Want to understand the macro case for cryptocurrencies? Our Head of Research, Zach Pandl @LowBeta_, breaks it down in his latest research report. 🧵👇

Cryptocurrencies like Bitcoin and Ethereum are alternative monetary assets based on new technologies. To understand how blockchains work, you need to understand computer science and cryptography. But to understand the value of cryptoassets, you need to understand fiat currencies and macroeconomic imbalances.

@LowBeta_ Credibility is crucial for fiat currencies.

Today, with high public debt, rising bond yields, and unchecked deficit spending, the US government's promise to ensure low inflation may no longer be entirely credible.

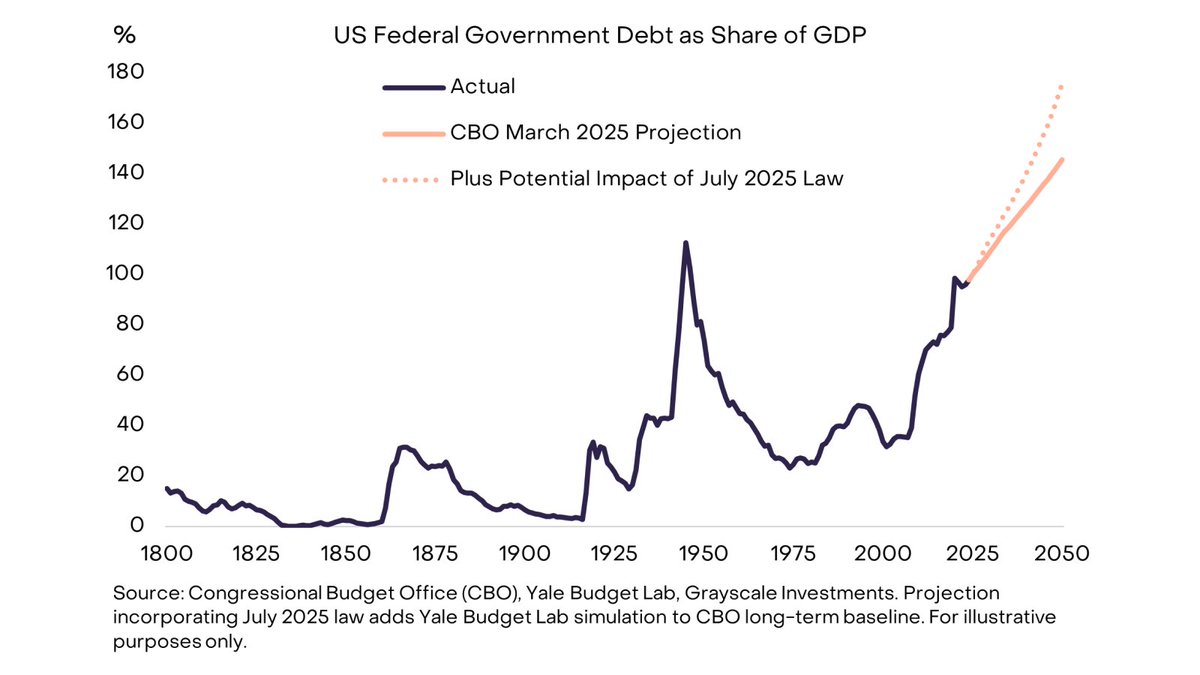

@LowBeta_ The US debt imbalance began with the 2008 financial crisis. In 2007, the US deficit was only 1% of GDP, while total debt was 35% of GDP. Since then, the federal government has averaged annual deficits of about 6% of GDP.

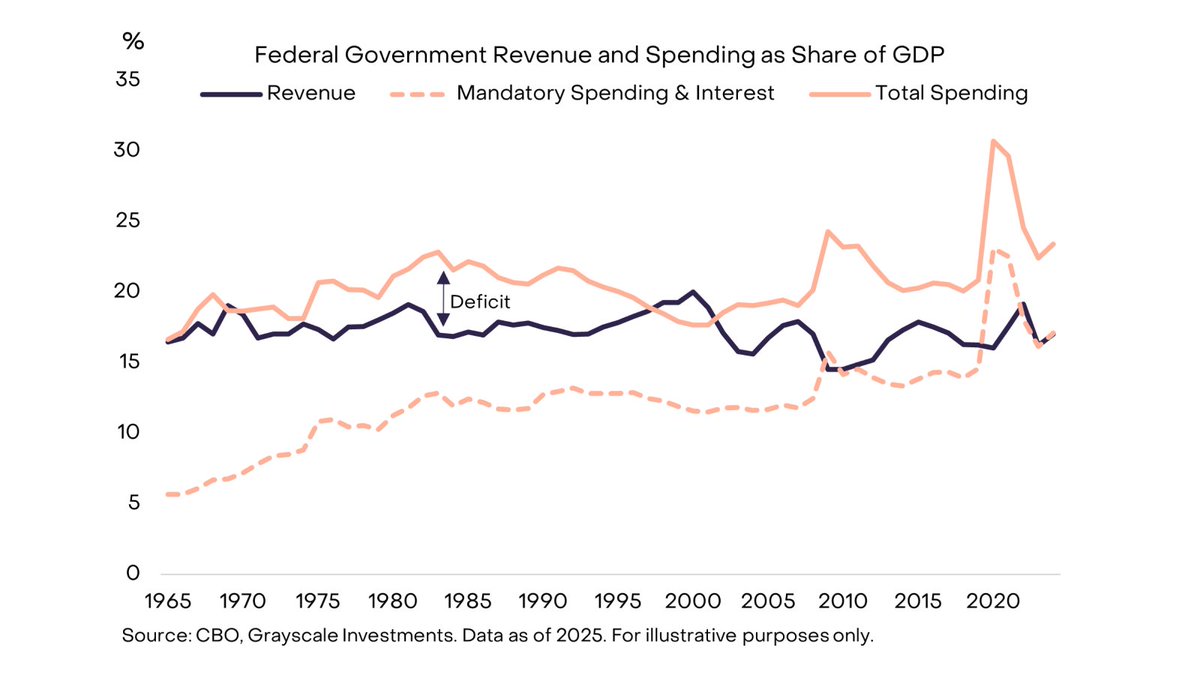

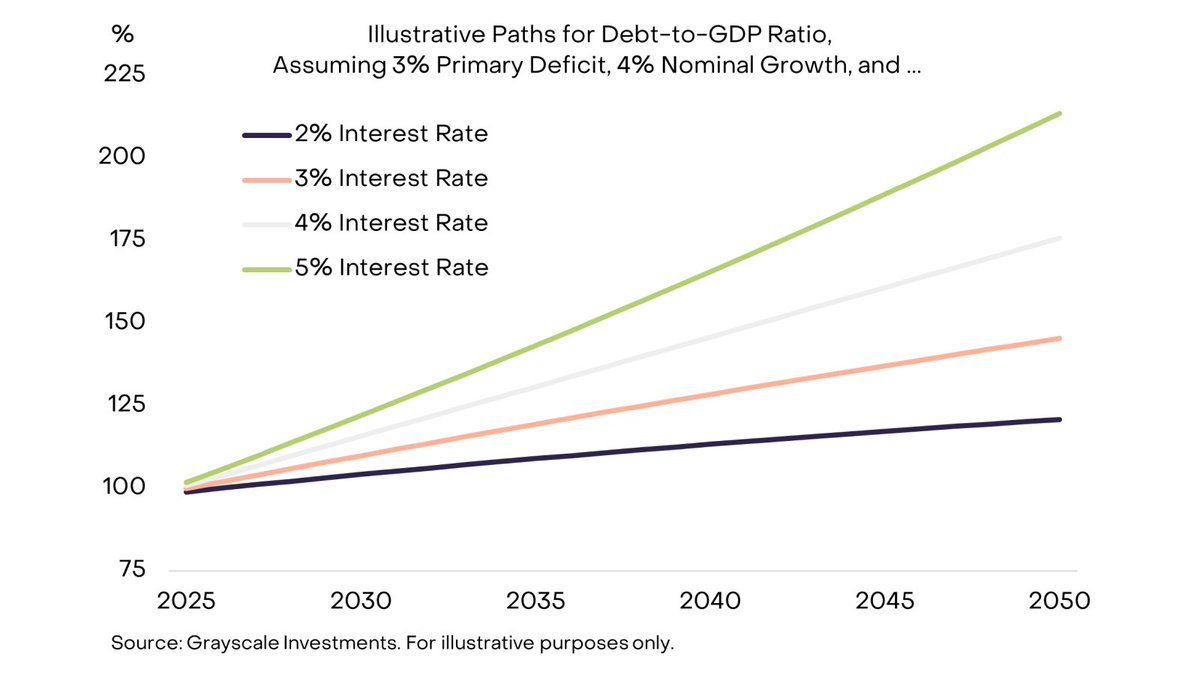

@LowBeta_ Currently, the US national debt is approximately $30 trillion, or about 100% of GDP, nearly the same level as the final year of World War II, and is projected to continue to grow significantly. Large deficits have always been a bipartisan concern, persisting even when unemployment was relatively low. Modern deficits appear intractable, as revenues now barely cover mandatory spending and interest payments. Balancing the budget may require politically painful spending cuts and/or tax increases.

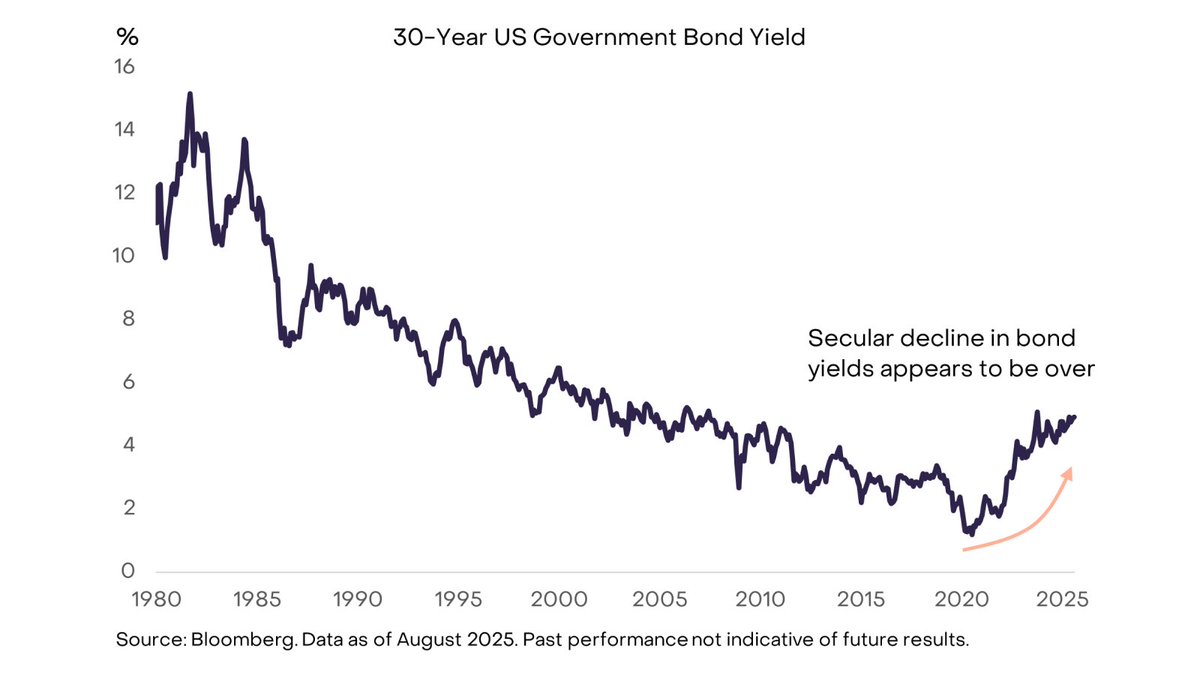

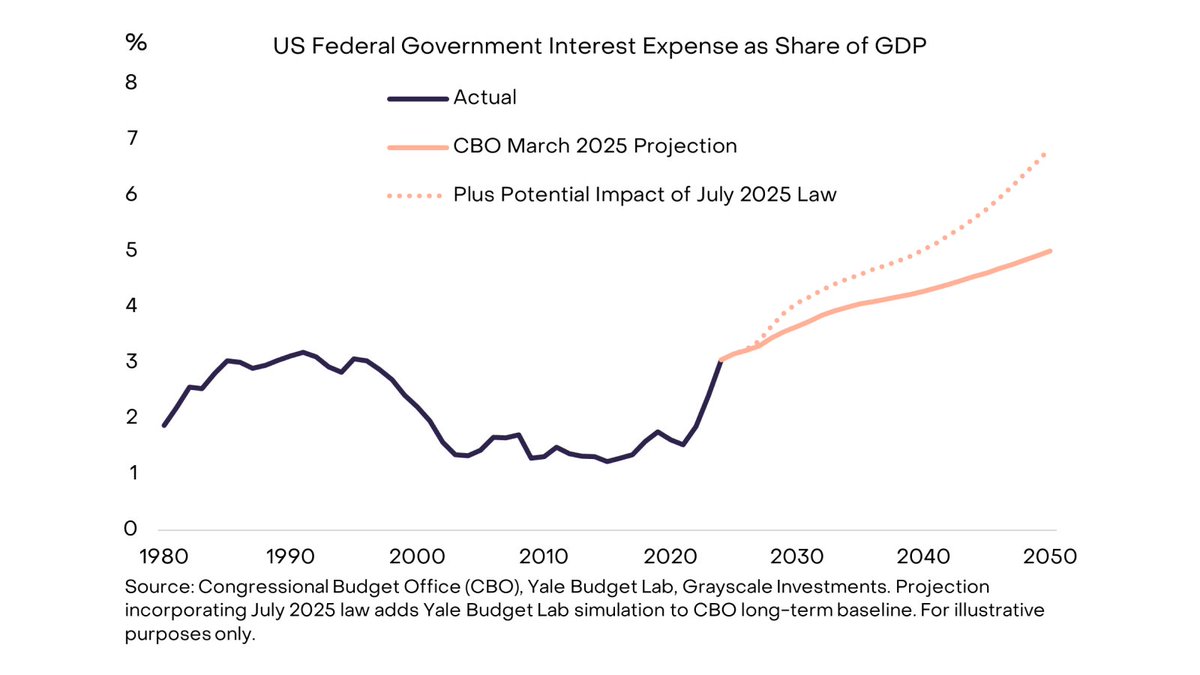

@LowBeta_ Economic theory cannot tell us how much government debt is too high. What matters is the cost of financing the debt burden. Now that the decades-long trend of falling bond yields appears to have ended, limits on debt growth are becoming increasingly binding.

As the U.S. government refinances its debt at higher interest rates, a greater portion of its spending goes toward interest payments. Low bond yields allowed the debt stock to grow rapidly for nearly 15 years without significantly impacting the government's interest payments. But this situation has now ended, which is why the debt problem has become more pressing.

@LowBeta_ If interest rates remain too high relative to nominal economic growth, the debt problem could snowball.

@LowBeta_ As the name implies, unsustainable trends cannot continue forever. The unbridled growth of the U.S. federal government debt will eventually end, but no one can be sure of the exact timing. There are essentially four possible outcomes, which are not mutually exclusive.

@LowBeta_ Default is highly unlikely. Reducing the deficit through higher taxes and/or lower spending also seems unlikely, at least for now. A booming economy would be the ideal outcome, but growth is currently weak, and potential growth is projected to slow.

This has led to artificially low interest rates and inflation. Given the range of possible outcomes, the severity of the problem, and the actions of policymakers to date, we believe it increasingly likely that a strategy for managing the nation's debt burden over the long term will result in average inflation above the Fed's 2% target.

@LowBeta_ The value of fiat currencies ultimately depends on the government's credible promise not to increase the money supply. Therefore, if there is reason to doubt this promise, investors in all dollar-denominated assets may seek alternative stores of value.

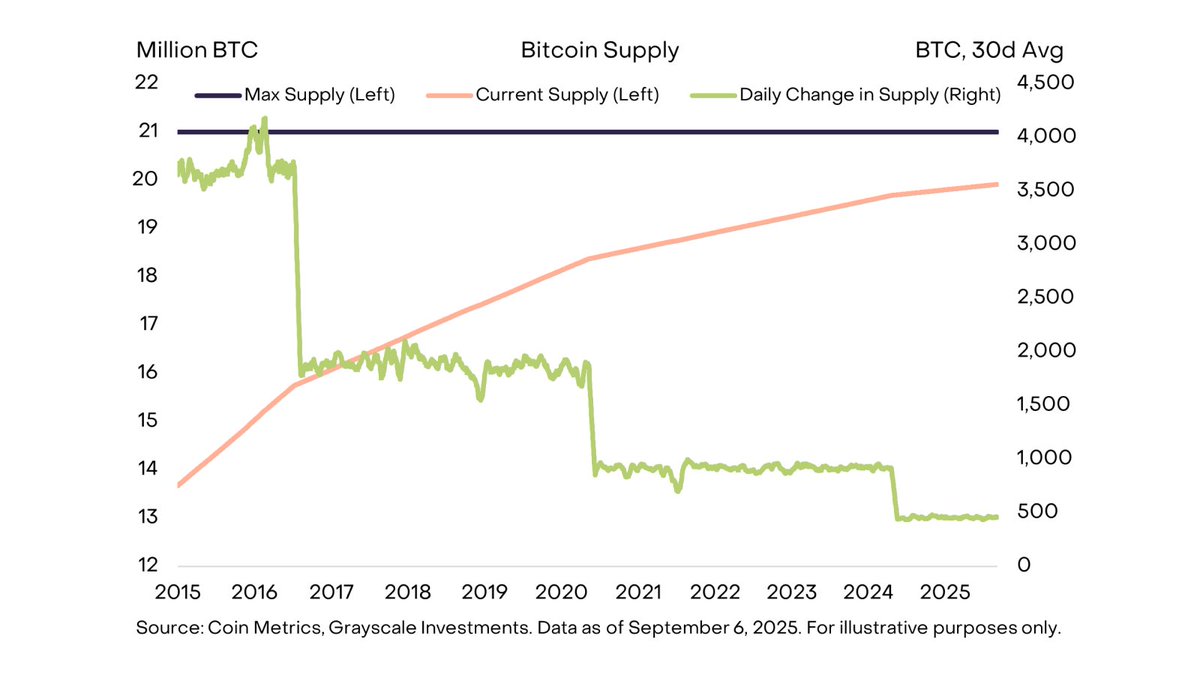

Cryptocurrencies such as Bitcoin and Ethereum may be able to achieve this goal. They are alternative monetary assets based on new technologies. Their most important characteristics as stores of value are a programmatic and transparent supply and autonomy from the control of any individual or institution. Like physical gold, their utility stems in part from their immutability and independence from the political system.

Like gold, Bitcoin doesn't pay interest and isn't currently commonly used for everyday payments. The utility of these assets lies in what they don't do. Most importantly, their supply doesn't increase because governments need to repay their debts—no government or other institution controls their supply.

As long as public debt continues to grow unchecked and governments can't credibly commit to maintaining low inflation, investors may question the viability of fiat currencies as a store of value. In this environment, macro demand for crypto assets may continue to rise. However, if policymakers take steps to bolster long-term confidence in fiat currencies,