Bears argue that $126,000 is the peak, that Bitcoin will fall below $100,000, and enter a bear market in 2026, primarily because of... a four-year cycle!?

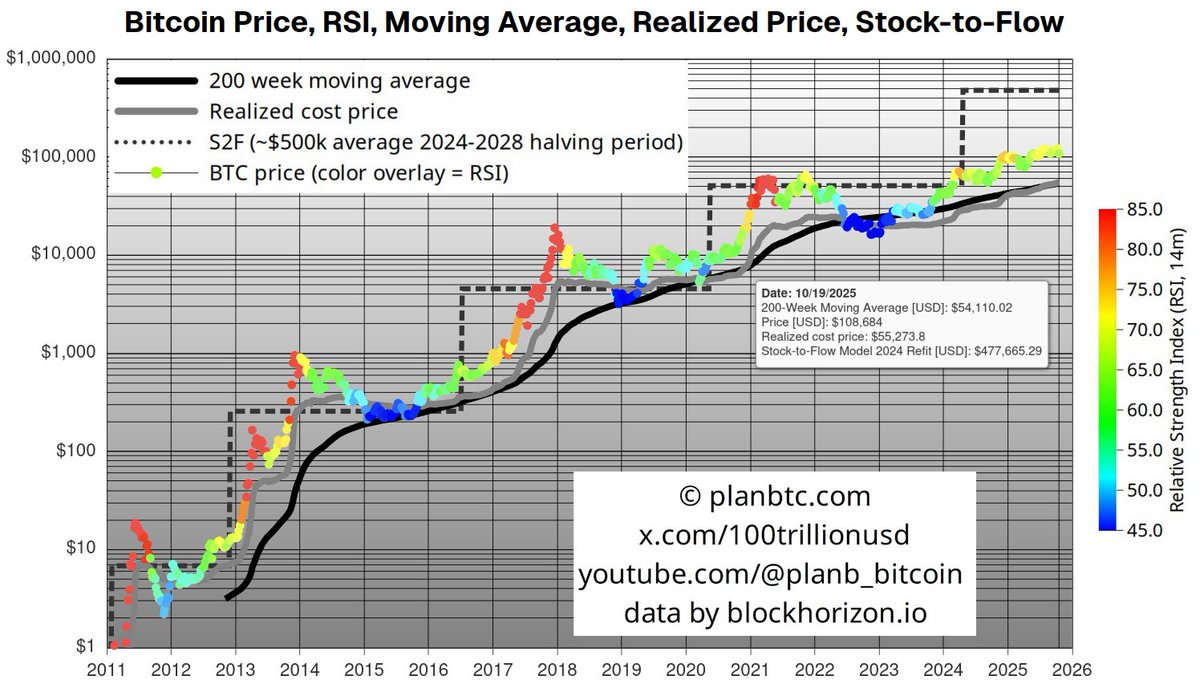

In my opinion, this is a huge misconception. Yes, there is a four-year halving cycle, the S2F ratio doubles, and the gains in the three cycles from six months before the halving to 18 months after the halving are very impressive. However, three cycles are not enough to form a reliable pattern, and there is absolutely no guarantee that a new peak will occur 18 months after the halving (October 2025!). Furthermore, the S2F model doesn't indicate a top or bottom, only an average price level within the halving cycle, assuming a fundamental phase transition (as discussed in my article about S2FX in the introduction to my website). So, in my opinion, the price peak is likely to be in 2026, 2027, or 2028... In fact, I'm more interested in the average price level than the peak (or bottom).

What I do know is this: Bitcoin has not yet undergone a fundamental phase transition in this cycle. The actual price (gray line) has not yet deviated from the 200-week moving average (black line), and the RSI has not yet exceeded 80 (red line). Either a major price increase has yet to occur, or we have already transitioned to a more stable price regime, dominated by institutional investors, fund custody (for example, 1%-10% of Bitcoin), and rebalancing (selling after a surge and buying after a plunge to keep risk exposure within the custody range). Both scenarios are very positive for Bitcoin. Furthermore, in my view, a major bear market will not occur without a major surge (RSI exceeding 80 in red and actual price deviating from the black 200-week moving average in gray).