

Potential expectations and traps:

8.9 is the recent support level. Above this level, there's an expectation of reaching around 9.85, with confirmation at 9.29. The trap is a false breakout of the ultimate target of 9.85.

Therefore, in the short term:

Support: 8.9, 8.7

Resistance: 9.29, 9.45

Combining the daily range and key levels, the two short-term structural turning points

are where trading opportunities lie.

Pay close attention to false breakouts near the expected targets. The long-term entry point for spot trading remains unchanged; when it reaches that level, act!

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data