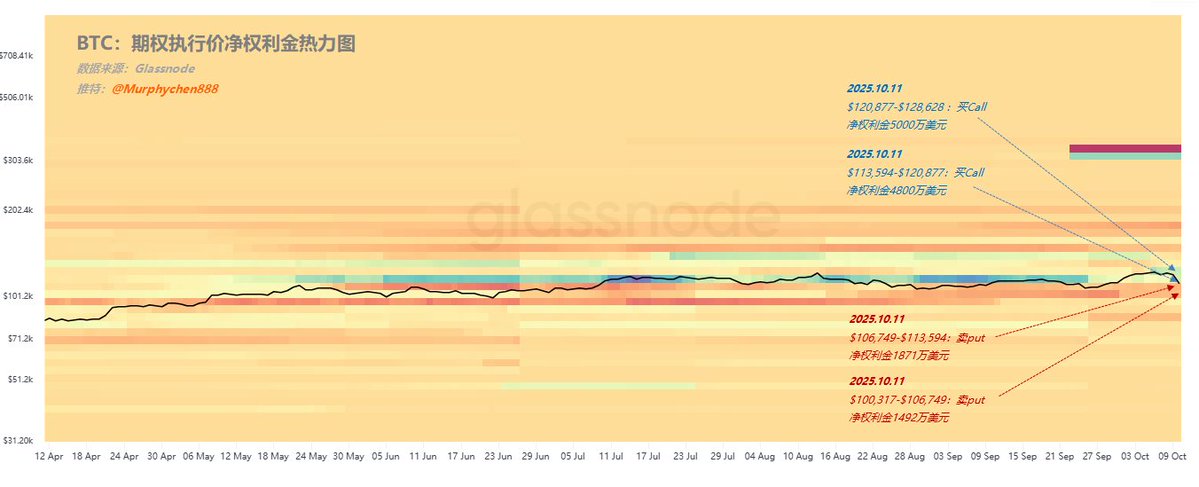

As of October 10th, the current BTC options market structure is dominated by call buying on the upper side and put selling on the lower side, forming a typical "short on top, long on bottom" gamma structure. The specific price range and net premium size are shown in Figure 1:

(Figure 1)

Therefore, when the price is within the range of dense call buying (US$113,000–US$125,000), market makers are in the short gamma zone. When the price rises, they must passively buy spot to hedge, generating a bullish effect; conversely, when the price falls, they must passively sell, driving the price down.

This range is therefore known as the "volatility amplification zone." When the price enters this volatility zone, market makers' hedging needs are most sensitive, and price fluctuations trigger stronger passive buy and sell feedback.

When the price falls below US$106,000, market makers are in the long gamma zone, meaning they will buy spot to hedge when the price falls, thus providing a buffer.

This is known as the "gamma support band." When prices fall into the long gamma band, market makers' hedging behavior shifts to "buying on the dip," providing natural support, absorbing downward fluctuations and causing prices to consolidate.

The above is for educational purposes only and is not intended as investment advice.

-------------------------------------------------

This article is sponsored by #Bitget | @Bitget_zh