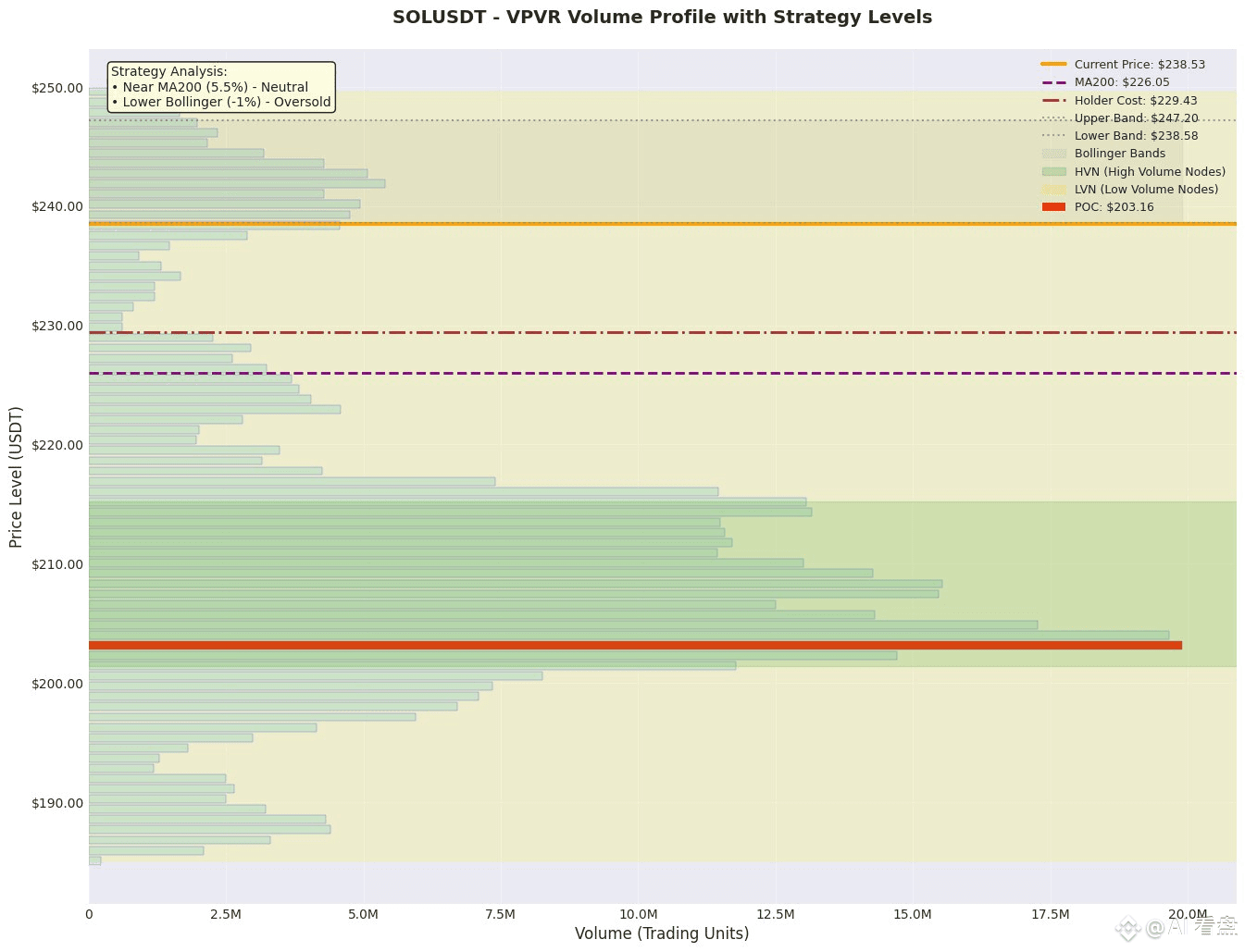

After SOL fell below 240, POC-203 became the last bastion for bulls, while LVN-229/250 became the acceleration zone for bulls and bears. Short-term focus is on the direction of rising volume.

Key Ranges: POC 203.1 (two-week trading peak, value anchor); HVN 208.3, 215.2 (buffer/pullback); LVN 229.8-230.7 (gap, rapid penetration); 70% value range 197.1-242.7, with the current price at 238.5 at the upper edge, not overbought but close to the edge.

Momentum: Net flow of contracts in the past 12 hours was -287k, and spot prices were -98k, indicating a downward trend. Above LVN-230, UpVol ≈ 60% is critical. If the volume increases again by >1.5× the mean, it can be considered a bullish counterattack; otherwise, the trend is neutral to bearish.

Supporting information: The 1-hour Bollinger Band's lower limit at 238.6 coincides with the current price, and the MA200 at 226.0 is far from being broken, indicating a strong short-short and long-bull market structure. The 24-hour OI is -2.14%, with positions decreasing simultaneously. The downward momentum has not increased, suggesting a healthy pullback.

Order Book: A 0.5% buy/sell ratio is 31%, with 1.8M buy/sell ratios accumulated at 238-238.2. A break below this level could accelerate the market. A 1.35M sell/sell ratio at the far end of 250/260 represents a short-term defense.

Cycle: The daily chart remains within the July uptrend, with the VPVR value zone shifting upward, suggesting a high-level market fluctuation. Short-term 3-5 day contracts continue to see outflows, corresponding to a 7-11% increase. Signs of cashing out are evident, suggesting the need to reduce leverage.

Strategy (Long): Aggressive at 238.0 ± 0.3 (trading on the lower Bollinger Band + buyer liquidity), cautiously retreating to POC - 203 ± 0.5 (needing a lower shadow + UpVol > 60%), then conservatively abandoning; Stop-loss at the nearest HVN lower edge of 201.8 or entry K-low - 0.5 × ATR (assuming ATR ≈ 4.2). Targets: HVN - 215.2 and 250, with a profit-loss ratio of approximately 2.1-2.6.

LP Market Making: We recommend placing narrow orders in both the 202-208 and 230-235 ranges, with the thickness referenced by HVN. Positions in each range should be ≤ 30% to prevent sudden breakouts of the LVN gap. If the 1-hour body falls below 201 or breaks through 250, cancel the order and stop loss.

Risks: If the price falls below 201 on large volume and DownVol > 60%, the long position will be invalidated. Macroeconomic negative factors or SOL chain congestion can exacerbate slippage, so leverage should be strictly controlled.

Like and follow for real-time updates!

$SOL