🚨📊 @ether_fi and Token Terminal have partnered for data.

▪️ ether_fi is one of the fastest-growing liquidity staking projects on @ethereum, @base, @HyperliquidX, @Scroll_ZKP, and @arbitrum. It recently transitioned to an alternative banking platform, allowing users to stake, earn yield, and spend from a single, self-custodial account.

▪️ The project has raised approximately $32 million in venture capital from firms like CoinFund and Maelstrom, and its core contributors have extensive experience building on-chain protocols.

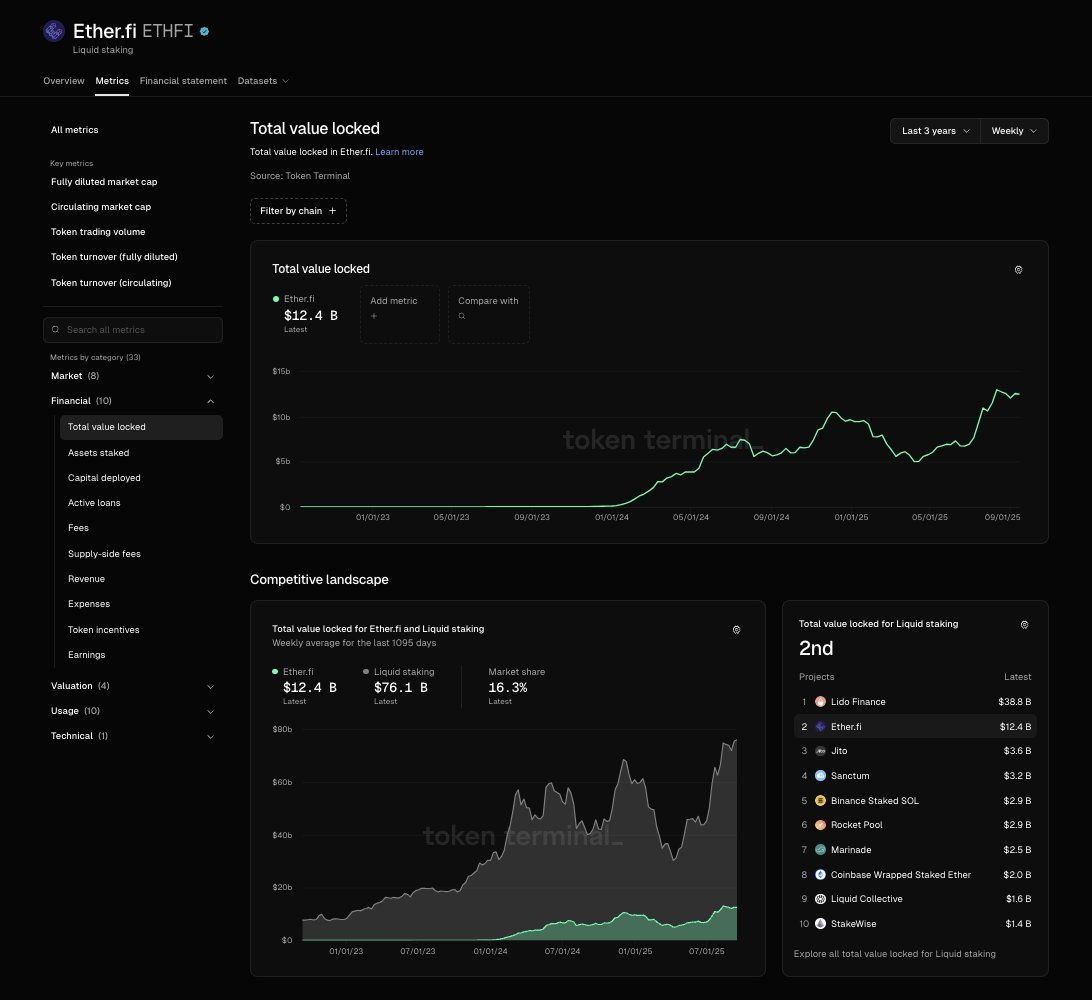

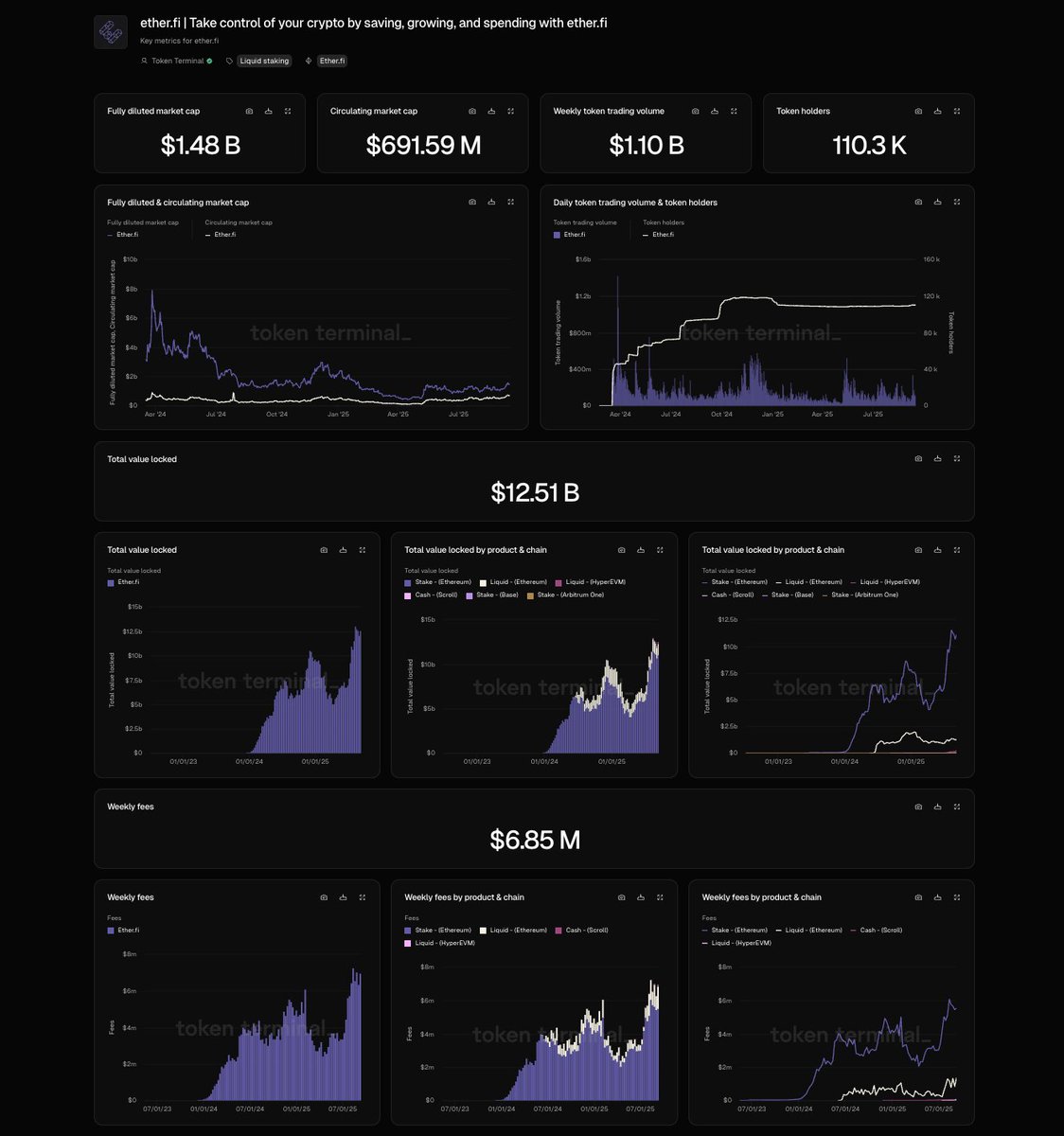

▪️ Currently boasting over $12 billion in total locked value, ether_fi recognizes the importance of reliable, consistent, and data-driven stakeholder reporting.

Reliable on-chain data and transparent stakeholder reporting are crucial.

▪️ To improve existing on-chain analytics and stakeholder reporting, ether_fi has partnered with Token Terminal. Token Terminal is a leading on-chain data platform trusted by institutional and retail partners such as Bloomberg, Binance, and Coingecko.

▪️ Token Terminal's focus on data standardization makes it an ideal partner for ether_fi.

▪️ Token Terminal's previous public reporting of standardized financial and usage metrics for other leading DeFi projects, such as pendle_fi, aave, and MorphoLabs, further solidified ether_fi's decision to partner with it.

"By partnering with Token Terminal, we are able to benchmark our performance against our competitors in a fair and accurate manner. Having a real-time dashboard on Token Terminal is incredibly useful not only for our team, but for all ether_fi stakeholders."

@MikeSilagadze, @ether_fi Core Contributor

Data Partnership

▪️ To ensure accurate and ongoing stakeholder reporting, ether_fi has established a data partnership with Token Terminal.

The data partnership consists of four (4) distinct parts:

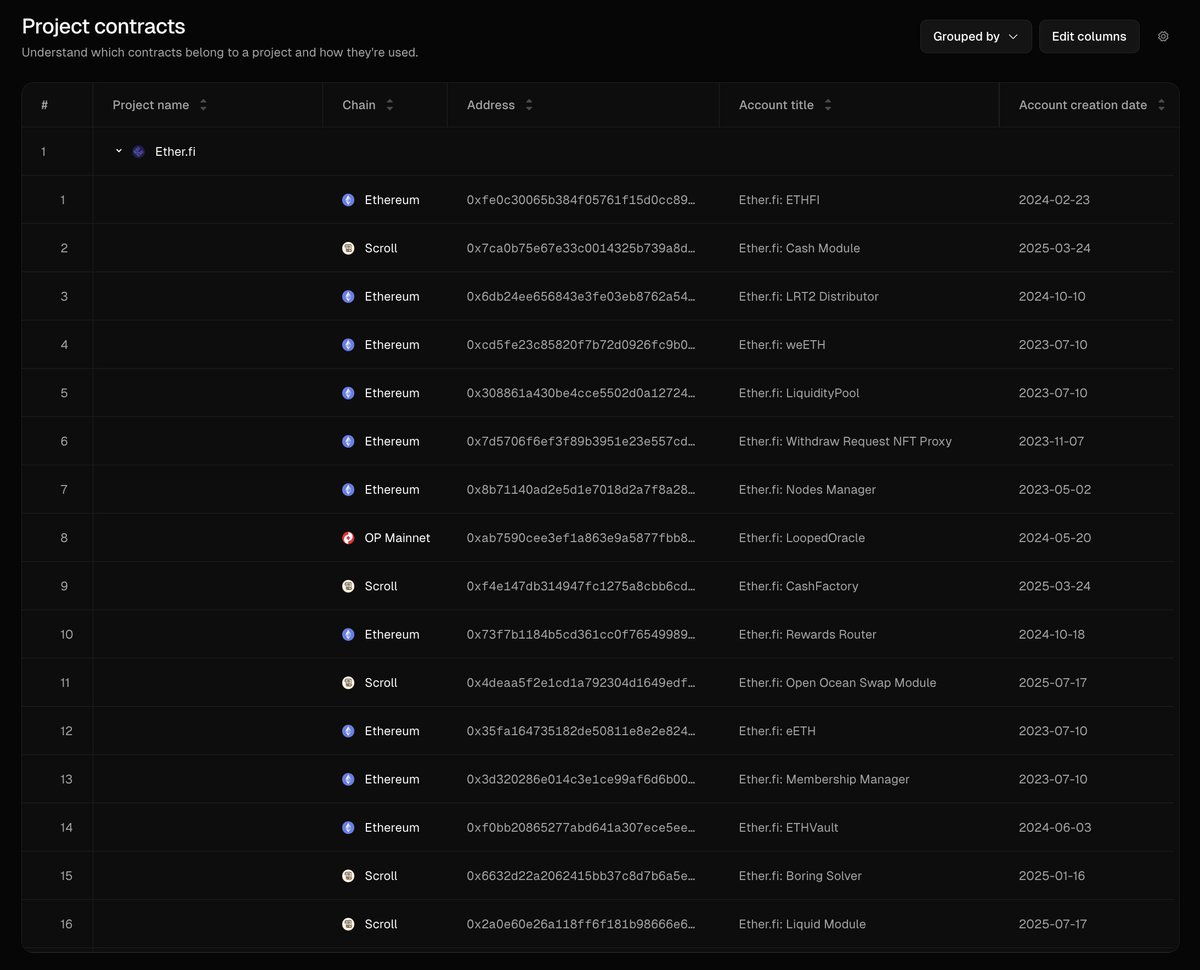

1. Smart Contract Registry

▪️ Since @ether_fi is not an application chain, but rather a set of smart contracts running on multiple chains, there is no need to set up node infrastructure as a first step. Token Terminal was able to rely on its existing node infrastructure.

▪️ First, the ether_fi and Token Terminal teams collaborated to build a token registry for ether_fi smart contracts.

▪️ A complete smart contract registry is a prerequisite for the next step: converting raw blockchain data into standardized financial and usage metrics.

2. Metric Conversion

▪️ Using the information in the smart contract registry, Token Terminal’s research team converts raw blockchain data from smart contracts into standardized financial and usage metrics.

▪️ For liquidity staking projects like @ether_fi, standardized metrics include total value locked, fees, revenue, daily active users, etc.

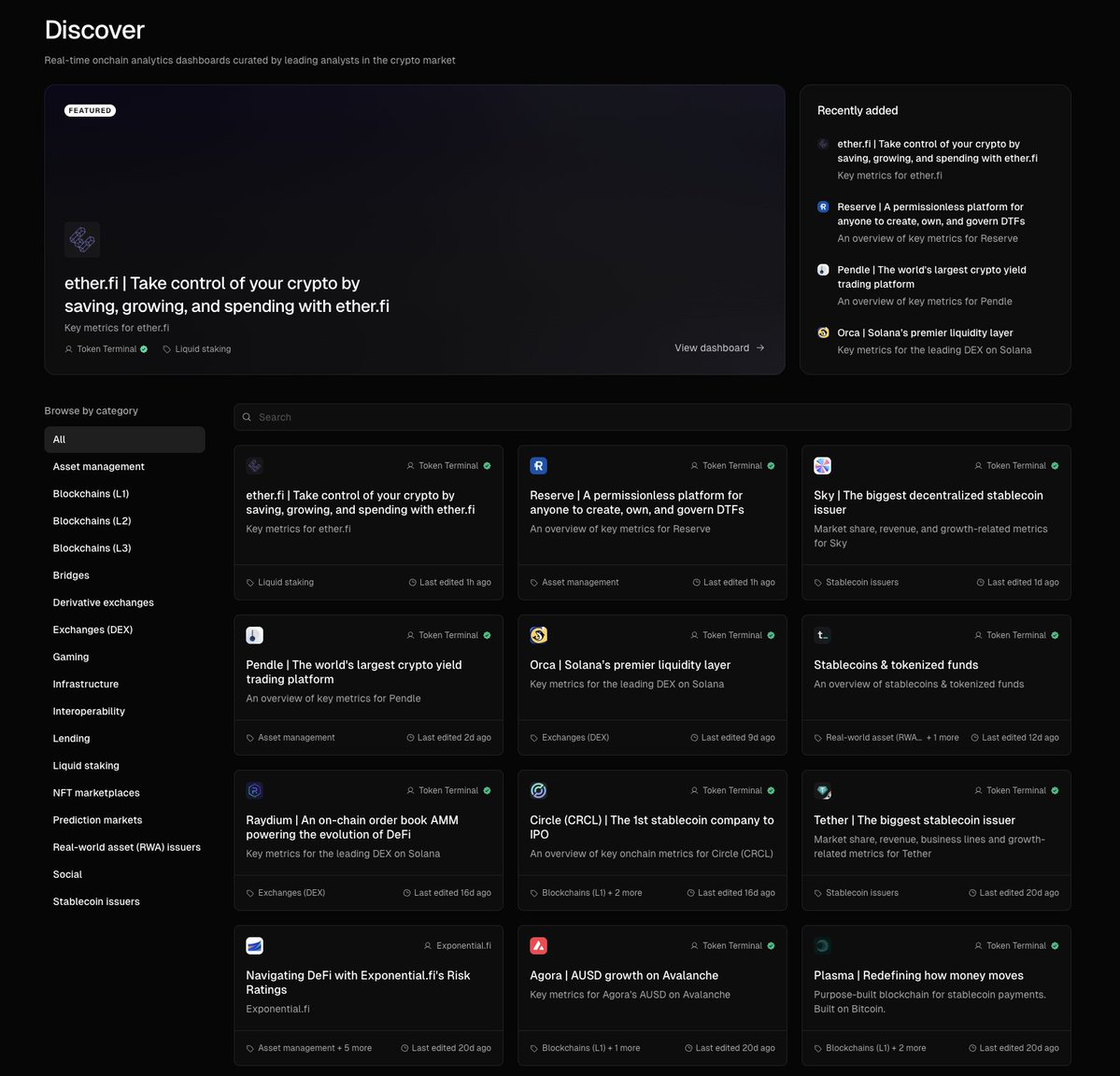

3. Discovery and Reporting

▪️ Following the completion of the metric conversion, @ether_fi is now live on Token Terminal's Liquidity Staking Markets dashboard and featured on the recently launched Discover page.

▪️ As a result, limited partners, developers, and investors can now refer to a single source to decide which liquidity staking projects to use, integrate with, and/or invest in.

▪️ For ether_fi, the dashboard on Token Terminal simplifies reporting to existing and future stakeholders.

4. Data Maintenance

▪️ Standardized on-chain metrics require ongoing maintenance, especially when ensuring completeness and accuracy.

▪️ Over the past few years, as more DeFi projects have evolved from single-chain applications to multi-chain applications, often with multiple business lines, the scale and importance of this maintenance effort has grown.

▪️ Establishing a data partnership with Token Terminal means @ether_fi can rely on Token Terminal to manage all future metric updates, allowing it to focus all its efforts on growing its on-chain business.

Future Opportunities

▪️ In addition to standardized financial and usage metrics, ether_fi and Token Terminal are eager to explore opportunities to create custom dashboards that include more project-specific metrics.

▪️ These dashboards will provide LPs and other stakeholders with deeper insights into platform functionality and performance.

▪️ Through our partnership with Token Terminal