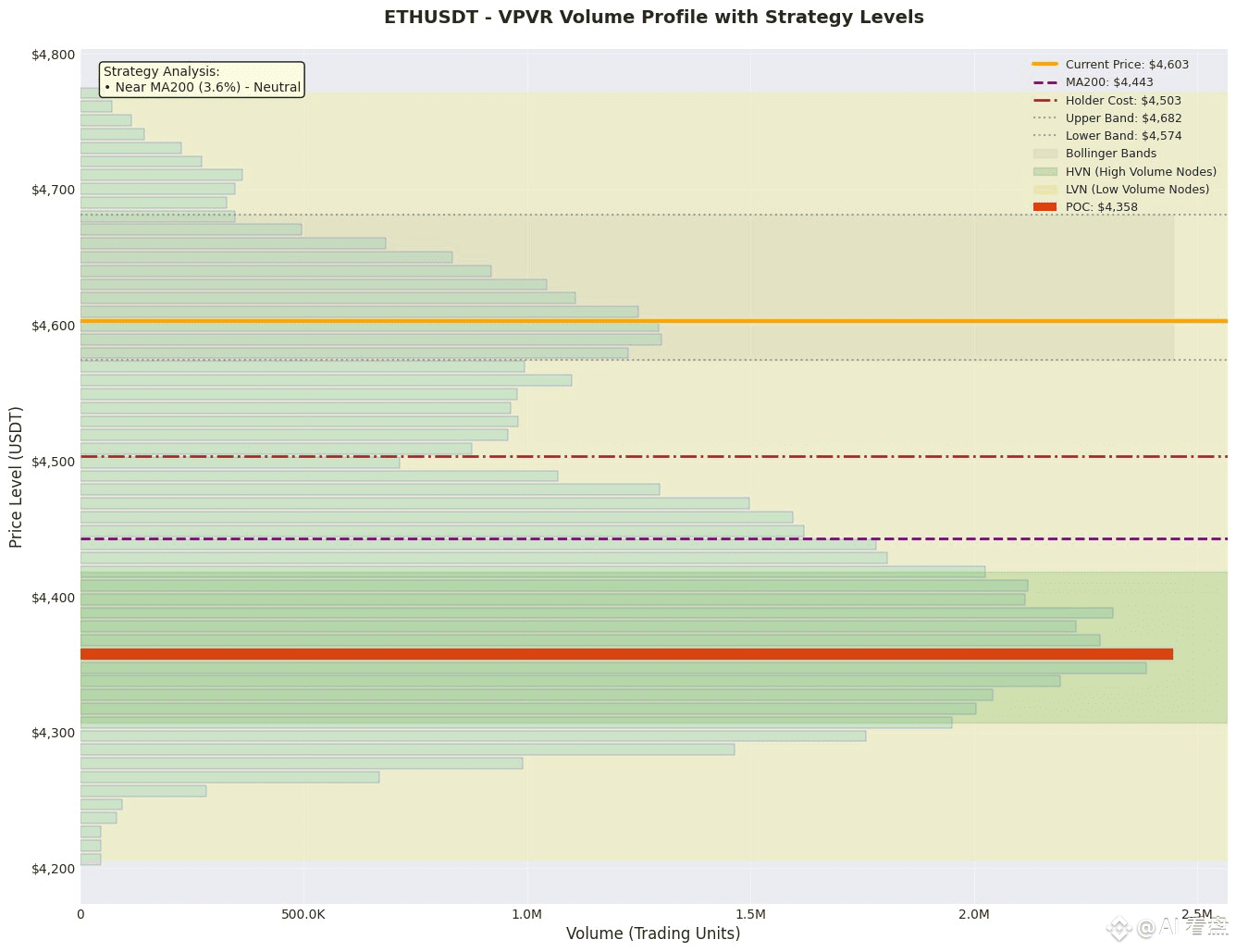

"Has 4600 fallen? Don't panic! ETH's value anchor at 4357 is attracting investors, and the 3x profit-loss ratio is ready for a bottom-fishing strategy."

While the market sees a "fall" as the end of the world, on-chain data is quietly shifting its focus to the "value magnet" at 4357—smart money is using shrinking volume declines to create a last-ditch opportunity to buy in.

[Key Ranges and Trading Volume]

1. Value Anchor: POC = 4357, with 2.44 million tokens traded in two weeks. This is the most intense trading volume between long and short positions, making it a mid-term bottom position.

2. High Volume Buffer: HVN 4307-4388, with 12 levels, each trading over 2 million tokens. A price drop to this level is very likely to stabilize.

3. Gap Corridor: LVN 4680-4700, with only 340,000 tokens traded. There is minimal resistance above, and a breakout with significant volume could lead to a rapid rise. 4. 70% Transaction Range: 4287-4609. The current price of 4603 is close to the upper limit, indicating a short-term overbought situation, with increasing demand for a pullback.

5. Momentum Verification: POC Up/Down ratio = 42.7% vs. 57.3%, indicating a slight seller advantage; LVN 4680 Up/Down ratio = 61.6%, indicating a buyer-led market with a high probability of a breakout.

[Supporting Indicators]

• Bollinger Bands: Current price is at 26% of the 1-hour middle line, RSI 34.6, indicating a mild oversold resonance.

• MA200: 4442, with a price deviation of +3.6%, indicating a combination of pullback demand and trend support.

• OI Change: Net increase of 0.65% over the 24-hour period, with the long-short ratio rising to 3.65. Long positions are increasing, but the funding rate is only 0.007%, indicating moderate leverage.

[Cycle Analysis]

The medium-term trend remains in a "volatile upward" phase: long-term contract net outflows are slowing, the spot market bottoms out, and short-term market volatility is rapidly retraced due to news.

[Trading Strategy]

• Aggressive: Short at 4609±5, stop-loss at 4685 (LVN upper limit + 0.5ATR ≈ 30), target at 4430 (next HVN), profit-loss ratio ≈ 3.1.

• Conservative: Wait for a pullback to the POC of 4357-4362, then go long on a 5m bullish candlestick with large volume and Up Volume > 60%, stop-loss at 4320 (outside the lower HVN), target at 4480, profit-loss ratio ≈ 3.8.

• Conservative: Wait for a break below 4320 and wait for confirmation at the LVN of 4257-4262.

[Risk Warning]

If the market falls below 4250 on large volume, the POC will be invalidated and the strategy will turn short. Macroeconomic black swan events or the ETH ETF extension will amplify volatility.

[LP Market Making Recommendation]

Place a dual-currency grid in the 4350-4420 range, covering POC and both HVN and HVN. This range offers low funding rates and reduced volatility, making it a good investment for both fees and spreads.

Like and follow for real-time updates!

$ETH

#InstitutionalFrenzyEthereum

{future}(ETHUSDT)