Why We're Now at the Crossroads of Bull and Bear Markets?

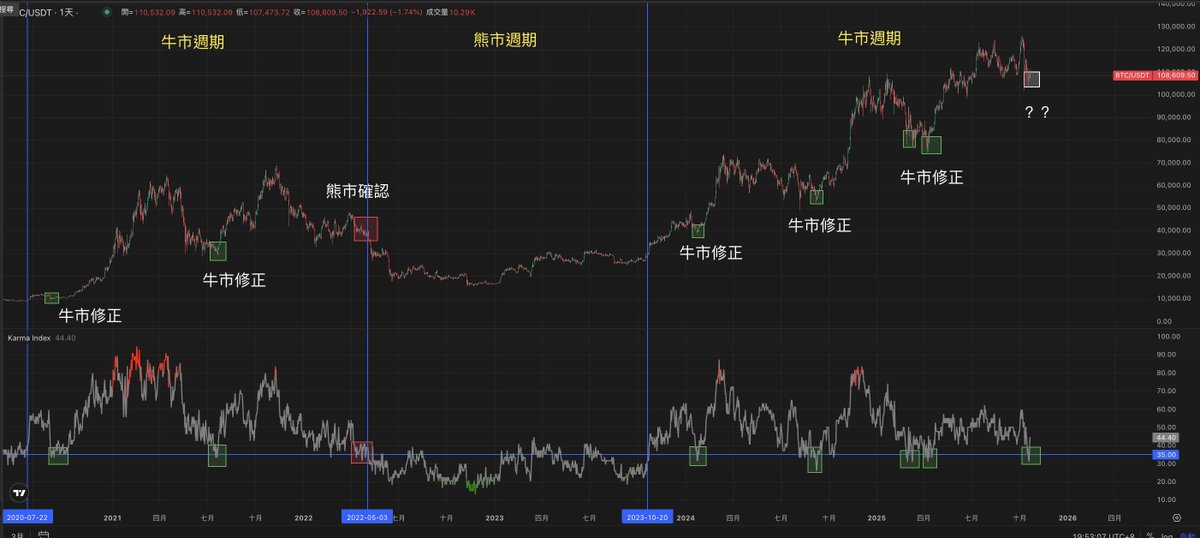

The Karma Index is @coinkarma_'s medium- to long-term cyclical indicator, used to monitor the overall market's current position in the cycle.

Historically, whenever the Karma Index falls below 35 (indicated by the green box in the chart), it often represents an excellent bargain hunting zone during a bull market.

During this bull market, the dates when the index fell below 35 were:

January 23, 2024

September 7, 2024

March 2, 2025

April 8, 2025

If the index continues to fall significantly below 35, it often signals a confirmed bear market.

For example, the red box on May 2022 (after the LUNA crash) is a typical early confirmation of a bear market.

On October 18, 2025, BTC briefly touched 103,000, and the Karma Index fell back below 35.

This means we are once again at a cyclical watershed:

If it can stabilize here and not fall below 100,000,

the bull market could resume, reaching new highs.

If it continues to fall below that level,

then we are very likely entering the bear market confirmation phase.

So objectively speaking, we're currently at the crossroads of a bearish and bullish market. There are reasons to be bullish or bearish.

Based on sentiment on Twitter, I believe now is the time when most players who have achieved results in this cycle are choosing to withdraw.

Some people also withdrew during the tariff war in early March, but not as many as now.

This is perfectly normal. An event as significant as October 11th could indeed change the overall market structure.

However, due to the third bull peak (126K) in early October, we haven't seen overheating with the Karma Index above 80.

(Both bull peaks on March 2024 and December 2024 were above 80.)

Adding Bitfinex... I'm still aggressively adding to my positions.

So, I personally still lean towards the bullish side.

But if 100,000 doesn't hold, I'll withdraw.

It's crucial to maintain the results.