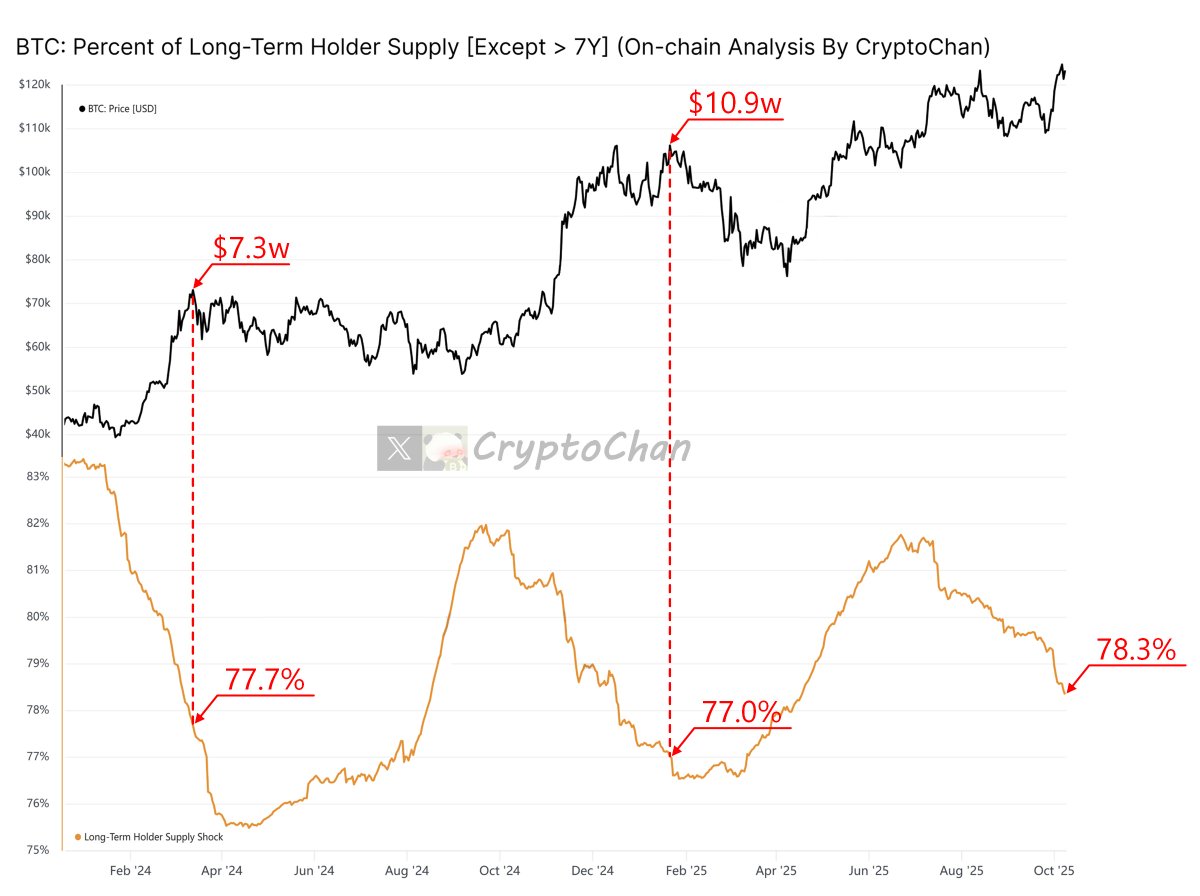

At the peak price of $73.8k in March 2025, this indicator was 77.7%. At the peak price of $109k in January 2026, this indicator was 77.0%. The current value is 78.3%.

The indicator in the figure is: Number of Bitcoin Long-Term Holders / (Number of Bitcoin Long-Term Holders + Number of Bitcoin Short-Term Holders), commonly referred to as the Long-Term Holder Ratio. This reflects the relative holdings of long-term (LTH) and short-term (STH) Bitcoin holders. By excluding ultra-long-term (>7 years) coins that may be lost, permanently held, or inactive, this ratio focuses more on the proportion of "relatively active" long-term holders relative to short-term holders. It is an important indicator for analyzing Bitcoin market sentiment, investor behavior, and market trends. Specifically, this ratio can reflect the following aspects:

1. Market Confidence and Stability:

• A high percentage (high proportion of long-term holders): indicates that more Bitcoin is controlled by long-term holders. These holders generally have strong confidence in the market and are reluctant to sell. This situation often occurs during market accumulation or long-term bullish sentiment, which may result in lower market volatility.

• A low percentage (high proportion of short-term holders): indicates that more Bitcoin is in the hands of short-term holders, who are more likely to engage in frequent trading or speculation. This often reflects increased market uncertainty and may be accompanied by price fluctuations or market corrections.

2. Market Cycle Phase:

• During a bull market or a period of rapid growth, long-term holders may begin selling to lock in profits, causing the proportion of long-term holders to decrease and the proportion of short-term holders to increase.

• During a bear market or bottoming accumulation phase, long-term holders tend to increase their holdings, while short-term holders decrease (possibly due to selling at a loss or switching to long-term holding), resulting in an increase in the proportion of long-term holders.

Therefore, this ratio can help determine whether the market is at a bull market peak (or phase), a bear market bottom, or a transition phase.

In summary, the proportion of long-term holders is an important indicator of #BTC market health and cycle stage. A high percentage generally reflects market stability and long-term bullish sentiment, while a low percentage may indicate speculation or overheating.