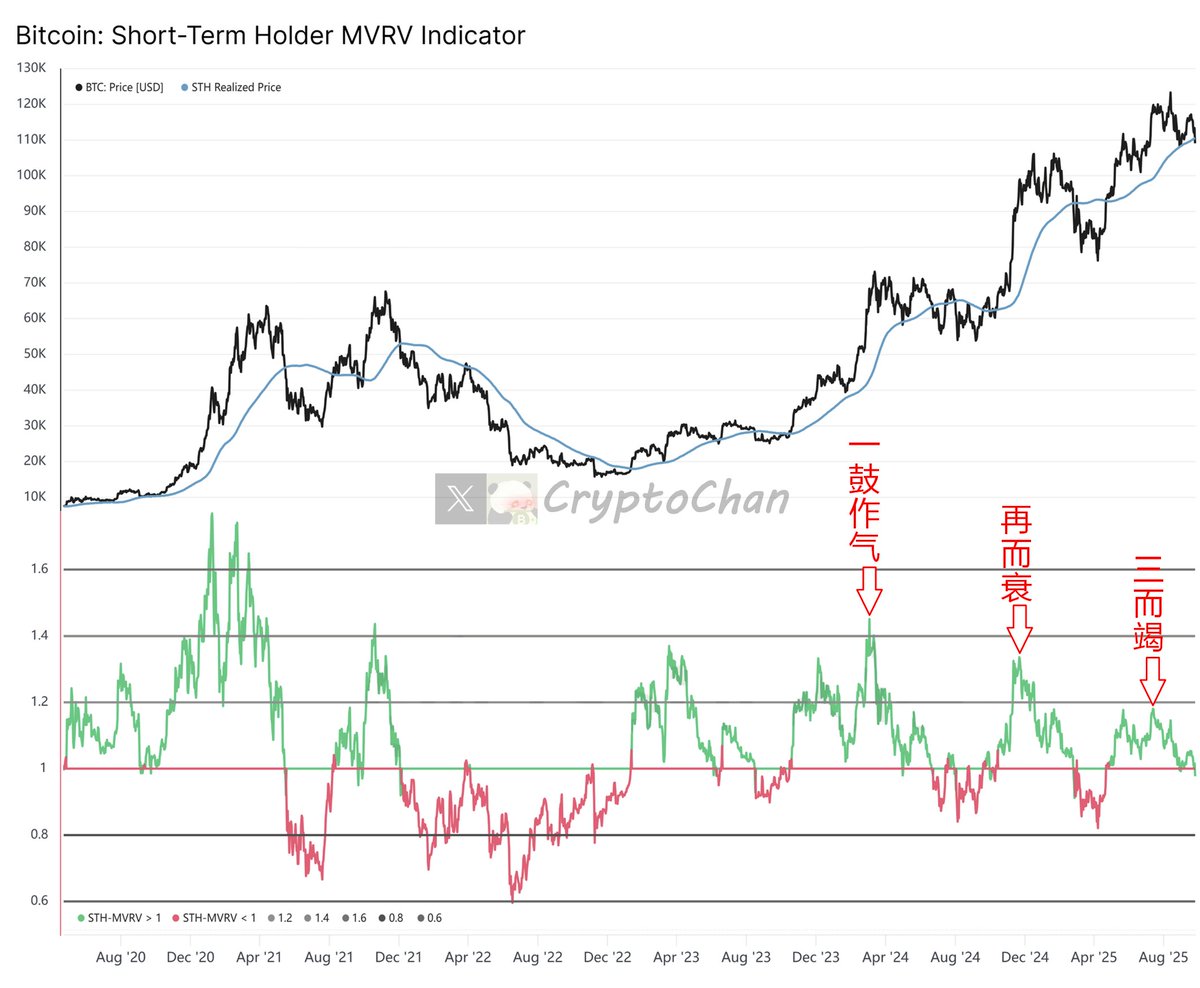

[A Series of Strong Starts, Declines, and Exhaustion]

The upper indicator in the chart represents the #BTC price and the average cost price of short-term BTC holders; the lower indicator represents the MVRV of short-term BTC holders.

The MVRV (Market Value to Realized Value) ratio of short-term BTC holders is a MVRV metric specifically tailored to short-term holders. It is a commonly used on-chain metric in crypto market analysis, used to assess Bitcoin market sentiment and potential buying and selling pressure.

Definition:

MVRV = Market Value ÷ Realized Value

Market Value: Current Bitcoin market capitalization, i.e., the total value of all Bitcoin held by short-term holders at the current market price.

Realized Value: The actual cost of Bitcoin purchased by short-term holders, i.e., the sum of their purchase prices (based on on-chain data tracking the last traded price of each Bitcoin).

Short-term holders: Typically refers to Bitcoin holders who have held for less than 155 days. This group tends to trade short-term and is susceptible to market fluctuations.

• MVRV > 1: The market value of Bitcoin held by short-term holders is higher than their purchase price, indicating they are profitable and may be motivated to sell (especially when MVRV is too high, indicating an overheated market).

• MVRV < 1: The market value of Bitcoin held by short-term holders is lower than their purchase price, indicating they are losing money and may be reluctant to sell (possibly signaling a market bottom).

• MVRV ≈ 1: Market value and realized value are close, indicating short-term holders are at break-even. The market may be relatively stable or in a transitional phase.

• High MVRV: Indicates that short-term holders are making substantial profits. This may indicate an overheated market and a potential correction, as they may sell to lock in profits.

• Low MVRV: Indicates that short-term holders are generally losing money. This may indicate a market downturn or nearing a bottom, with weakening selling pressure and a potential buying opportunity.

Fluctuations in the MVRV of short-term holders often reflect shifts in short-term speculative sentiment.